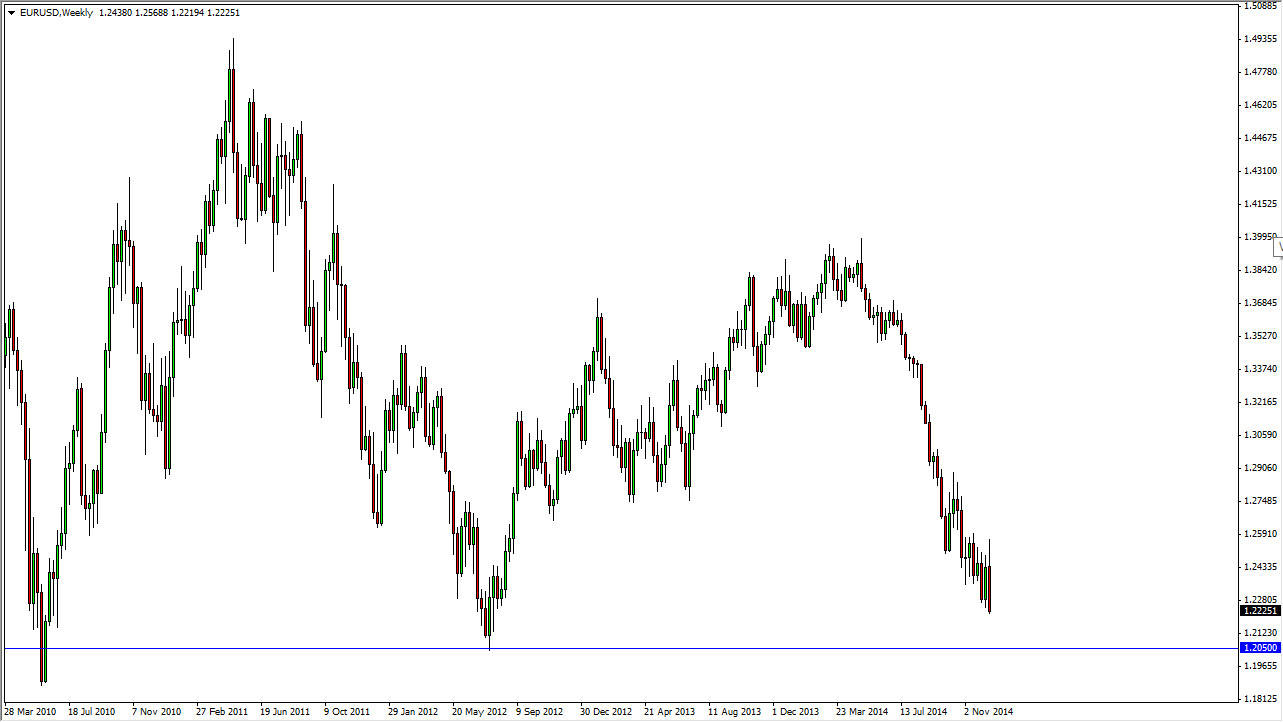

EUR/USD

Looking at the EUR/USD pair, we tried to rally during the course of the week. However, the 1.25 level above is without a doubt resistive, and I believe that we will continue to fall from here. You can see that I have a line at the 1.2050 level. That is the beginning of the uptrend that we have now completely reverse, or at least will once we get down there. I think that the Euro continues to struggle overall, and should continue to fall over the next several weeks.

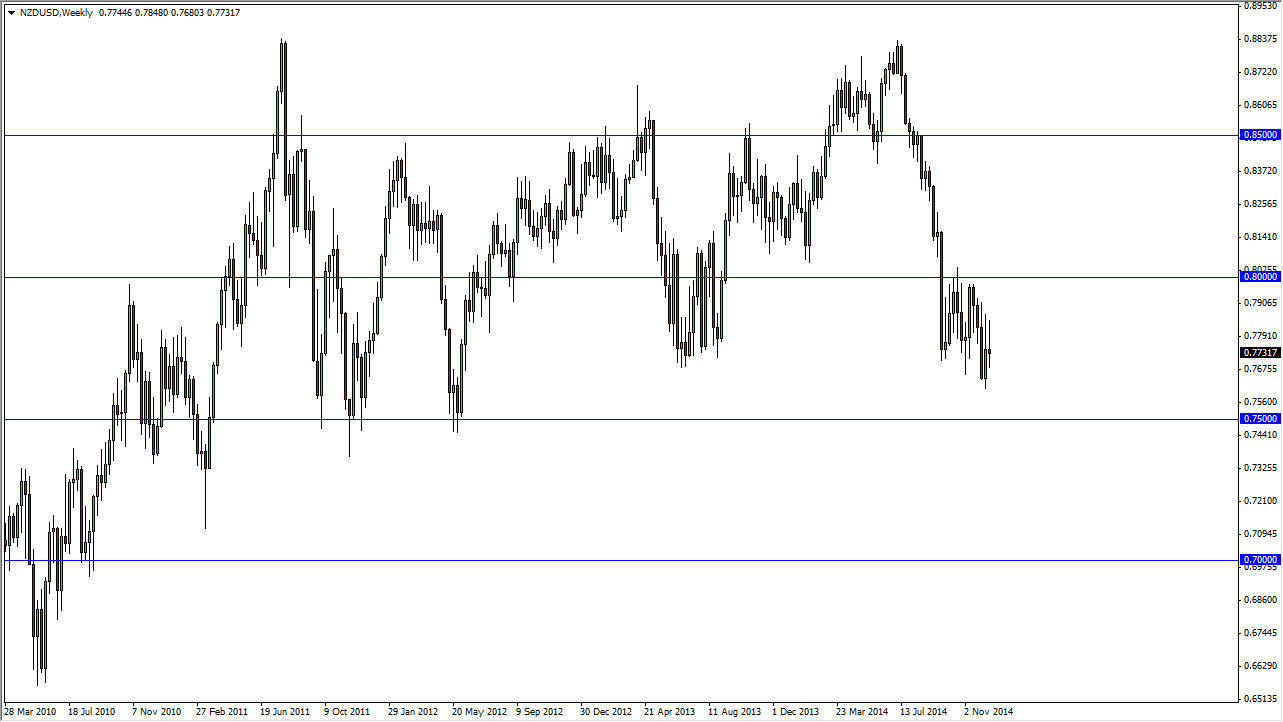

NZD/USD

The NZD/USD pair initially tried to rally during the course of the week, but ultimately pullback to form a shooting star. I believe the signifies that we are in fact going to go lower, and given enough time we should head down to the 0.75 handle. That is a pretty significant support level, so I think that we should have buyers step in at that level. Over the next couple of weeks I would expect this market to continue to have a bearish pressure in it.

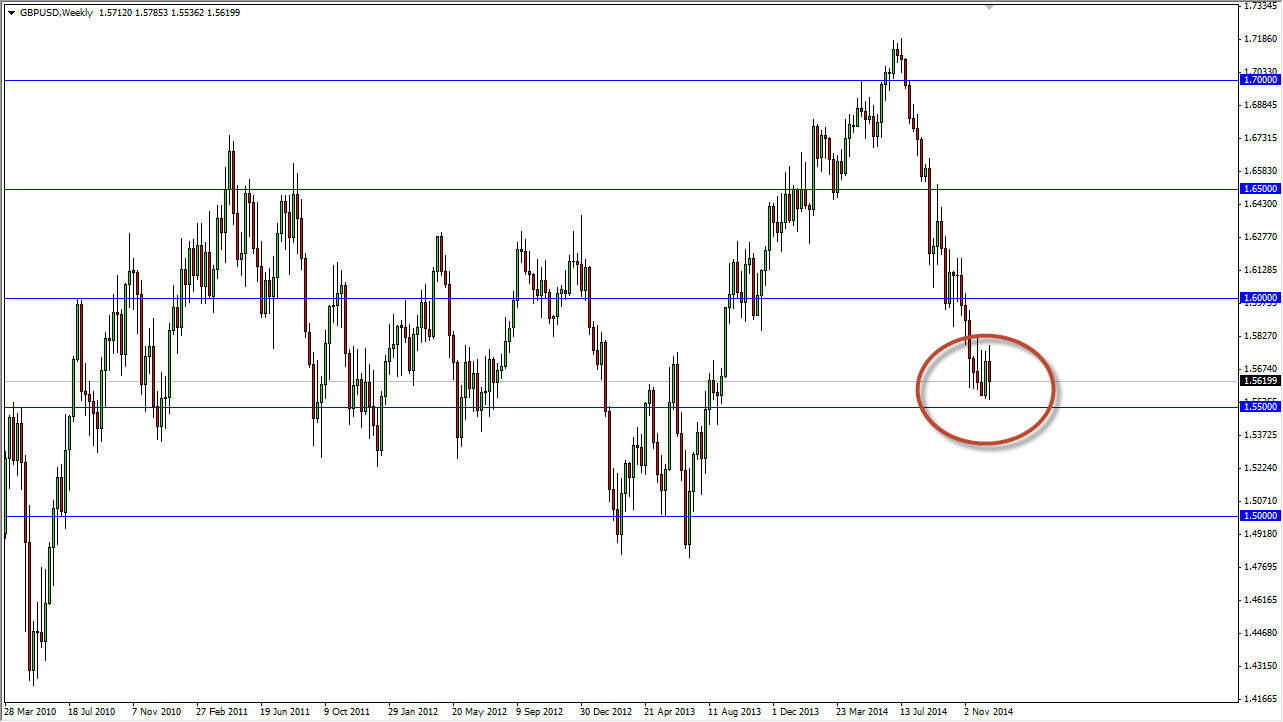

GBP/USD

The GBP/USD pair fell during the bulk of the week, but as you can see found enough support at the 1.55 level to form a fairly significant amount of consolidative support. Ultimately, I think we do break down below the 1.55 handle and head towards the 1.50 level. However, I do not think that happens in the next week or two, as the liquidity will be an issue. There is no interest on my part of buying in this market. I think that the 1.60 level above needs to be broken solidly in order for me to think that the trend has changed.

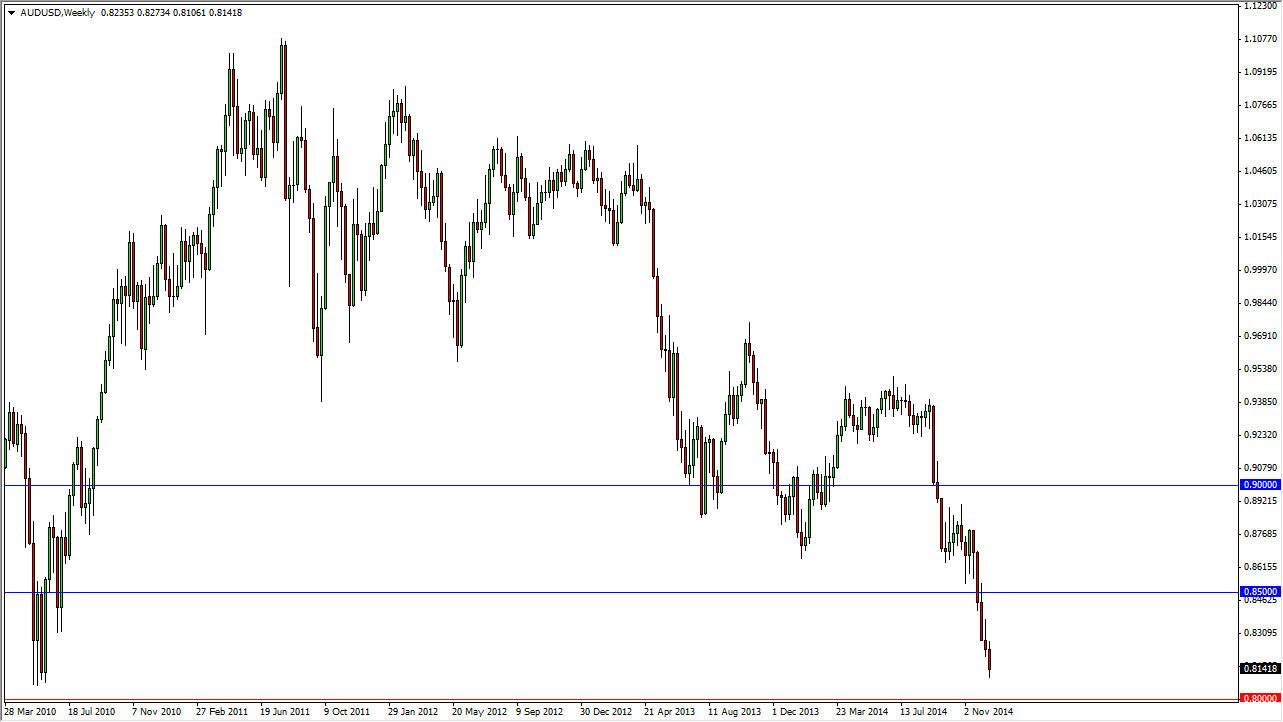

AUD/USD

The AUD/USD pair continued to fall during the course of the week, but as you can see we are getting down towards the 0.80 handle. At that level, there is a significant amount of support, as it was the site of a massive breakout a couple of years back. This is an area where I would fully anticipate seeing buyers step back into the marketplace, and with that I believe that simply waiting to see what happens at the 0.80 level could possibly be a massive buy-and-hold signal if we get enough support. In the meantime, although I expect this market to fall, I’m going to ignore that as I think we are approaching far too much in the way of support.