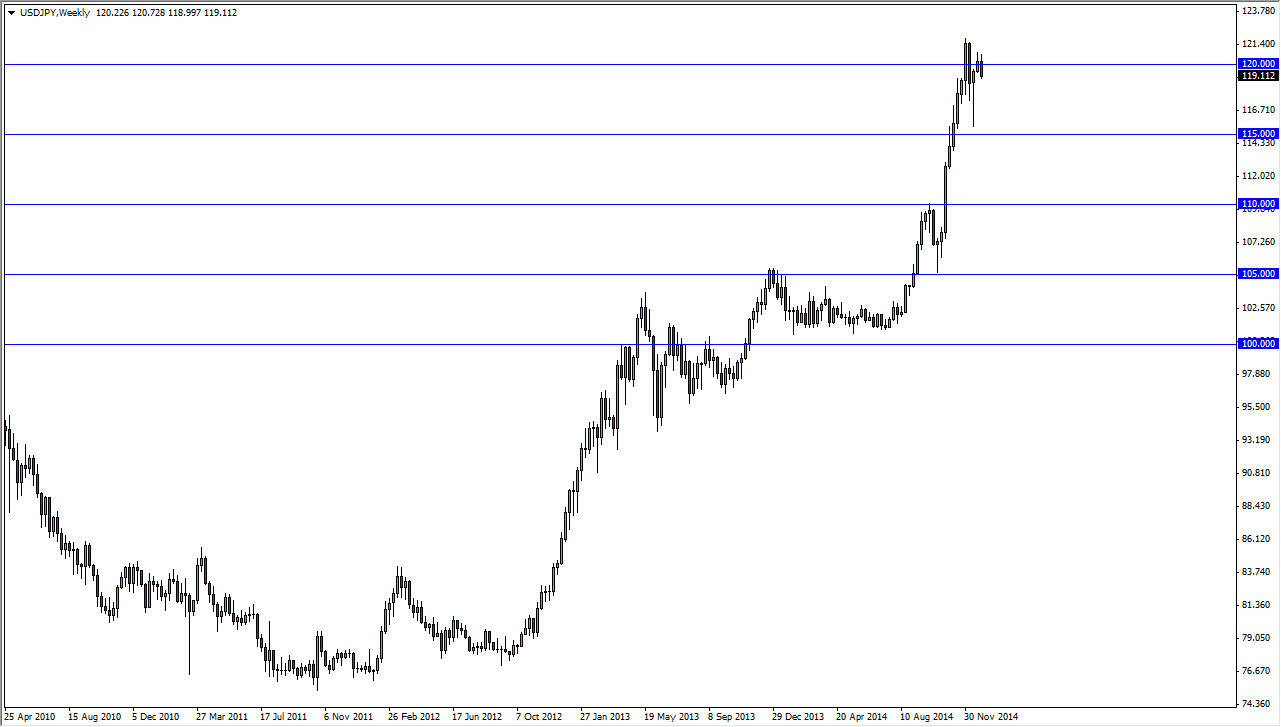

The USD/JPY pair has been on an absolute tear to the upside for some time now. I believe that January will may be a bit of an anomaly, as I think of pullback is probably needed. We could drop as low as 115, or even 110 over the course of the next several weeks. Nonetheless, I think this is simply going to end up being a buying opportunity in a market that has gotten a bit too far ahead of itself. I believe in the uptrend, I just believe that perhaps we’ve gotten a bit too far to the upside into short of a time period.

The interest-rate differential will continue to separate between these two central banks, but quite frankly the US dollar should continue to be an asset that you either buy, or wait for a better price. I have no interest whatsoever in selling this market simply because that means you buying the Japanese yen, and while I do think that it could appreciate during the month of January, there is no point in stepping out in front of a massive uptrend like this, risking having your account decimated.

Ultimately, we go much higher.

Ultimately, I believe that we continue to go much higher as the US dollar will continue to be the favored currency, and on top of that the US economy continues to be one of the best performing economies in the world. With that, we also have to look across the other side of the Pacific, where the Bank of Japan continues to keep a very loose monetary policy. With that, the value of the Japanese yen should continue to depreciate over the longer term, but that doesn’t mean that it will completely fall apart immediately. That’s essentially what I think the month of January is going to be about: a simple pullback in order to reload the long positions that the market seems to want to build. When you see a move like this though, quite often you need a pullback in order to build up enough momentum to keep going.