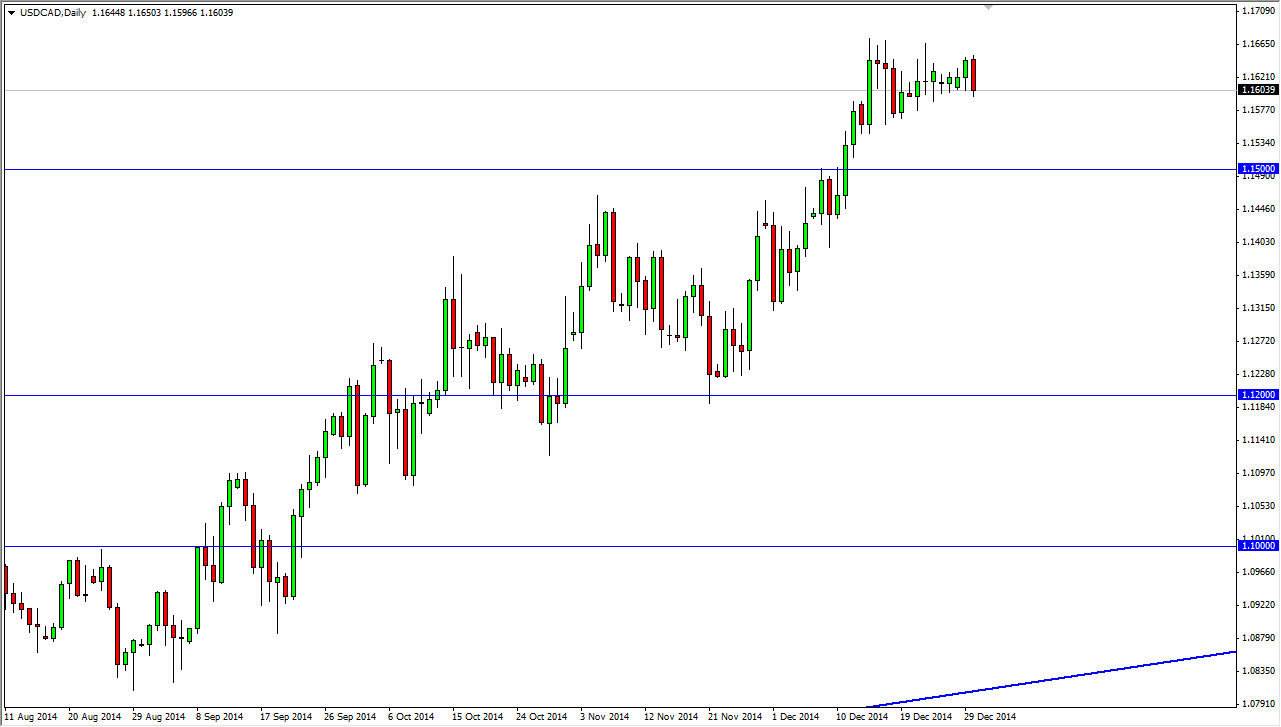

The USD/CAD pair fell during the course of the session on Tuesday, as we continue to grind sideways. It’s not a big surprise, this pair tends to do that a lot, and the fact that we are talking about New Year’s Eve now, and it suggests that the market will continue to do very little. We believe that pullbacks will continue to be buying opportunities, and therefore I’m looking for a move down to the 1.15 handle where buyers should continue to enter the market.

This is one of those situations where I am simply waiting for some type of supportive candle in order to go long, and therefore have no interest in selling this market. The oil markets certainly are not helping the Canadian dollar, although they are getting way oversold at this point in time and could therefore bounce, which could be one of the catalysts to send this market lower.

Intertwined economies

I believe that the fact that the United States and Canada have such intertwined economies is one of the main reasons this market go sideways for long periods of time. Ultimately, this is a market that I believe goes much higher and I think the 1.18 level will be targeted. But I need to see some type of “value” in the US dollar first. Looking around the Forex markets, I think that the US dollar is a bit overbought in general, so it’s likely that we will only see strength for the short-term, and then perhaps some type of “revaluation” of the greenback itself.

I do think that ultimately you can buy the Dollar, but you just need to have better prices. It just simply is a bit overvalued at the moment, and as a result I am a little bit leery of going long of this market right now. Being patient is exactly what you will have to be, as the time of year dictates patience, just as the levels of the market do at the moment. Wait for pullbacks, they will be opportunities.