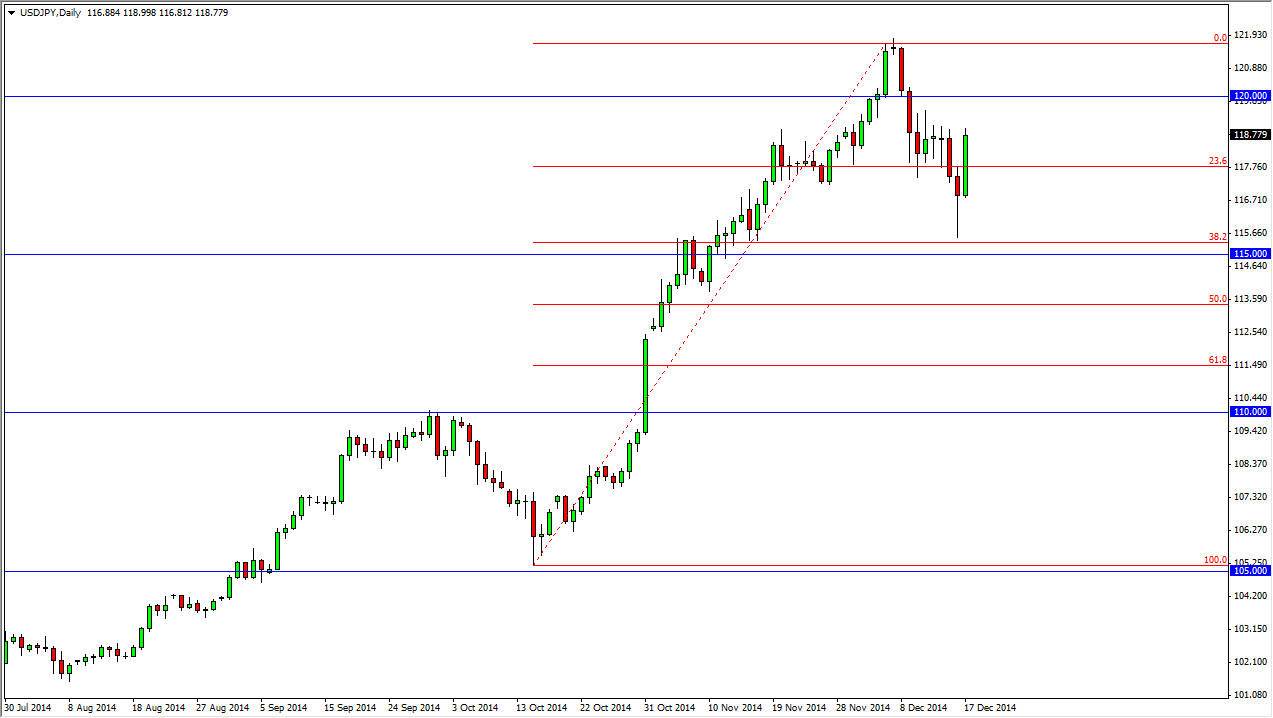

The USD/JPY pair broke higher during the course of the session on Wednesday, clearing the top of the hammer that had formed on Tuesday. Remember, I mentioned the hammer yesterday due to the fact that it sat right above the 115 level, and the 38.2% Fibonacci retracement level from the move higher. With that being the case, I felt that this could be a nice buying opportunity. That’s exactly what we got as the market heading towards the 119 handle. We can break out over that level during the session, but at this point time I think the 120 will be tested. If we can get above there, I don’t see any reason why this market does go to the 122 handle to retest the previous high again.

Ultimately, I have no interest in buying the Japanese yen anyways, as the Bank of Japan continues to work against the value of the currency. I believe the pullbacks continue to be buying opportunities, and should be thought of as “value” in the US dollar, which of course is the most favored currency in the Forex markets right now.

Buying dips

I’m continuing to buy dips in this pair as I think it’s only a matter time before the market breaks out to the upside for the longer term. I think that this is a multitier trading I cannot stress enough how much profit can come by shorting the Japanese yen one the currency markets stabilize as they seem to have done recently. After that the fact that the US dollar is so favored, and you essentially have a “one-way trade” in this marketplace right now.

Keep in mind that dips can be 200 pips, and still don’t change the trend. With that being the case, you have to simply look at value add small positions on top of the ones you are have, and discipline build a monster position. That’s what I have been doing for a couple of months now, and I’ve already had nice returns due to that position.