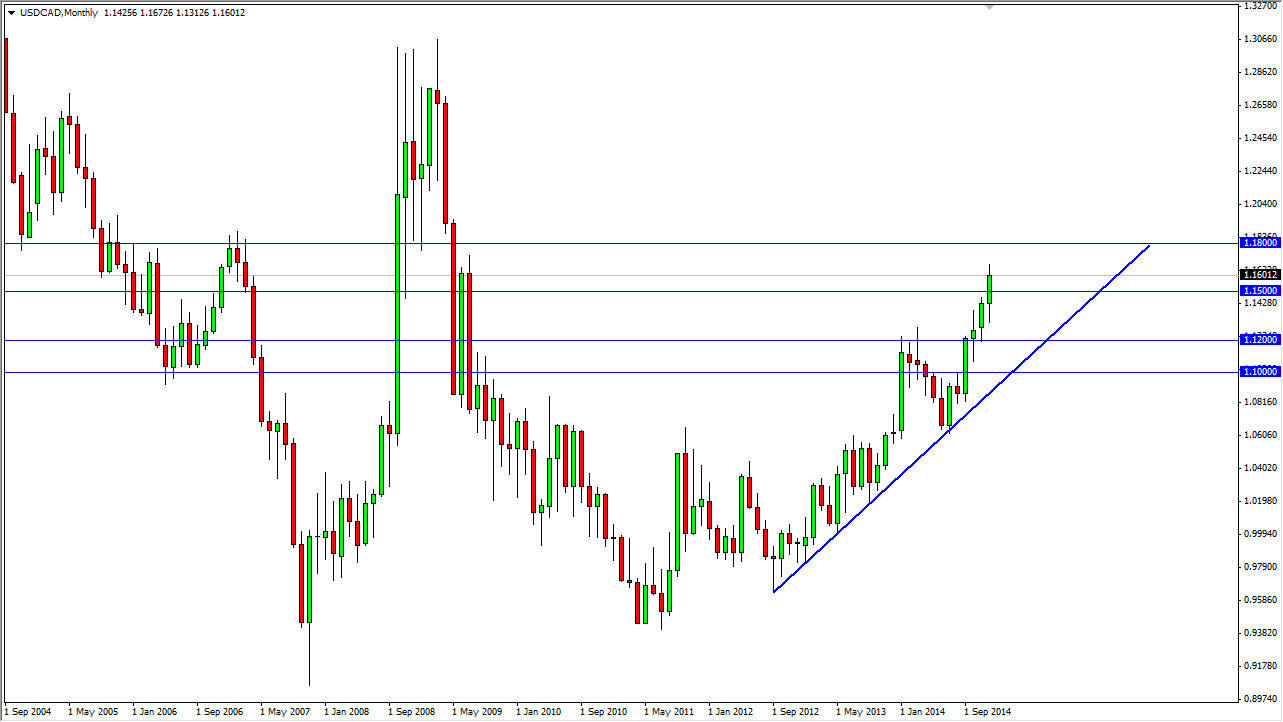

The USD/CAD pair has had a nice run since the middle of 2012, and I believe that it will continue. It’s possible that we might get a little bit of a pullback first, but ultimately I believe that the trend line that I have on the monthly chart is going to hold. I also believe that by the end of the year, we are heading to the 1.18 level, and possibly even higher than that. However, keep in mind that this pair does tend to grind sideways for long periods of time, and that means that you have to be very patient to trade this particular pair.

Pullbacks could fall all the way down to the 1.12 level without causing too much concern as far as I see. With that being said, I think that the trend line will pick the market back up as buyers step back in. Ultimately, I think that the market could go even higher than that but it’s only a matter of time before we get more choppiness.

Oil markets

Keep in mind that the oil markets haven’t exactly been helping the Canadian dollar either, and at this point in time we have to admit that the US dollar is without a doubt the most favored currency in the Forex markets. With that being the case, I’m not a big fan of shorting the US dollar, and certainly not against commodity currencies. Don’t get me wrong, I think we will have a significant pullback from time to time, but I still think that the longer-term trend holds up.

I would be especially interested in buying this market on a supportive candle near the 1.12 level, and as a result I am going to be very patient for my longer-term trades. That being said, keep an eye on the oil markets as they tend to move in the exact opposite direction and I think we are due for a bounce early in the year in the petroleum markets. That should push this pair back down, and again I think that the 1.12 level looks like a very interesting place to start buying longer-term.