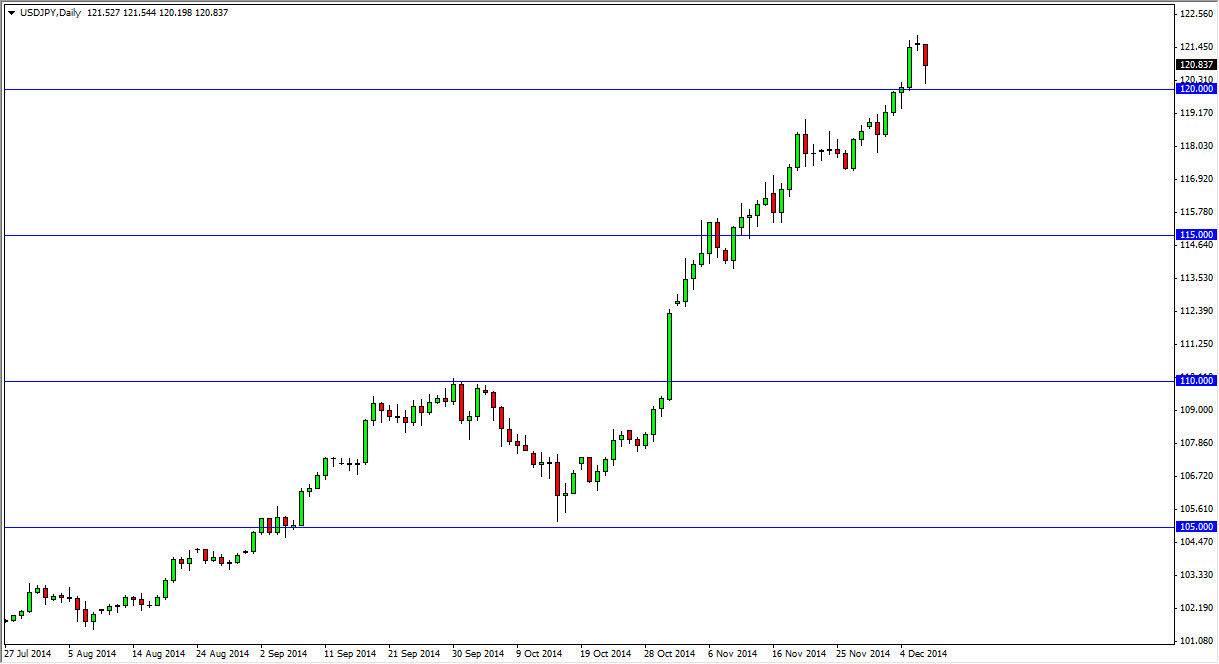

The USD/JPY pair falls during the session on Monday only to find significant support at the 120 handle. With that, the market bounced enough to form a fairly supportive candle, and as a result I am bullish of the market yet again. I believe that this has been a buying opportunity, and quite frankly I think there’s plenty of support all the way down to at least the 118 level to offer more than enough buying pressure to be long of this market. On top of that, you have to keep in mind that the US dollar is a currency that you cannot sell at the moment.

The Bank of Japan continues to work against the value the Yen, so really at this point in time there’s no way to short this market. With that, I believe that this market will continue to be a “buy on the dips” situation, as the buyers should return again and again to this marketplace.

Career making trades

I believe that this market will make several careers, as people will be able to buy again and again in a marketplace that is so obviously bullish and trending. Because of that, I think that this is a market that you should be involved in for the long term, and continue to add little bits and pieces as we go along. I think that every time we pullback, that will be significant opportunity to go long of the US dollar which of course is favored against almost every other currency.

The Japanese yen of course is the weakest currency out there just about, with even the lowly Euro going fairly well against it. The Yen should continue to be a currency you can sell against almost every other currency, not to mention some other assets. I believe that this pair is ultimately going to be one that we can buy again and again throughout the year of 2015 as well. In fact, this is starting to look a lot like him the USD/JPY of old, when all you had to do was buy it every time it fell to make quite a bit of money in the Forex markets.