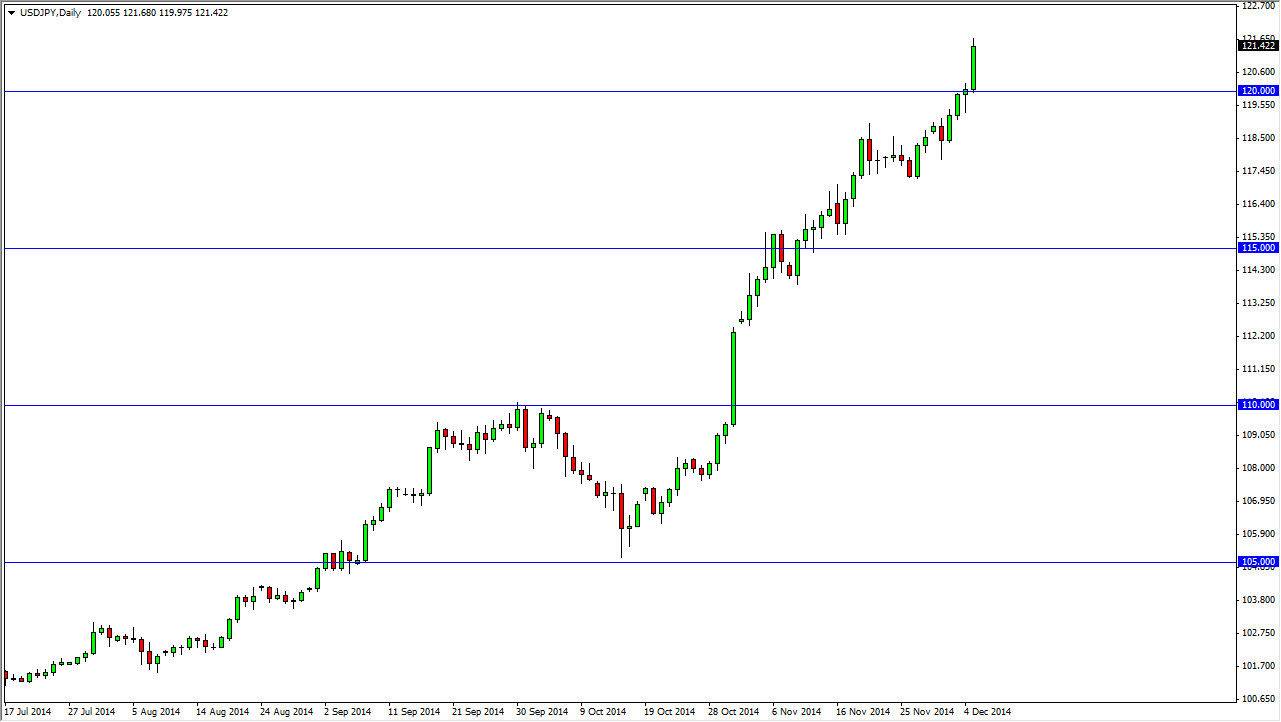

The USD/JPY pair broke higher during the course of the day on Friday, smashing through the 120 level finally. This is a significant move, as it signals the next leg higher. This of course was exacerbated by the nonfarm payroll numbers coming out better than anticipated in the United States, meaning that we should continue to see bullish pressure to the upside.

Pullbacks at this point in time should see the 120 level act as the floor, and as a result I am looking at them as value. Ultimately, we could go much higher, but I think there are going to be several opportunities to step into this market and pick up the US dollar again and again. In fact, I believe that several careers will be made by stepping in and buying the pair over and over.

Candle looks good also

I believe that the candle looks good as well, and that we should continue to see buying pressure based upon the fact that we close towards the very top of the range for Friday also. Ultimately, I think that the next stop will be of the 122 level, and then possibly the 125 level. Over the longer term, I think that we go much higher, but there is going to be a bit of volatility.

It is possible that we get a bit of selling pressure between now and the end of the year, which of course would just simply be money managers taking profits so that they can report gains to their investors. However, that is a short-term situation, and it should only bring value into this market as I fully anticipate be buying pressure to return after New Year anyway. That being said, right now I don’t see any way you can sell this pair, especially considering that the Japanese yen itself is so weak. The Bank of Japan will continue to weaken the currency, and as a result this is essentially a “one-way trade” as far as I can see, and with that I fully anticipate doubling my account over the longer term with this one particular trade.