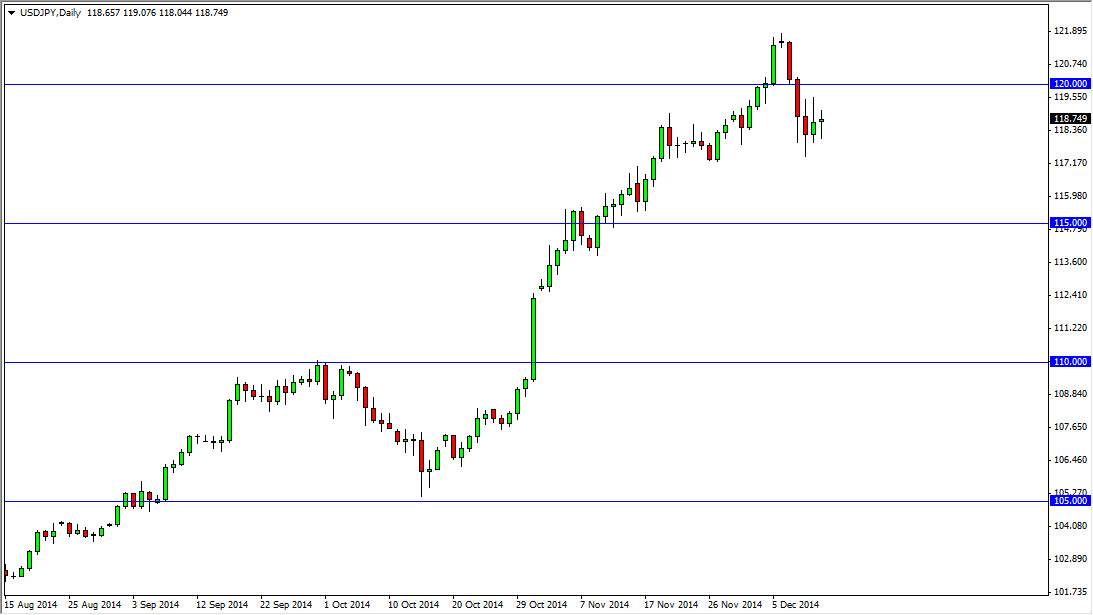

The USD/JPY pair did very little during the session on Friday, as we continue to hover just above the 118.50 region. This is an area that has been somewhat supportive lately, and as a result would not be surprising at all if we went higher from here. I recognize of the 120 level is a bit of a resistance barrier though, so we need to get above there in order to really feel comfortable being long. Nonetheless, I have no interest in shorting this pair as the US dollars without a doubt the paramount currency in the Forex market right now and the Bank of Japan continues to work against the value of the Yen anyway.

I think that there’s a bit of a floor in this market down at the 115 handle, and any supportive candle between here and there is an opportunity to buy this market. I think it’s only a matter of time before we break out again, and perhaps head to the 125 level. However, be aware the fact that there could be a bit of profit taking here of the next couple of weeks so we may have sudden pullbacks out of the blue.

Buying on the dips longer-term

I’m still buying on dips in this pair for the longer term as I believe the market will ultimately go much higher. In fact, I would not be surprise at all to see this pair of the 130 level sometime during the year 2015. I think that any pullback at this point in time has to be looked at as potential value for the greenback, as it is so strong against everything else, and the Japanese yen of course is one of the weakest currencies in the Forex markets. I believe that this pair will be “career making” for some traders out there as they continue to add to the pullbacks. This is starting to look more and more like the old carry trade days, which of course was very easy in you would just simply buy every time it fell.