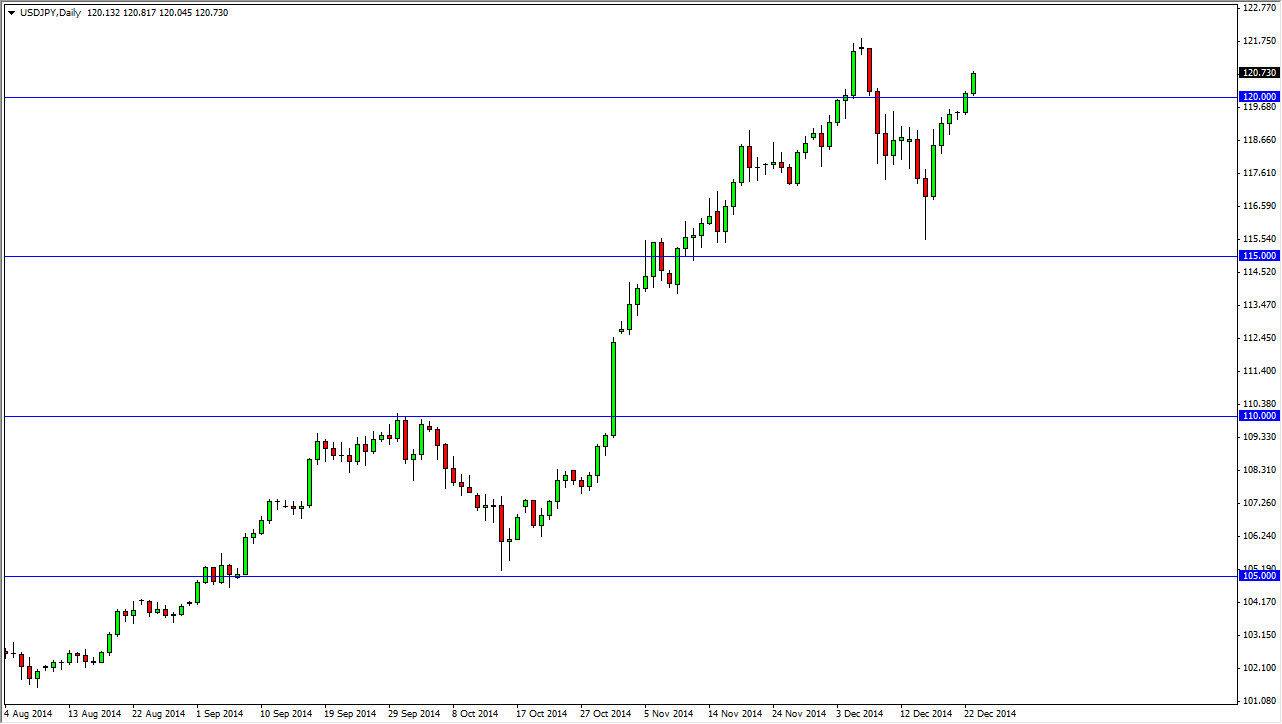

The USD/JPY pair rallied during the session on Tuesday, breaking well above the 120 level but as you can see we gave back about half of the gains and formed a shooting star. I don’t think this is a sell signal though, I think this simply shows that the market could pull back a little bit looking for more buyers and more momentum. With that, I think it’s only a matter of time before we go higher in any pullback at this point in time to me suggests that the market should be bought yet again. I believe that this market will be a “buy on the dips” type situation going forward, although I am the first person admit that we are probably a bit overbought at the moment.

Ultimately, every time we pullback and form a supportive candle I think that’s reason enough to start buying, and therefore that’s exactly what I will do. I’m actually not too worried about this market falling for any real length of time, as the uptrend is so solid.

Divergent central bank policies

The divergent central bank policies that we see between Washington and Tokyo make this essentially a “perfect storm” for an uptrend. The Federal Reserve has step away from quantitative easing while the Bank of Japan continues to add to their program. I really don’t see that changing anytime soon so I think it’s only a matter of time before the pair goes much, much higher. That’s not to say that we won’t have a significant pullback from time to time, what frankly we are way overbought at this point. However, I don’t see any reason the short this market and I would look at any pullback as a gift representing “value” in the US dollar, which is by far the most favored currency out there right now.

I believe that this pair will probably go as high as 135 by the end of the year in 2015, possibly even higher than that. Regardless, I would be stunned to see this pair dropped below the 115 level, and even more so the 110 level.