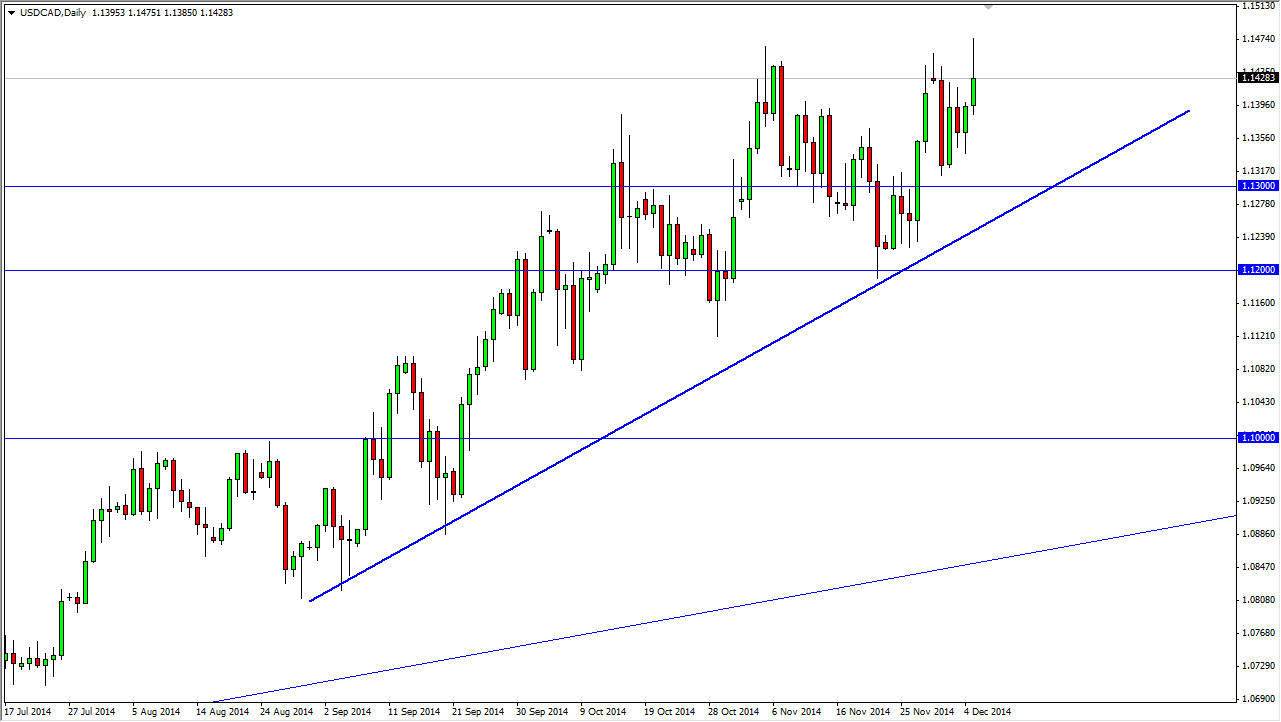

The USD/CAD pair originally broke higher during the course of the day on Friday, but as you can see gave back most of the gains in order to form a shooting star. It appears that the 1.15 level should continue to put bearish pressure on the marketplace, but as you can see I have drawn a uptrend line on this chart that the market has been following since August. With that, I think that the buyers are going to step back into this marketplace eventually, and therefore I am looking for supportive candles below to represent value in the US dollar.

After all, the oil markets are doing absolutely nothing to help the Canadian dollar, as they continue to show extraordinarily weak conditions. At the same time, the US dollar is by far the most favored currency in the world, with the Federal Reserve stepping completely away from quantitative easing, something that no other central bank is really doing at this point in time.

Following the trend

I believe that we are simply following the trend at this point in time, and will look at these pullbacks as potential buying opportunities. I would be rather surprised to see the inner trend line broken to the downside, as it has been so reliable. I believe that the 1.13 level below should be supportive as well, so therefore I think somewhere in that general vicinity we should see the market turned back around to test the 1.15 level yet again.

On the other hand, we could break above the top of the shooting star, which of course is a very bullish sign in and of itself. I think that it’s only a matter of time before we break above the 1.15 handle, and then head to the 1.20 level after that. I really don’t see the market has been one that you can sell at any point now, as there has been such a strong showing by the buyers. With that, I am very bullish and continue look at dips as potential buying opportunities going forward.