USD/JPY Signal Update

Last Thursday’s signals were not triggered and expired.

Today’s USD/JPY Signal

Risk 0.75%

Trades must be taken before 5pm New York time, or after 8am Tokyo time.

Long Trade 1

Go long following bullish price action on the H1 time frame immediately after the price first reaches 117.03.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following bullish price action on the H1 time frame immediately after the price first reaches 120.18.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

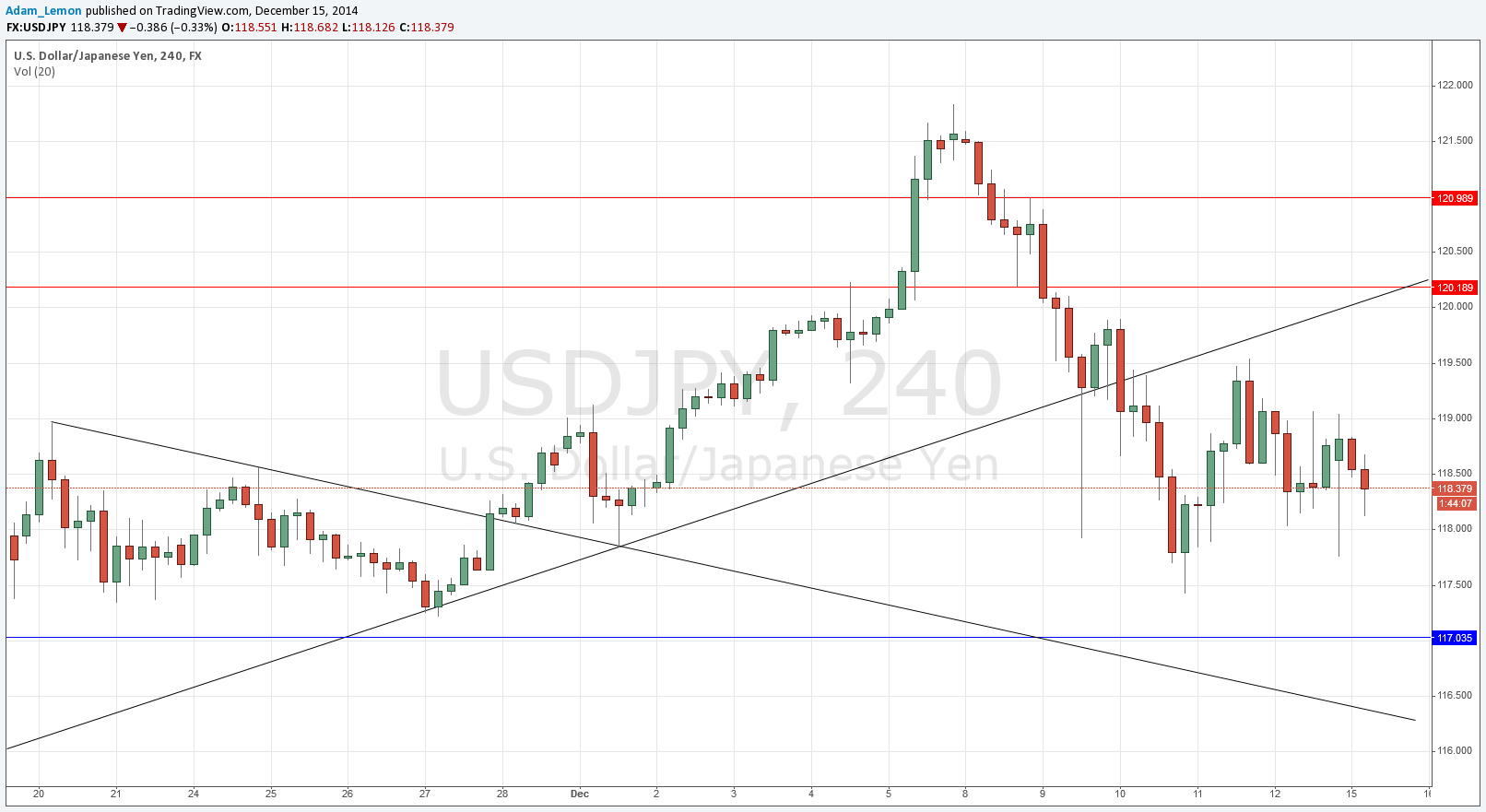

USD/JPY Analysis

The pair found a little support last Thursday somewhere above 117.03 which is now a key level. There are broken trend lines both above and below the current price which might act as mobile support and resistance, but they are both moving too far away from the current price to be useful. We have been consolidating slightly supportively for the past couple of days and the Japanese election result does not seem to have had much effect on the price overnight.

This pair will probably range between 117.00 and 120.00 for a while.

There are no high-impact data releases scheduled today directly concerning either the JPY or the USD. It will probably be a quiet day today for this pair, although there might be unusual activity in the aftermath of the Japanese election result that has just occurred.