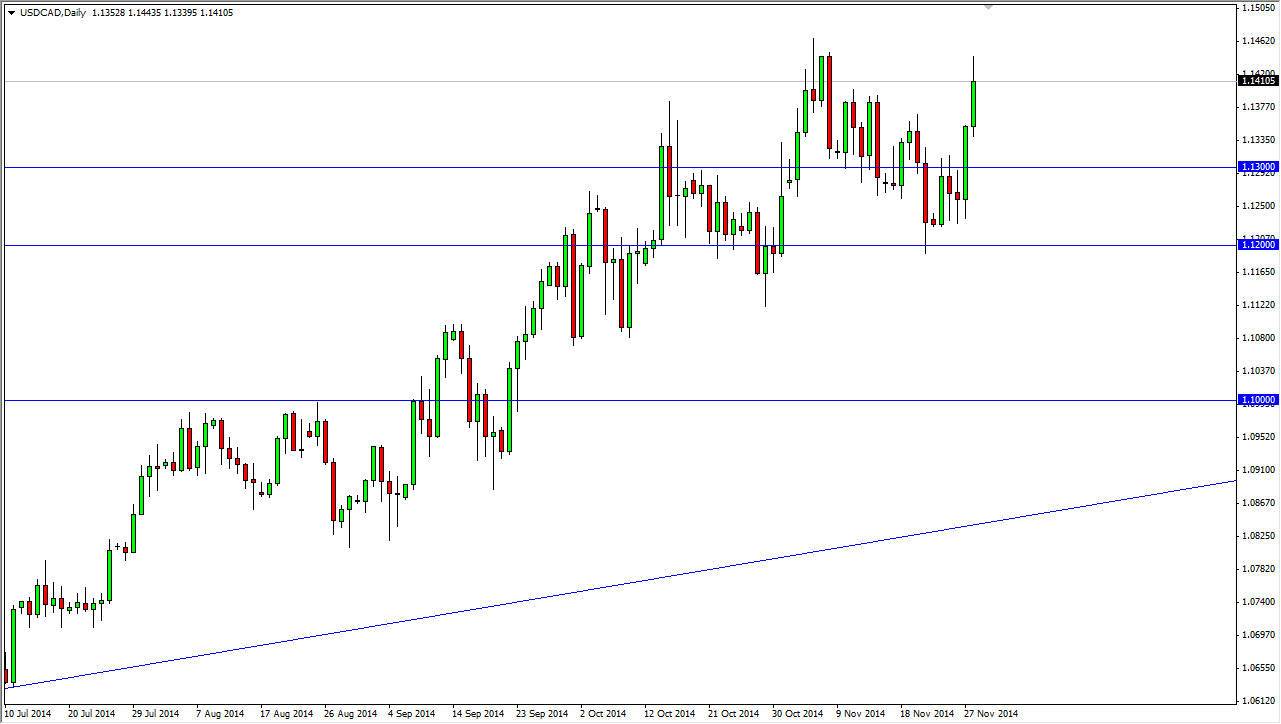

The USD/CAD pair charged higher during the session on Friday, as we continue to test the 1.14 region. Above there, it’s very likely that the market will struggle with the 1.15 level, but it’s probably only a matter of time before we break out. Looking at this market, we are most certainly in a decent uptrend, so I have no interest in shorting this market anyway. On top of that, the US dollar is without a doubt the strongest currency out there right now, so it’s very difficult to short it anyways.

Adding to that is the fact that the Canadian dollar is a commodity currency, most specifically tied to the oil markets. The oil markets have absolutely collapsed, so that of course is not going to be helping the Canadian dollar going forward. With that being said, I feel that this market is in a longer-term uptrend now, although you can see how jagged and choppy the trading action has been. That actually is a sign of normal health, as the two economies are so intertwined you don’t see very many impulsive moves.

Pullbacks are your friend

I believe going forward, buying the dips as they appear will be the way to go in this market. You have to be patient though, because as you can see the action is quite a bit choppy or than a lot of other pairs. However, you can see also that we have formed a nice trend going higher since the middle of the summer. If you had been patient and stoic, you would’ve certainly made a decent amount of money by going long of this pair several months ago.

I believe that the 1.10 level is essentially the “floor” in this market, so therefore we would have to break down below there before I would seriously consider shortening this pair for any length of time. Every time this market pulls back you have to think of the US dollar has been “on sale”, and pick it up as you would any other object when it gets cheap all of a sudden.