USD/JPY Signal Update

Yesterday’s signal expired without being triggered as the price never hit 117.03.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am and 5pm London time.

Long Trade 1

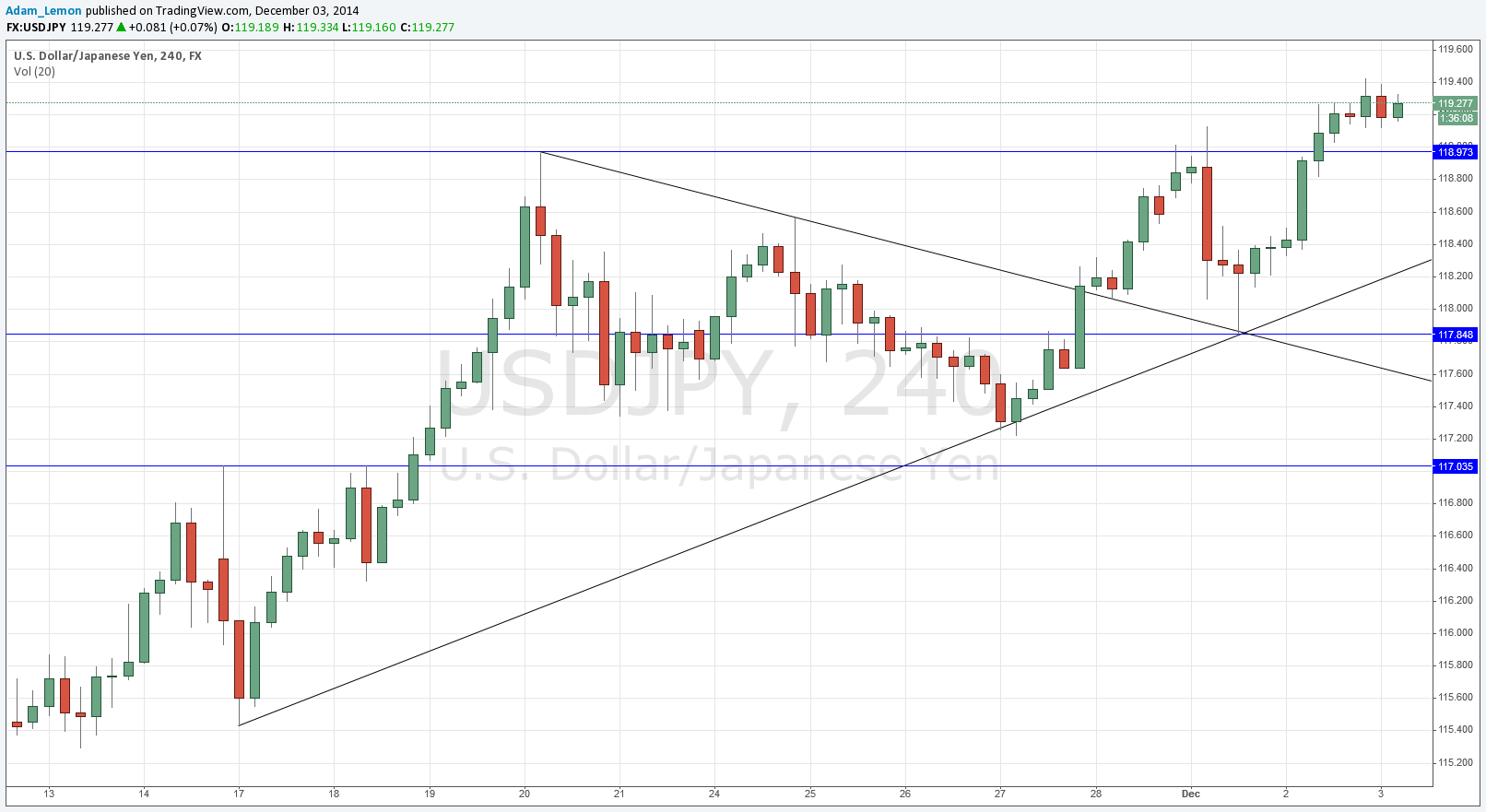

Go long following bullish price action on the H1 time frame immediately after a retest of the bullish trend line below, currently sitting at about 118.30.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Long Trade 2

Go long following bullish price action on the H1 time frame immediately following a touch of 117.85.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

We have made yet another multi-year high, only about 50 pips off the key psychological level of 120.00. There is key USD news coming up this Friday, so things are quite likely to calm down until that release is made.

Due to the strong bullishness I would not look at short trades, but there may be an opportunity today for another long trade.

Firstly, there is the double top just below 119.00 which is also confluent with a round number. This is likely to act as local support and so could be a good area for a long scalp. However I am not giving this level as a signal as it is really too close and too recent. If it is not hit today, tomorrow it will probably be stronger.

Secondly, there is a bullish trend line that has been forming for the past two or three weeks, it is only really apparent today. It is not a real 100% high-quality trend line, but in the current conditions a bullish bounce there should be significant.

Thirdly, there is a flipped level at 117.85 that is the origin of the most recent swing up. This level is quite likely to give a bounce.

We will probably not hit either of the good levels today, however.

There are no high-impact data releases scheduled today directly concerning the JPY. Regarding the USD, there will be a release of ADP Non-Farm Employment Changes at 1:15pm London time, followed later by ISM Non-Manufacturing PMI at 3pm.