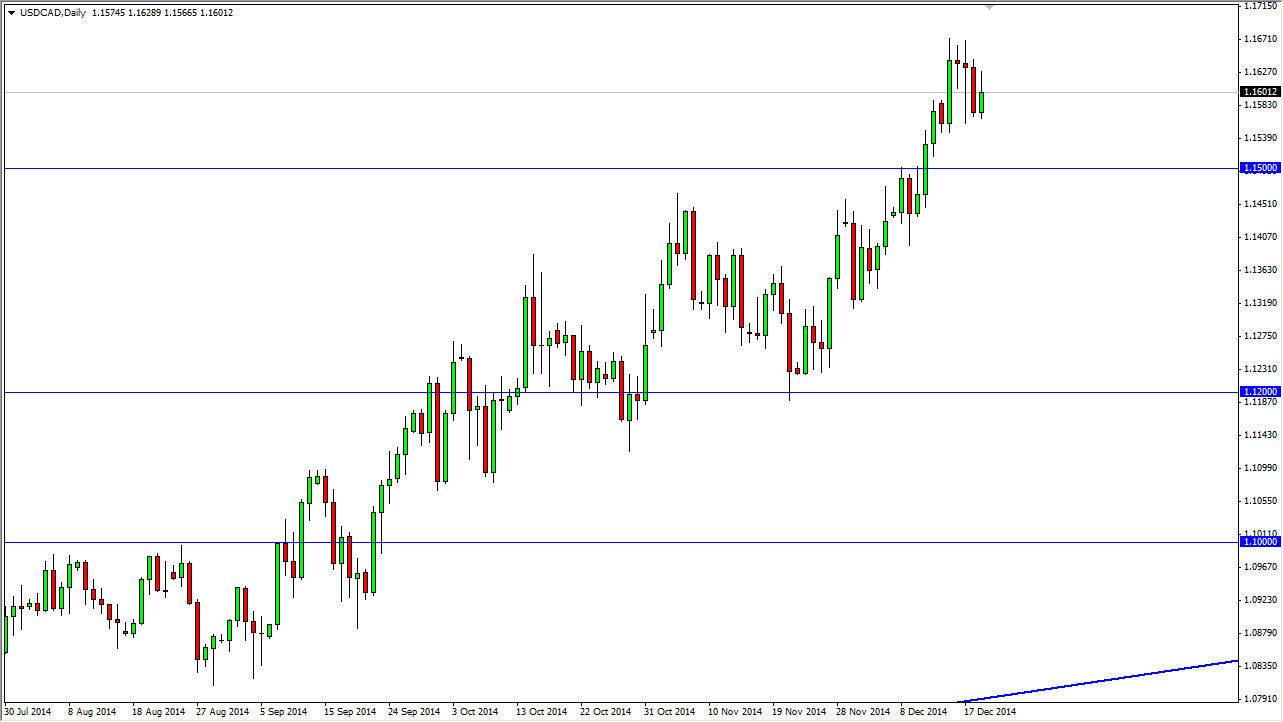

The USD/CAD pair tried to rally during the course of the session on Friday, but as you can see struggled above the 1.16 level. The resulting candle is a shooting star of sorts, and it suggests that the market is in fact going to continue falling from here in order to trying to find some type of support. I believe that support is at the 1.15 handle, and I would love to see that happen and perhaps a supportive candle form in order for me to go ahead and go long of this market which I believe has quite a bit of bullishness left in it over the longer term.

Looking at this market, it is most certainly a bullish market, so I have no interest in selling anyways. After all, the oil markets are doing the Canadian dollar no favor, and the US dollar is certainly the favored currency by Forex traders around the world at the moment. Keep in mind that this pair tends to chop around quite a bit over the short-term, but longer-term will make sudden impulsive moves. That is where you make your money.

Patience will be required

If you want to be a trader of this marketplace, you will have to be patient as this pair tends to grind quite a bit. It makes sense though, because the two economies are so intertwined. Canada sends 85% of its exports into the United States, so they are heavily leveraged to the US economy. Oil markets of course greatly influenced the Canadian dollar as well, and with the US dollar being so strong against most currencies right now, and the fact that the oil markets or falling apart makes this marketplace one that should go much higher over the longer term.

With that being said, I believe that even if we break down below the 1.15 level, there is plenty of support all the way down to the 1.12 level to simply sit on the sidelines and wait for that supportive candle. Ultimately, I think that this market goes to the 1.18 handle given enough time.