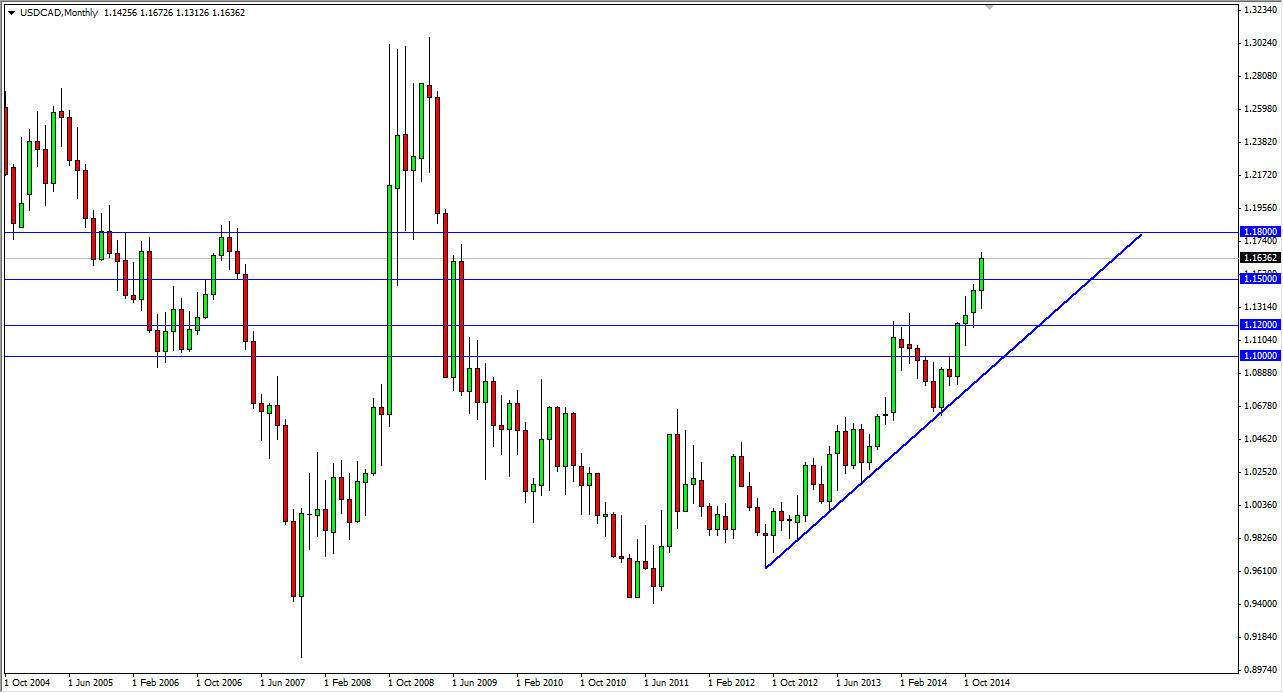

The USD/CAD pair has had a nice run over the last couple of years to the upside. I think this will continue find I believe that the 1.18 level will be extraordinarily resistive based upon previous action in both 2008, and 2006. On top of that, the oil markets have completely falling apart and although that does work against the Canadian dollar, we have to wonder whether or not the oil markets can continue to fall the way they have? I mean, after all sooner or later oil is going to have to find its bottom, and when he does this pair should fall.

On top of that, I believe that the US dollar is overbought at this point, and it’s only a matter of time before it retraces some of the strength. It doesn’t mean that I think that the US dollar is going to fall apart, just that it needs to retrace some of the gains and perhaps collect enough momentum to continue going higher.

Bullish momentum

This is a pair that has nice bullish momentum, and tends to chop around within that momentum. That’s what we have seen, but if you have held onto a long position for the last couple of years, you’re doing quite nicely. That being the case, the market looks as if we could run into a little bit of trouble above, pullback, and then find bullish momentum yet again as we continue the uptrend. You can see that I have a nice trend line drawn on the chart and we have extended higher and farther away from that trend line than is comfortable. In fact, you can almost make a bit of an upward channel, and that of course is something that the market will follow. We are at the top of the channel right now, so at this point in time it appears of the market is ready to pull back. With that being said, I think we have short-term bullish action, and then we pullback in order to try to find our footing somewhere closer to the trend line that is on the chart.