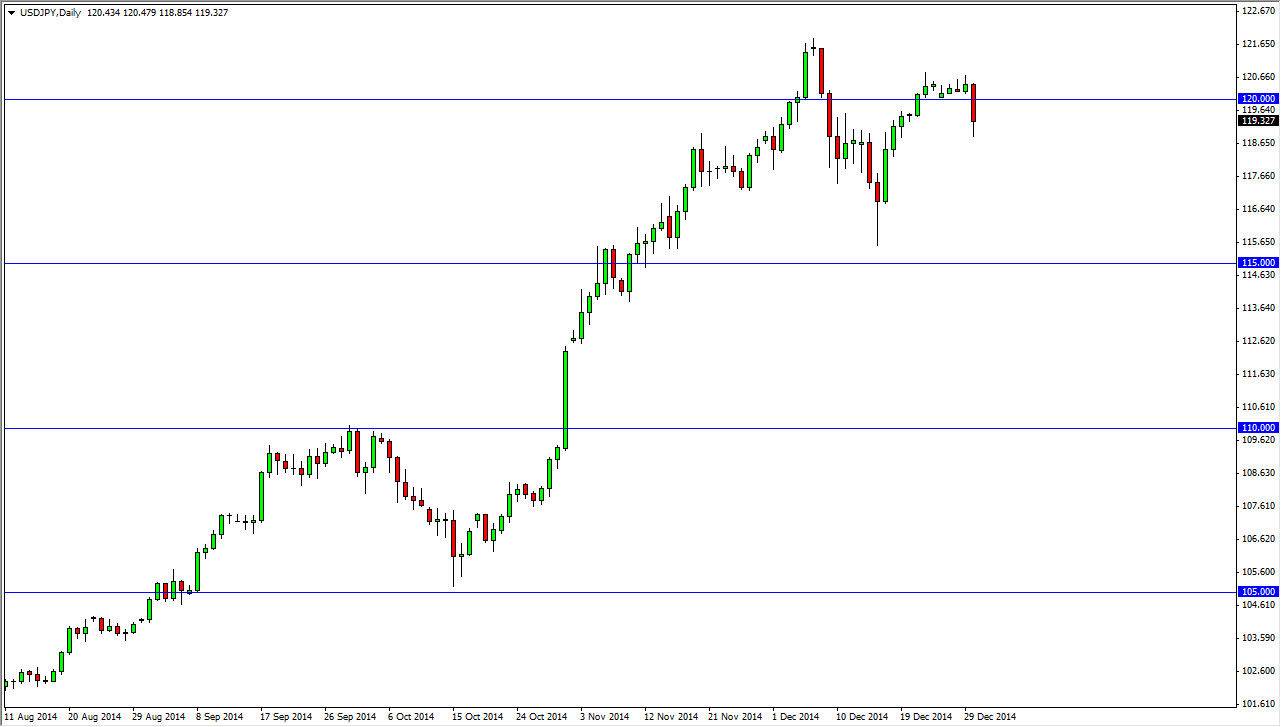

The USD/JPY pair fell during the course of the day on Tuesday, slicing through the 120 handle. I believe that the market is probably experiencing a bit of profit taking, as this pair has been so drastic and it’s uptrend, and although I agree with the uptrend, we are bit overbought at this point so I actually am encouraged by any type of pullback that we get. I think that represent value in the US dollar, and I believe that there is a massive amount of support below.

Any supportive candle below looks to be a buying opportunity as far as I am concerned, and I believe that we continue the longer-term trend should continue going forward. Ultimately, I believe that this is a multi-year opportunity for traders around the world to make serious money in the Forex markets. Yes, we are overbought at this point in time but I recognize that sooner or later all of the so-called “weak hands” will be flushed out of the market, allowing for real money to come back in.

Buying dips

One of the best ways to explain how I am approaching this pair is to simply suggest that I am buying dips. I am looking at longer-term charts, and recognize that even if we fall 200 pips right now, in the big scheme of things it doesn’t matter. It’s just hesitation on its way higher. If they sell this market off, you have to start looking for value.

I believe that value can be found in time and time again, and that we will eventually go to the 125 handle. After that, I believe that we will go much, much higher and that this is a trend that should continue for the foreseeable future. The Bank of Japan will continue to work against the value the yen, and as a result I believe that all yen related pairs will eventually go higher given enough time. This of course is going to be no different as far as this market is concerned.