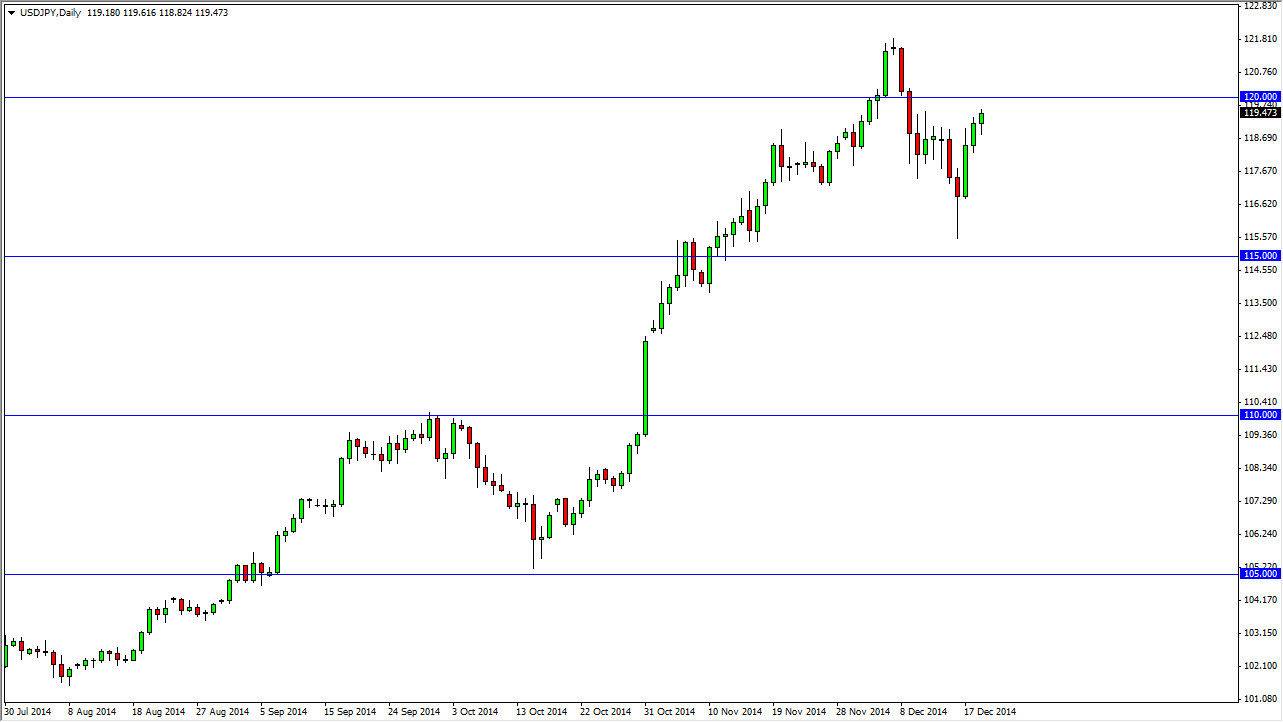

The USD/JPY pair initially fell during the course of the session on Friday, but as you can see we found enough support to turn things back around and form a hammer. The hammer of course suggests that there are buyers in this marketplace and are ready to continue to influence the pair, and I believe that we will more than likely make an attempt to break out above the 120 level. I don’t know that we can do it this week in based upon lack of liquidity, but even if we don’t make it above there, we believe that a pullback should be a nice buying opportunity as it represents “value” in the US dollar.

This marketplace looks very healthy, but pullbacks are what I need to see in order to get involved. It is a necessarily that I have any interest in shorting this market, it’s just that I look for value when it comes to picking up this particular asset, in this case the US dollar. I have absolutely no interest in owning the Japanese yen, as I think the central bank in Tokyo will continue to work against the value.

Uptrend is intact

The uptrend is intact as far as I can see, and quite frankly as long as we stay above the 110 level I don’t think that changes. That being the case, it’s only a matter of time before we can start buying dips again and again, building a massive position that we can hold for years. Sooner or later, the swap will become positive again, and that will only add fuel to the fire so to speak. With that, it’s very likely that the dips will be relatively shallow, but the lack of liquidity over the next several sessions could make some of the moves relatively erratic. Although there is the possibility of making money to the short side during these moves, I will simply look for massive pullbacks as an opportunity to load up on this position yet again.