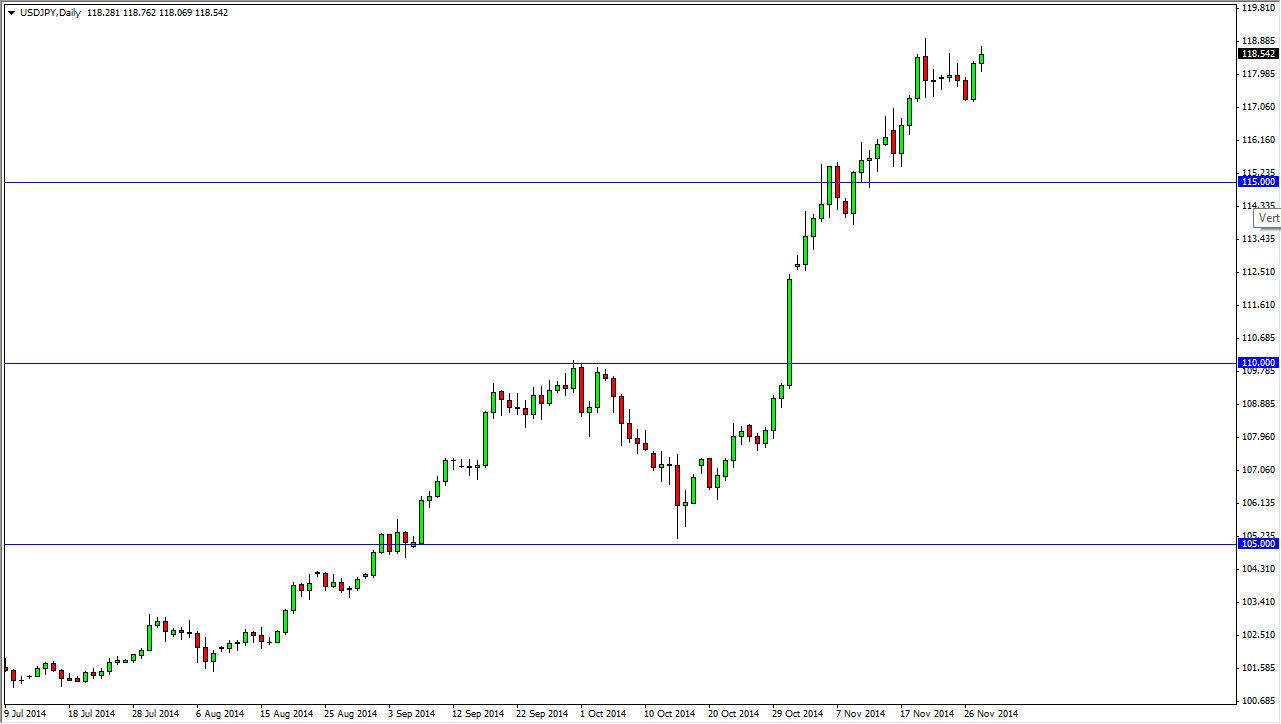

The USD/JPY pair went a little bit higher during the session on Friday, as the buyers remain stubborn. This is a market that continues to offer buying opportunities again and again, and quite frankly it is a bit surprising that we have not had a decent pullbacks since breaking out of the 110 level. Classic technical analysis would have this market falling all the way back down there to test for support, but quite frankly it may be a very long time before that happens. It is possible that it could happen in the month of December though, because the lack of liquidity will have this market going in a fairly impulsive moves, especially once we get fairly close to the Christmas holiday.

However, I still believe that the only thing you can do is buy this pair. You don’t need to get cute and start selling this pair on countertrend moves, because I have yet to see a countertrend system make money over the longer term. True, a lot of countertrend moves are much more impulsive than ones that go along with the trend, but quite frankly why would you want to make your life more stressful than it is already? Remember, the idea is to make money doing this, not get some type of cardiovascular workout.

Multi-year trend

I believe that we are in a multi-year trend when it comes to this pair. With that being said, it doesn’t surprise me if we go back to the 110 level at one point or another, because although it is 800 pips from where we stand right now, in the big scheme of things it really isn’t that big of a deal. Forex traders often get too hung up on the short-term moves, and don’t look at the longer-term charts. Do not do that when it comes to this pair, because this is a pair that has broken through significant resistance, which of course was the 110 level and that is an area that you can see clearly on the monthly chart as being important. Because of this, there’s no way to sell this market.