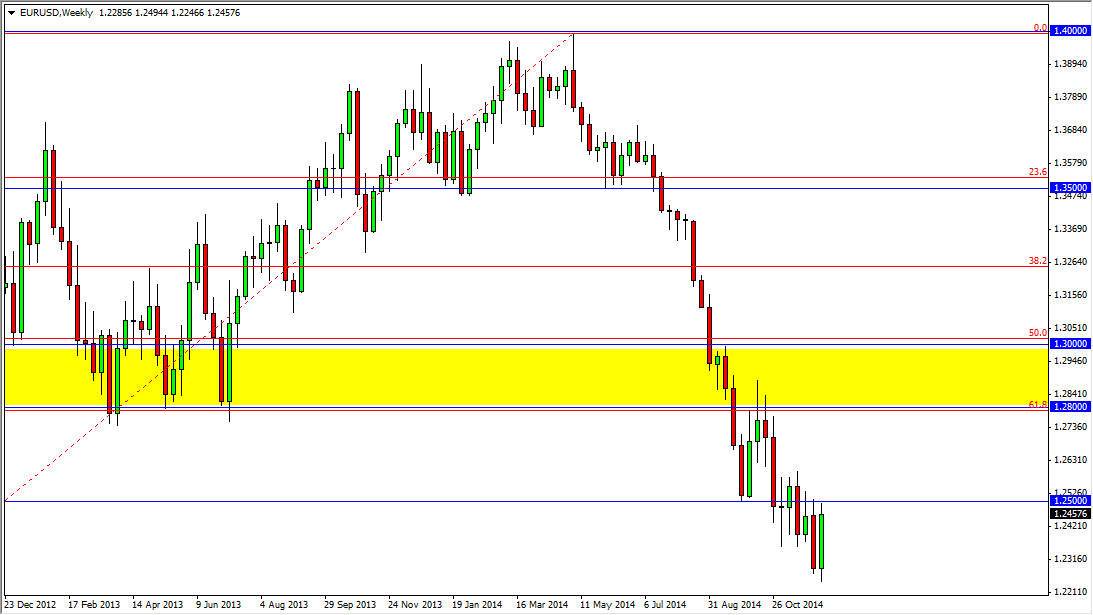

EUR/USD

The EUR/USD pair had a very positive week, but as you can see struggled at the 1.25 level yet again. Because of this, I think there were going to continue to see bearish pressure every time it reaches area. Ultimately, I think that we need to break above the 1.30 level in order to start buying with any type of significant size. I think that resistive candles continue to offer selling opportunities but it will be difficult to trade this market for longer-term moves as we approach the Christmas season.

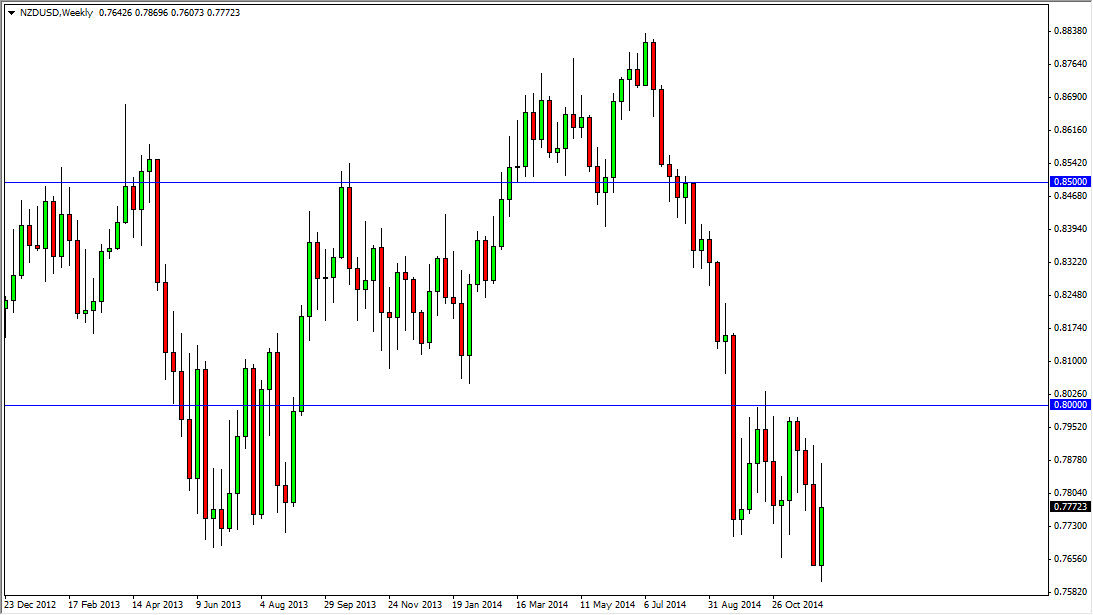

NZD/USD

The NZD/USD pair broke higher during the course of the week, but as you can see struggled above the 0.78 handle. It really doesn’t matter though, because the Royal Bank of New Zealand has already stated that it believes fair value is somewhere closer to the 0.68 handle. With that, I am a seller of the Kiwi dollar going forward and I do believe that we will hit the 0.75 level fairly soon.

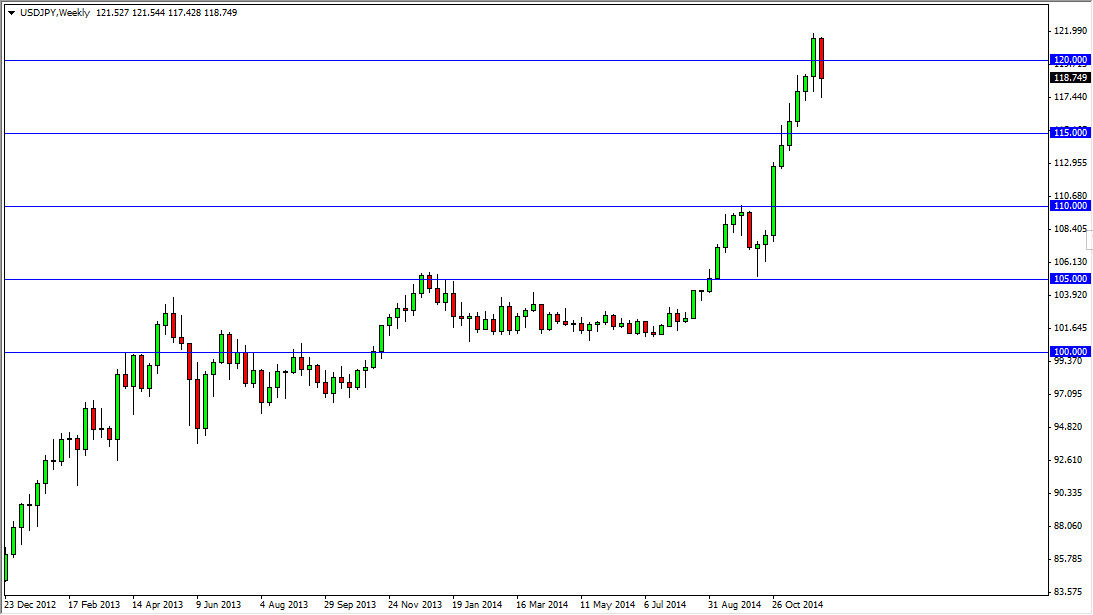

USD/JPY

The USD/JPY pair fell hard during the course of the week, but struggled at the 118.50 level to go any lower. I believe that this market is going to go much higher given enough time, but we could see a little bit more of a pullback. I would be especially interested in a supportive candle near the 115level, and even more so at the 110 level. Ultimately, I believe this is a “buy on the dips” type of market and should be for the balance of 2015.

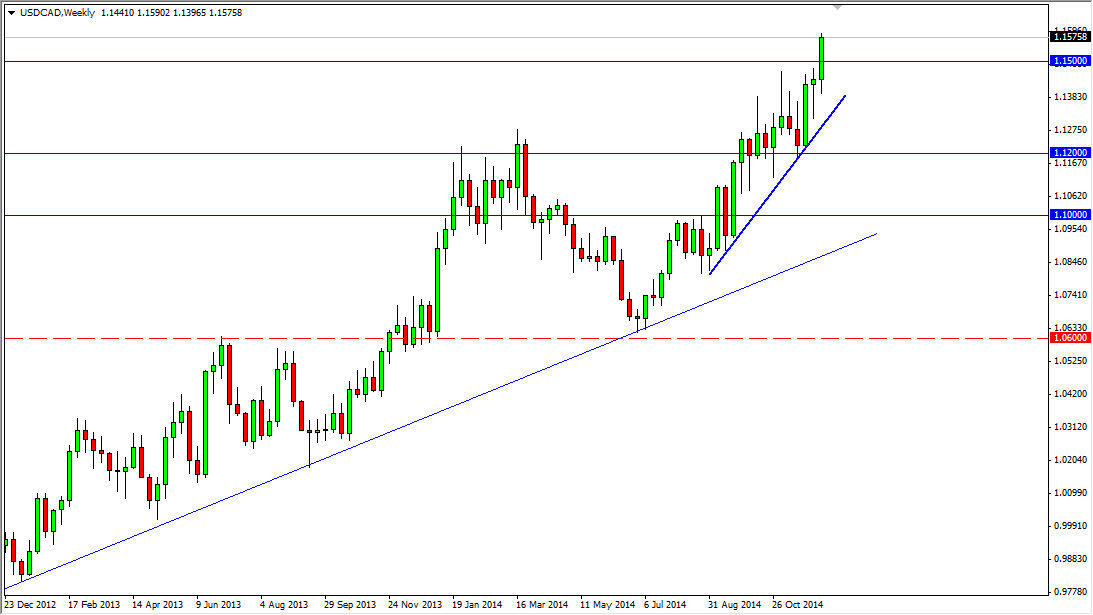

USD/CAD

The USD/CAD pair broke out above the 1.15 level this week, which of course is a very strong sign. Because of that, I think we are heading to the 1.18 level, and then possibly the 1.20 level after that. As the oil markets fall apart, so does the Canadian dollar’s I really don’t see any direction in this market besides up. Have no interest in selling, so I think that this could be a nice longer-term trade as we “buy on the dips” for the next several months.