USD/JPY Signal Update

Yesterday's signals expired without being triggered as although the price did reach both of the bearish trend lines, there was no bearish price action there.

Today’s USD/JPY Signal

Risk 0.75%

Trades must be entered before 5pm New York time, or after 8am Tokyo time.

Long Trade 1

Go long following bullish price action on the H1 time frame immediately after the price first reaches 117.77.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following bearish price action on the H1 time frame immediately after the price first reaches 120.19.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

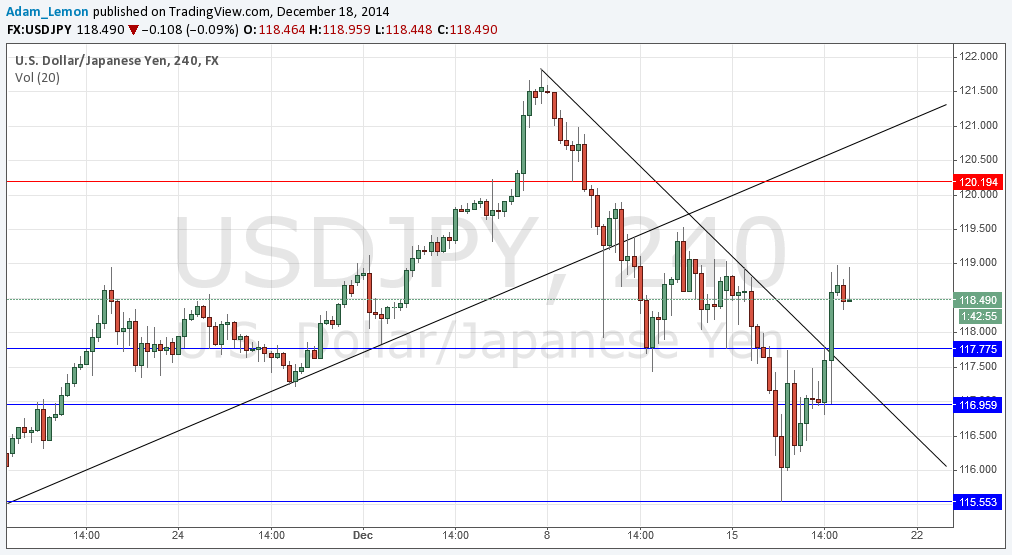

Yesterday's FOMC events have kick-started a renewal of the Usd bullish trend. This has seen USD/JPY break through both of the short-term bearish trend lines that I highlighted yesterday, before stalling overnight at the local resistance confluent with the round 119.00 level.

The first trend line, which is still on the chart shown below, could provide more bullish impetus if it is retested, especially if this happens within the supportive candlestick zone shown between 117.00 and 117.77.

Above, if we can break past 119.00, the next key resistance is likely to occur at around 120.00.

There are high-impact data releases scheduled today directly concerning the USD, but nothing regarding the JPY. At 1:30pm London time there will be a release of U.S. Unemployment Claims data followed later at 3pm by the Philly Fed Manufacturing Index.