USD/JPY Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/JPY Signal

Risk 0.75%

Trades may be entered only before 5pm New York time, and then after 8am Tokyo time.

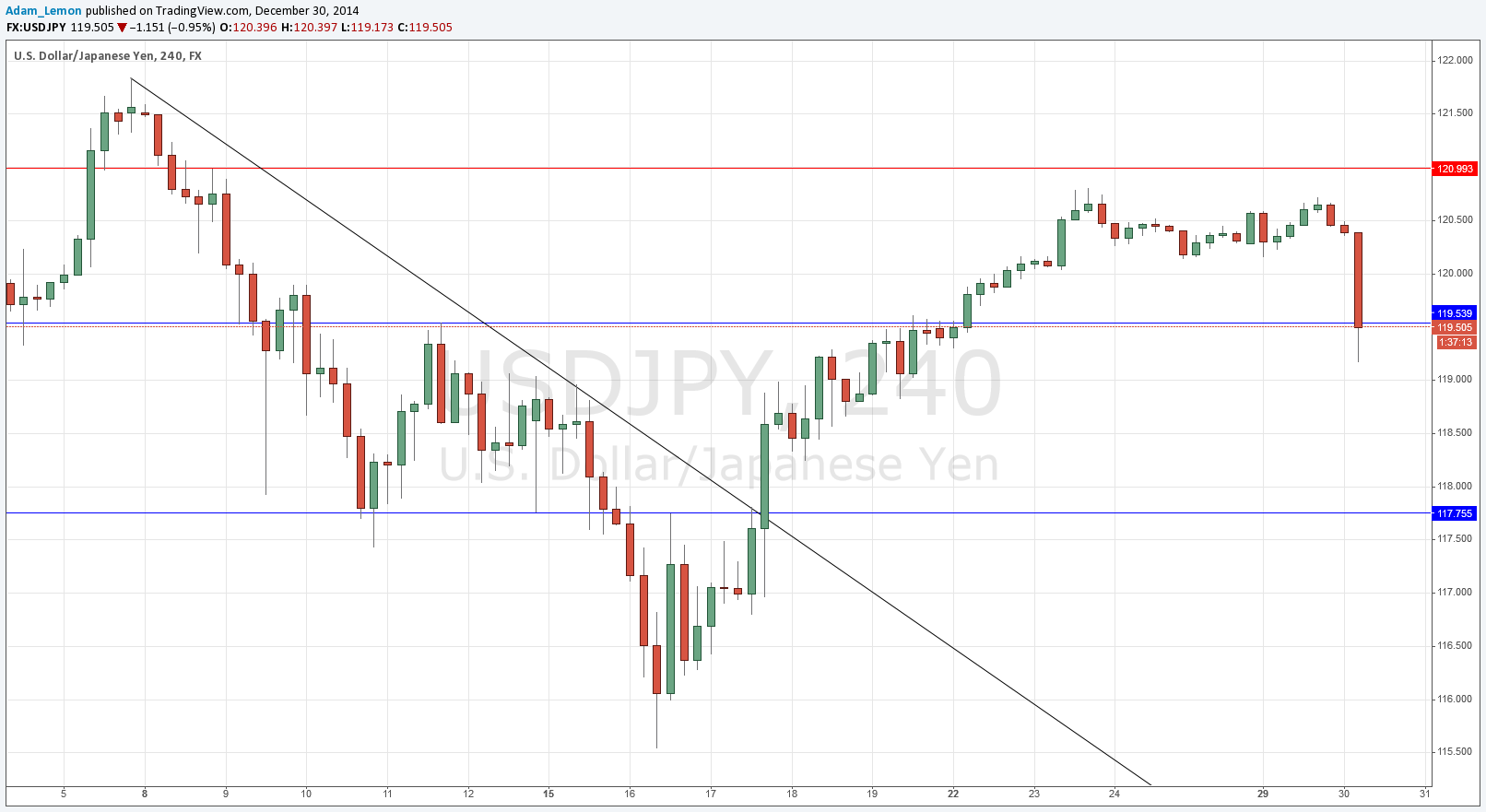

Long Trade 1

Go long following bullish price action on the H1 time frame immediately after the price first reaches 119.54.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Long Trade 1

Go long following bullish price action on the H1 time frame immediately after the price first reaches 117.75.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following bearish price action on the H1 time frame immediately after the price first reaches 121.00.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

Despite the slight USD bullishness yesterday, the pair went sideways, which was a hint that we might have been about to see some JPY strength. That strength has just been revealed early this morning as the price plunged below the anticipated support at 119.54. If at 9am London time the price is below this level, we should consider that support invalidated, and if not, be very careful with taking a long trade from here, as the candlestick pattern does not seem to be one that will allow for a quick recovery. It seems more likely that the next area for a long would come at the 117.75 level.

There are no high-impact data releases scheduled today concerning the JPY, as it is a public holiday in Japan tomorrow. Regarding the USD, there will be a release of CB Consumer Confidence data at 3pm London time.