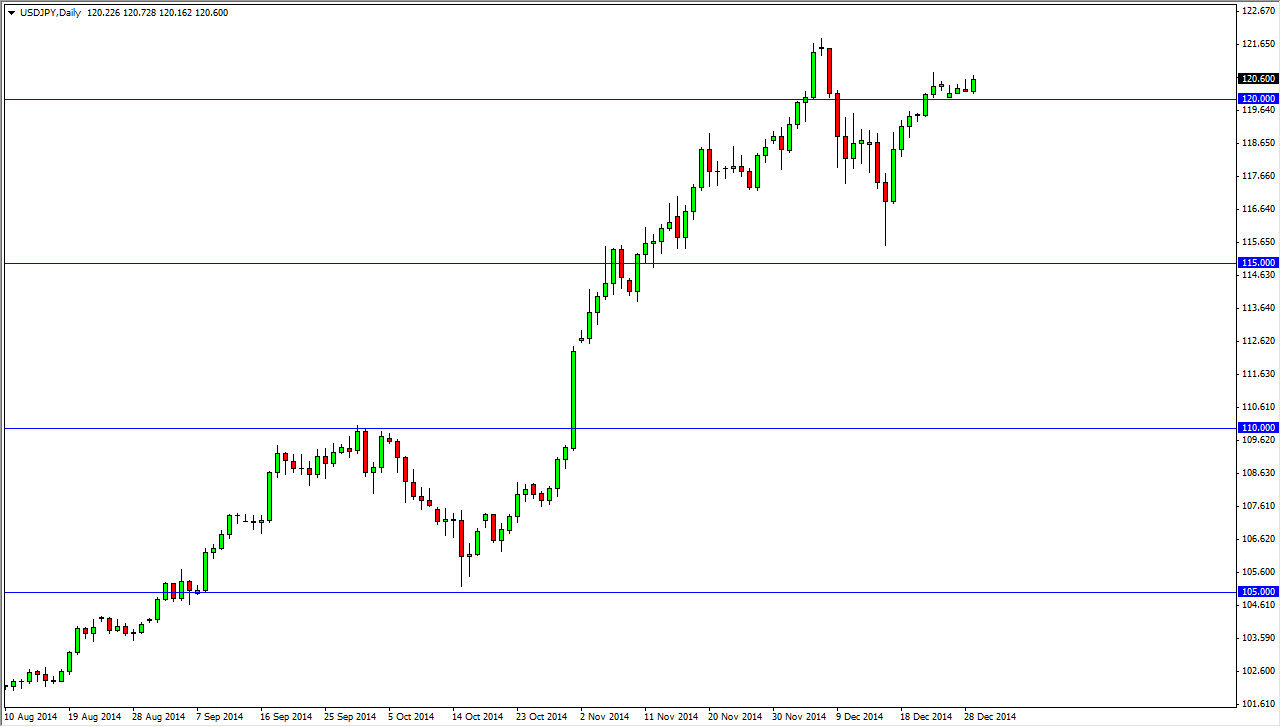

The USD/JPY pair rose during the course of the session on Monday, using the 120 level as a supportive barrier. That being the case, we bounce slightly, but as we are getting so close to the New Year’s holiday, it’s very difficult to imagine this market moving rapidly. Quite frankly, if we were going to get some type of huge surprise based upon a lack of liquidity, we would’ve had it already.

I believe that the US dollar continues to be the favored currency around the world for the foreseeable future, and as a result it’s only a matter of time before this pair goes much higher. Quite frankly, if we can get above the 122 level, I think that we would then head to the 125 level. That being the case, I think that every time we pullback it is a buying opportunity. Also, this is essentially a “one-way trade” as far as I can see due to the fact that the central banks are completely polar opposites when it comes to interest-rate policy and monetary policy.

The Federal Reserve and the Bank of Japan

The Federal Reserve has step away from quantitative easing, which of course brings up the value the US dollar overall. With that being the case, US dollar has taken off against most other currencies, and this is been especially true when it comes to the Japanese yen. The Bank of Japan continues to do what it can to loosen monetary policy, and as a result it’s only a matter of time before this pair continues to climb much higher. Quite frankly, if we pullback from here I am more than willing to continue to add to my already sizable position in this market.

I believe that this market should continue to go higher every time it dips, as buyers will return again and again and this is a longer-term uptrend. With that, I am bullish of this pair, and will continue to be in general. In fact, I believe that the Japanese yen can be sold against just about everything at the moment, including precious metals.