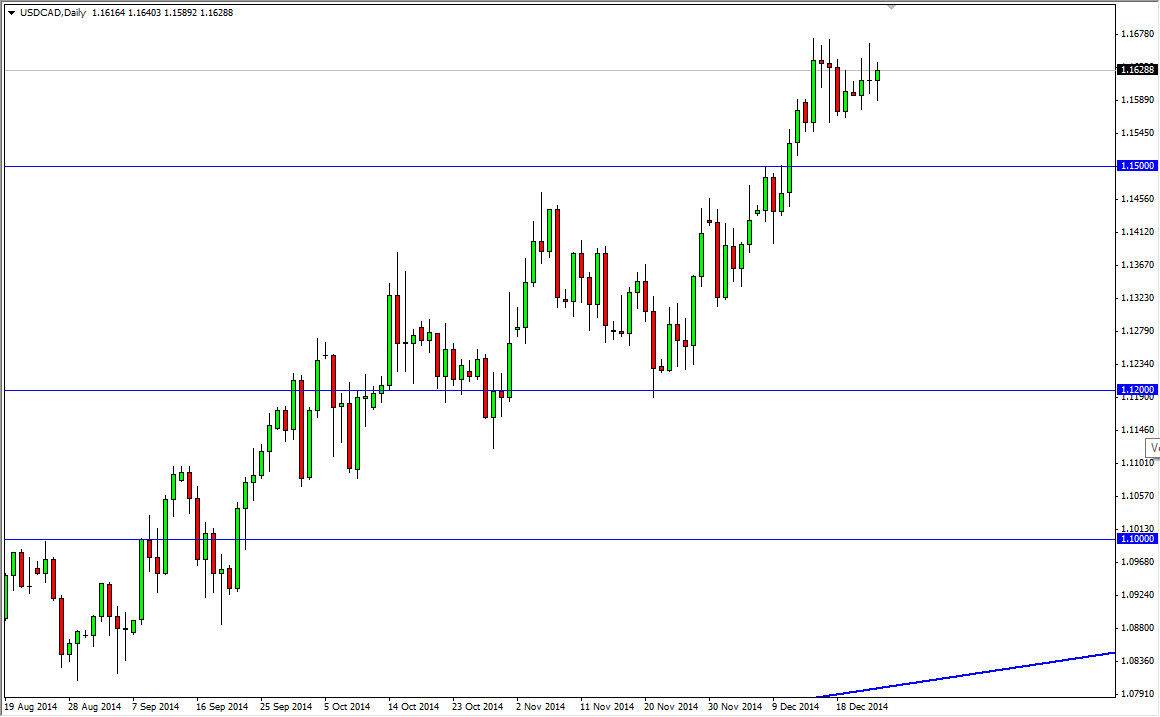

The USD/CAD pair initially fell during the session on Wednesday, but as you can see fell support at the 1.16 region to turn things back around and form a hammer. The Tuesday candle was of course a shooting star, which of course runs directly counter to what we saw during the Wednesday session. Normally, that means that your about to see consolidation in a marketplace that is struggling to get its footing in one direction or another. I personally believe that is what we are going to see, but most certainly we have an upward bias at this point in time.

I see the 1.15 level below as supportive, and any pullback to that region should be thought of as value. If we get some type of supportive candle between here and there, I don’t see any reason why the buyers will step in and continue to pick up the US dollar overall. After all, it is the favorite currency of Forex traders right now, and the oil markets of course are soft.

Oil markets not helping

Below markets are not helping the Canadian dollar at all. Because of this, I believe that we will continue to see quite a bit of bullish pressure and we will ultimately break out to the upside, after targeting the 1.18 level. I think that the pair will be choppy in the short-term, some looking for short-term charts to show me supportive candles in order to start buying for little 20 and 30 pip trades.

Ultimately, I think that every time this pair pulls back you have to look at it as the US dollar “going on sale.” Because of this, you have to think of this is a longer-term play, and think of the relative value that comes into it every time we fall. I think that ultimately the “floor” in this pair is at the 1.12 handle, and even if we fell as low as there I think the buyers would still be willing to step in and take advantage of US dollar value.