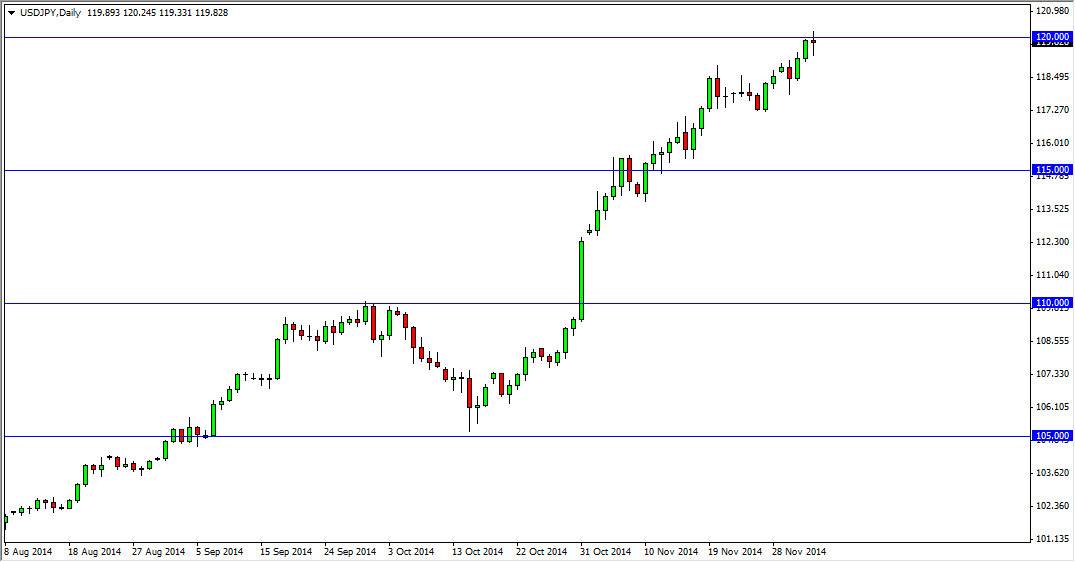

The USD/JPY pair stopped at the 120 handle as it prepares for the nonfarm payroll announcement. That announcement of course will be crucial as his pair always react strongly during in one direction or the other. That being the case, I believe that a pullback could be coming based upon the fact that there is so much resistance above, and the fact that we could get a less than stellar news. If that’s the case, think of that as value, as the US dollar should continue to be an asset that everybody wants to own.

On top of that, the Bank of Japan should continue its very loose monetary policy, and that should continue to work against the value of the Japanese yen overall. With that, this is a bit of a “perfect storm” as the pair should continue to go higher over the longer term. That’s not to say that we won’t get pullbacks from time to time obviously, and those should be attractive to people as we continue to see the longer-term trend unfold.

Buying on the dips

I still believe that buying on the dips is the best way to go going forward in this pair, and as a result I have been building a position in this pair that is getting quite large. I think the 115 level below should continue to be supportive, and as a result I think it’s essentially the “floor” in this market right now. Regardless, I don’t have an interest in selling this pair as I just can’t make the fundamental argument to do so.

Ultimately, I believe that this is a “buy-and-hold” type of situation, and that’s exactly how I have been treating it. I believe that there are a lot of traders out there are building careers based upon this larger move, and as a result I think there should continue to be strengthened buying pressure, as we should head to much higher levels, perhaps as high as 150 over the next couple of years.