By: Stephanie Brown

McDonald's Corporation (NYSE:MCD) might be in serious trouble after the fast food giant posted its biggest U.S. sales decline in 14 years. What analysts find most troubling is that it occurred in its prime market. Its sharper than expected fall can be mostly attributed to increased competition. McDonald's U.S. sales drop of 4.6% was significantly higher than the original 1.9% estimate. Additionally, its global sales fell by 2.2% as opposed to 1.7%.

A surge in competition in recent months is by far the biggest challenge that McDonald's has faced. It recently admitted that it might be high time it carried out an aggressive marketing campaign, aimed at attracting more customers. Menu simplification has also been mooted as a possible upcoming change as well as the implementation of a more locally driven organizational structure geared towards increasing relevance with customers.

McDonald’s has been losing a number of customers because of a bloated menu that has resulted in slower service delivery in most of its restaurants. CEO, Don Thompson, has already affirmed that plans are underway to fix this problem. A management reshuffle has already seen McDonald's appoint a new president for its U.S. demographic, while additionally creating a new organizational structure.

Technical Analysis

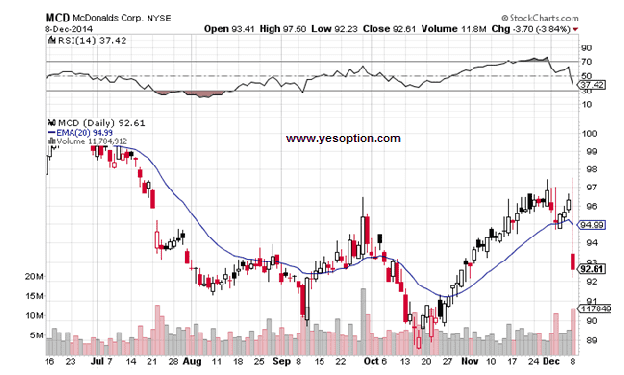

McDonald's dropped 3.84% during yesterday’s trading session after it reported disappointing sales numbers. The stock closed below its 20-Day EMA of $94.99 on heavy volumes. The stock has support at $89, $86 on the downside, while resistance stands at $94, $96 on the upside.

Actionable Insight

Sell McDonald's Corporation (NYSE:MCD) below $92.1 for target of $91.5, $91 with a stop-loss of $92.5.