USD/JPY Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/JPY Signal

Risk 0.75%

Trades must be taken before 5pm New York time, or after 8am Tokyo time.

Long Trade 1

Long entry following bullish price action on the H1 time frame immediately after the price first reaches 117.03.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following bullish price action on the H1 time frame immediately after the price first reaches 120.18.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

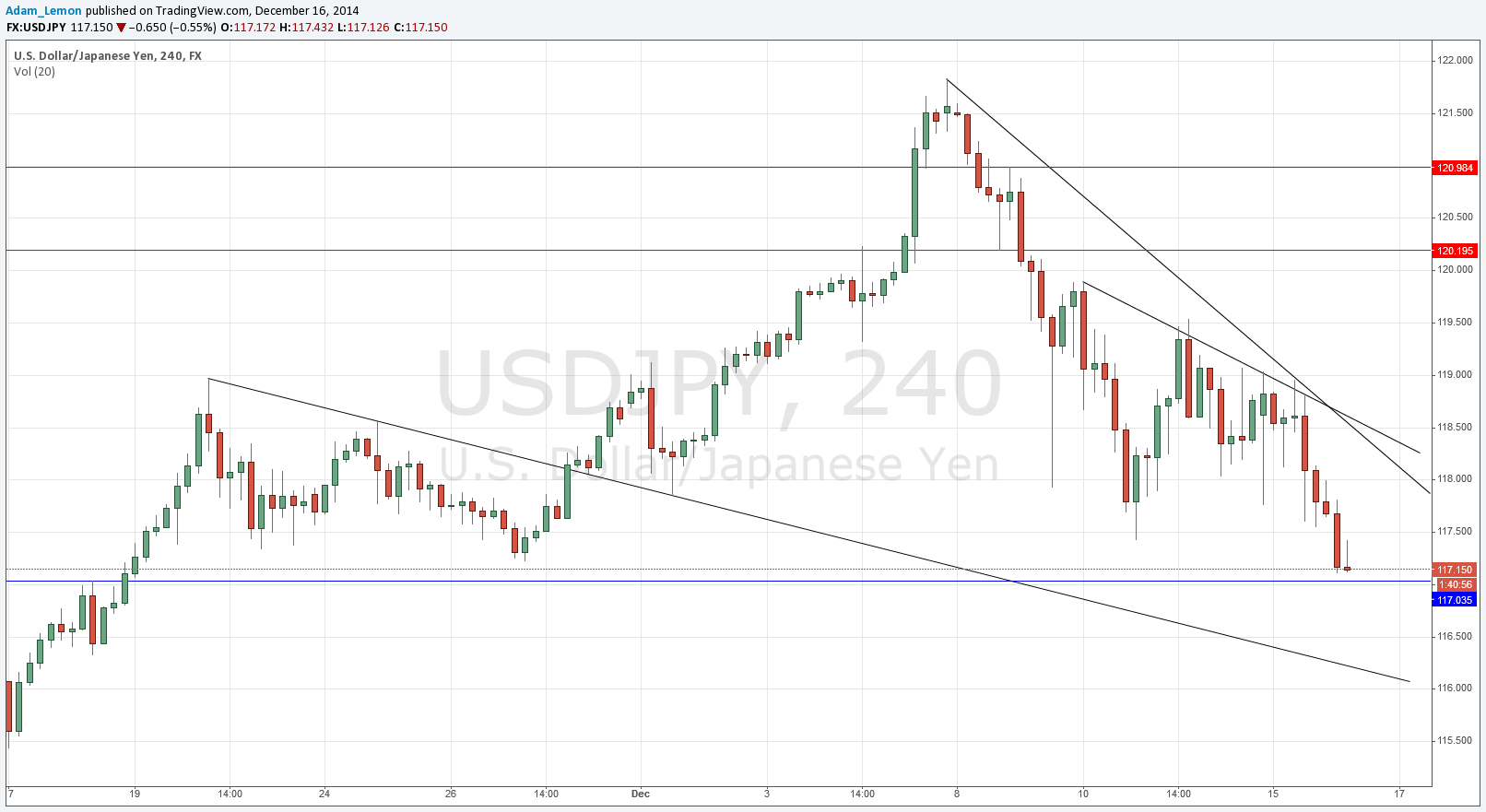

USD/JPY Analysis

After a small and short-lived rally last week, the pair has continued to fall, as the JPY strengthens and the USD fails to continue its bullish trend, at least for now.

At the time of writing, we are approaching support close to the 117 round number as shown in the chart below; this may produce some strong buying if we get there which might trigger a long trade opportunity.

We have a couple of bearish trend lines above that should be watched carefully as potential exit points for any long trade that may be taken.

Another retest of the broken bearish trend line below might give a bounce, but is probably unlikely to produce a high-quality entry.

There are no high-impact data releases scheduled today directly concerning either the JPY or the USD.