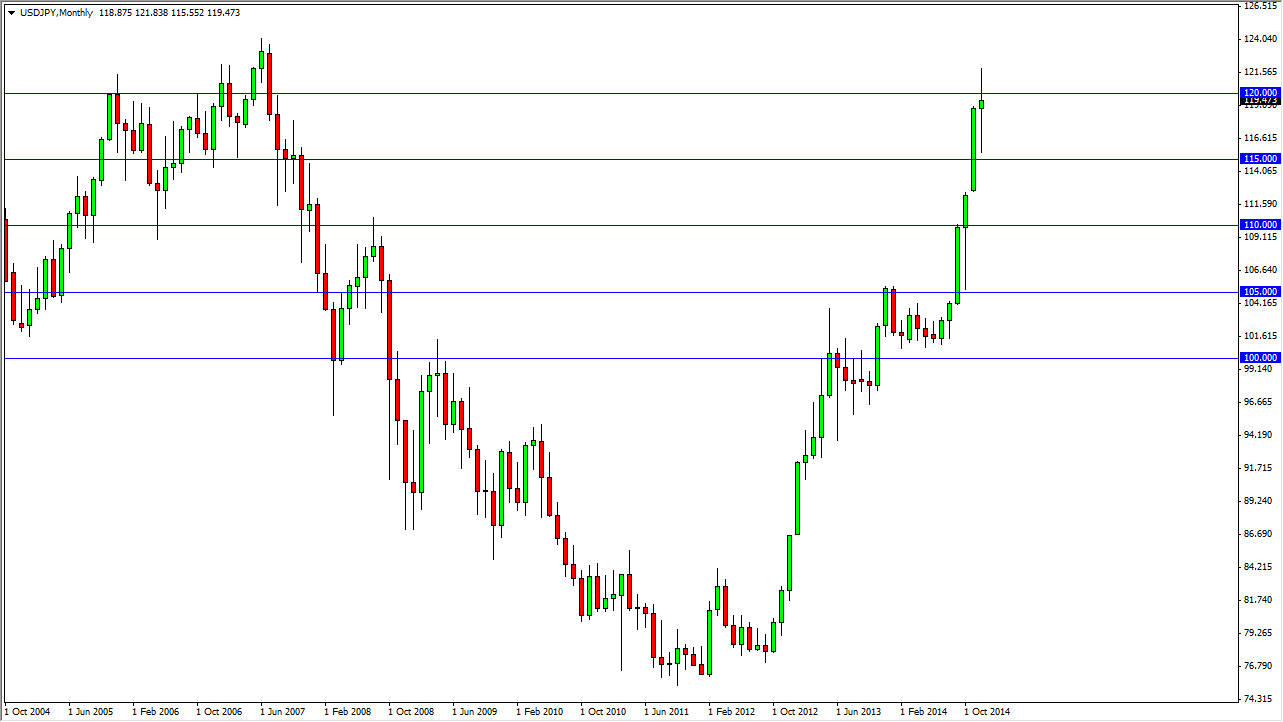

The USD/JPY pair had a massive move higher during the course of the back half of 2014, probably more so than acceptable. The market is without a doubt parabolic, and as a result we would not be surprise at all to see this market fall from here to pick up buyers to continue to push the market higher. Looking at the chart, there is a significant amount of support to be found every 500 pips in this marketplace, and as a result I’m looking for supportive candles at the 115 level, the 110 level, and then the 105 level.

Ultimately, I think this pair does go higher during the course of the year, but there is obviously oversold conditions at the moment in this market. With that, we should see buyers enter every time this market pulls back, and the 123 level needs to be broken in order for the longer-term uptrend to continue. It’s not that I don’t think it will happen, it’s just that I know that we need to pick up more buying pressure in order to build momentum to go to the upside.

Central banks influencing this market

The Bank of Japan of course has a very loose monetary policy, as they are trying to drive down the value of the Yen. It’s been very effective over the last two years, and I think that they will continue to get their way. However, we need to pull back in order to build up the momentum necessary to go higher in my opinion. Ultimately, you have to look at the two central banks. The Federal Reserve on the other hand has left the quantitative easing game, and it’s more than likely going to be raising rates much sooner than the Bank of Japan.

The Bank of Japan continues to work against the value the Yen, and it will do so directly in this market if it has to. Even now I’m negative on the Yen overall, this is probably the perfect example of divergent central banks pushing a currency pair and one direction over the longer term. I expect a pullback, and then I expect a great long-term buy-and-hold opportunity