USD/JPY Signal Update

Yesterday’s signals were not triggered as although the price did reach 117.03, there was no suitably bullish price action at the first touch of this level

Today’s USD/JPY Signal

Risk 0.75%

Trades must be taken before 5pm New York time, or after 8am Tokyo time.

Long Trade 1

Long entry following bullish price action on the H1 time frame immediately after the price first reaches 115.56.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

Short Trade 1

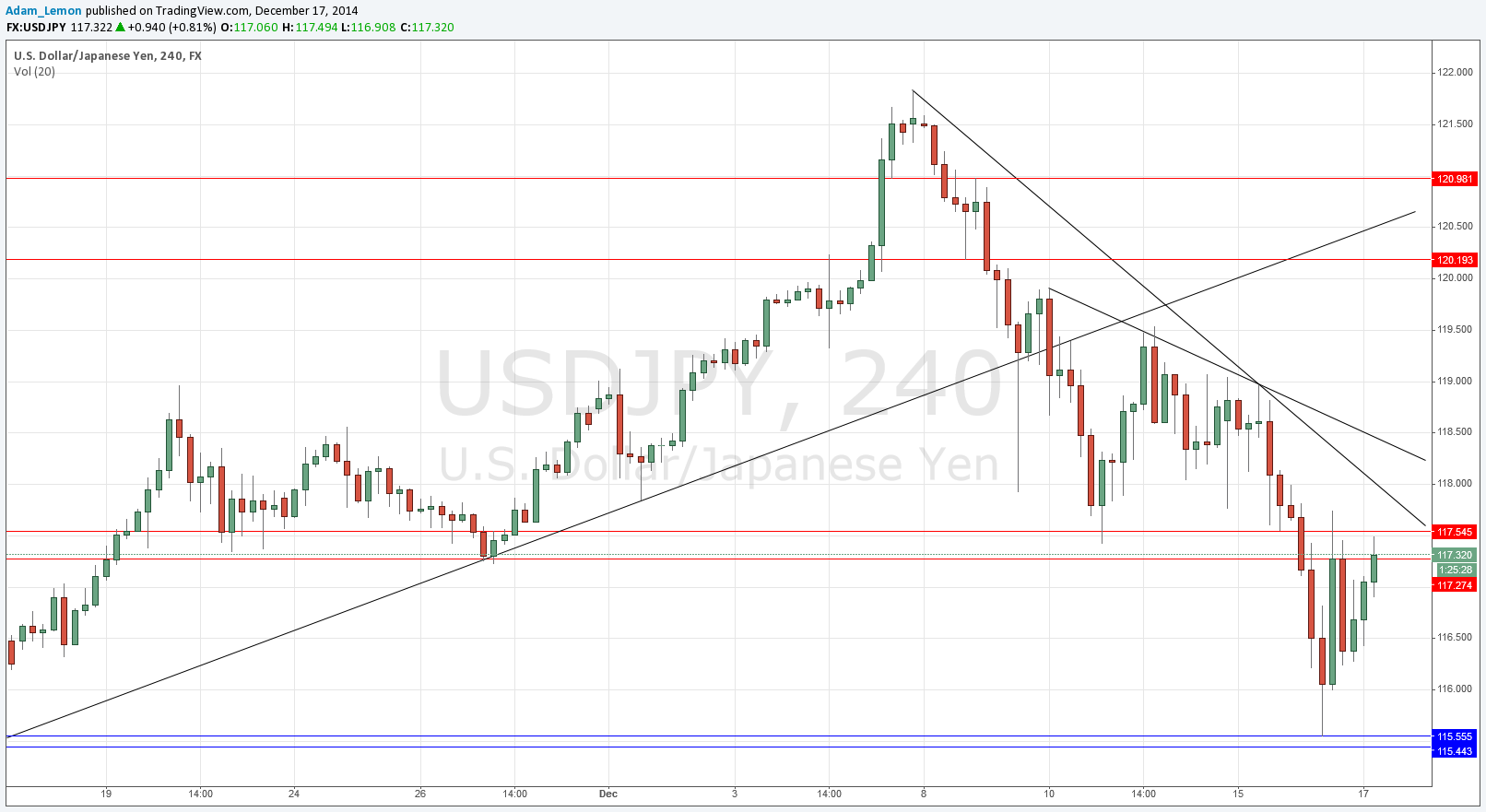

Go short following bearish price action on the H1 time frame immediately after the price first reaches either of the bearish trend lines shown on the chart below.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

This pair went into freefall yesterday, breaking support before turning around when the New York session began and rising strongly from its low at around 115.55.

There is a supportive zone from about 115.44 to 115.56 that can be expected to be bullish again when we next return there.

However right now we are stuck at a resistant zone, which is too fresh and close to be used for a reliable short signal, but which still might hold today.

A little way above the current price are two bearish trend lines. A rejection of either of these could provide a good opportunity to go short.

It looks like the area at around 115.50 could be the floor for another up move. My colleague Christopher Lewis saw 115 as a base from which the price would go back up for another attempt at 120 and beyond.

There are high-impact data releases scheduled today directly concerning the USD but nothing regarding the JPY. At 1:30pm London time there will be a release of CPI data followed later at 7pm by the FOMC Statement and Projections and announcement of the Federal Funds rate. The FOMC even is likely to be crucial to the next important directional development of this pair.