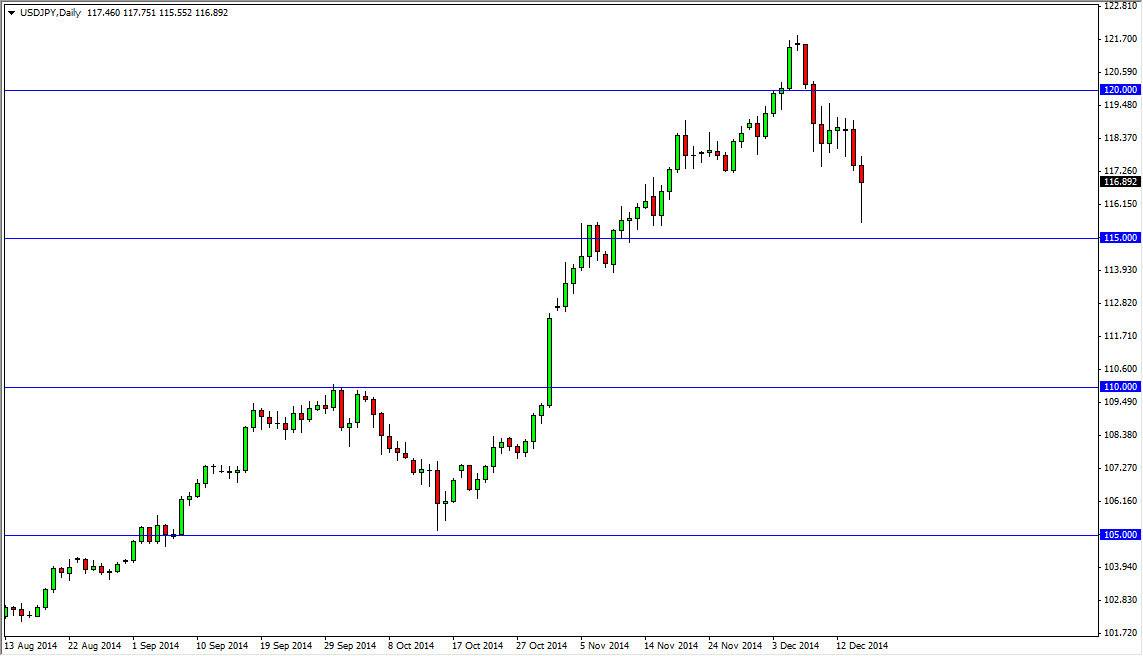

The USD/JPY pair formed a hammer during the session on Tuesday, as we trying to to break down below the 115 level, but failed. This was an area that I had spoken of as being the “floor” in the Forex markets, so I have to admit this only validates what I’ve been thinking for some time. The fact that we formed this hammer suggests that if we break above the top of the hammer we should continue the bullishness and head back towards the 120 level. Ultimately, if we can break above there I feel that the market will then go to the 125 handle, but at the end of the day this is a longer-term “buy on the dips” and “buy-and-hold” type of situation anyways. In other words, I’m looking at the longer-term prospects of this pair and simply have no interest in selling it.

The hammer of course is one of my favorite signals, as it shows that there is significant buying pressure underneath. On top of that, we have a perfect storm in this pair as far as I can see.

Battle of the central banks diverging

Previously, we had two central banks that were involved in extreme monetary policy, keeping things is losing the easy as possible. However, the Federal Reserve has now walked away from quantitative easing, and that of course means that the US dollar is free to rise in value in a world of ultralow interest rates. This is especially true against the Japanese yen, as the Bank of Japan has been so easy with its monetary policy.

I believe that we are in a longer-term uptrend, and that if we see this pair fall, think of it as value as the US dollar should continue to be much stronger than the Japanese yen anyway. With that being the case, I feel that selling isn’t even a possibility, and with that I continue to add to my position over the longer term and little chunks as I believe this is going to be a career making move.