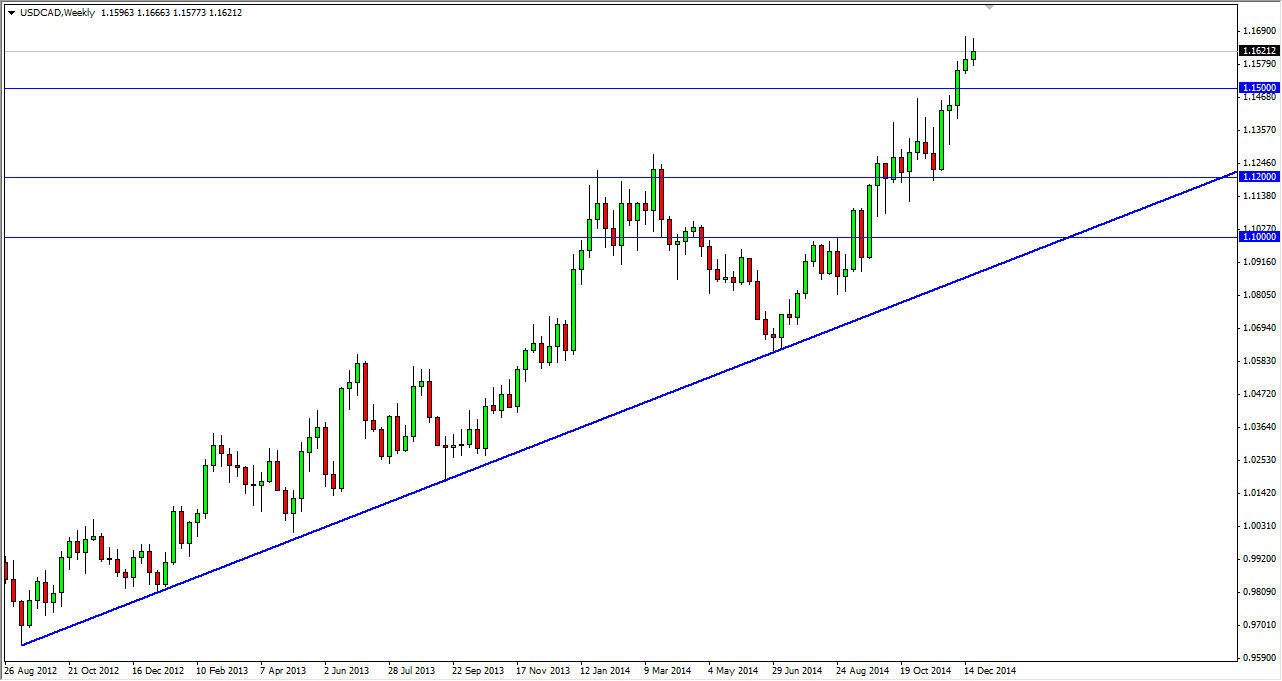

USD/CAD

The USD/CAD pair initially tried to rally during the course of the week, but for the second week in a row pullback and formed a shooting star. The shooting star of course signifies weakness, and the fact that we have seen it form for the second week in a row suggests that the market desperately needs a pullback. It is a little bit overbought at this point, so I feel that the market could use a little bit of momentum building in order to go higher. Because of that, I feel that waiting for a little bit of a pullback in order to start going long again is probably the way to go when it comes to trading this pair.

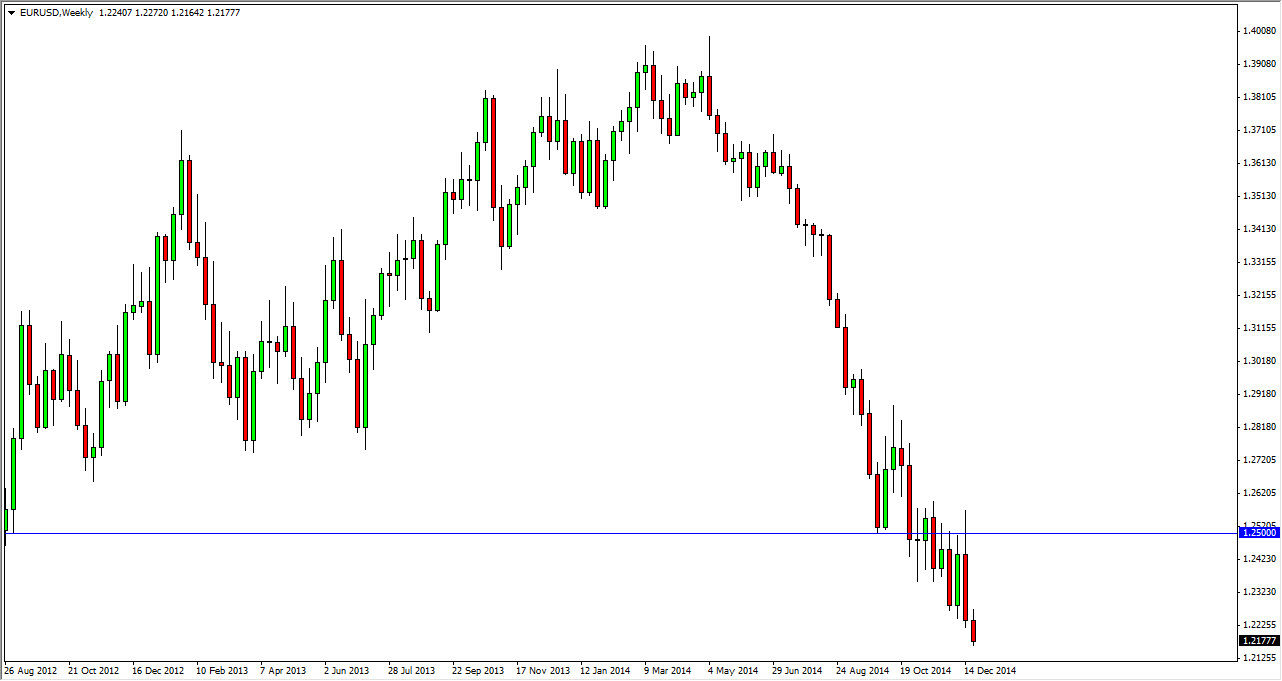

EUR/USD

The EUR/USD pair initially tried to rally during the week, but as you can see continue to fall. With that being the case, it appears that the Euro is in fact going to hit my target of 1.2050 fairly soon. With that being the case, the market is one that I will sell every time it rallies, but I do recognize that the moves might be a bit choppy between here and there. Nonetheless, I have absolutely no interest in buying this pair.

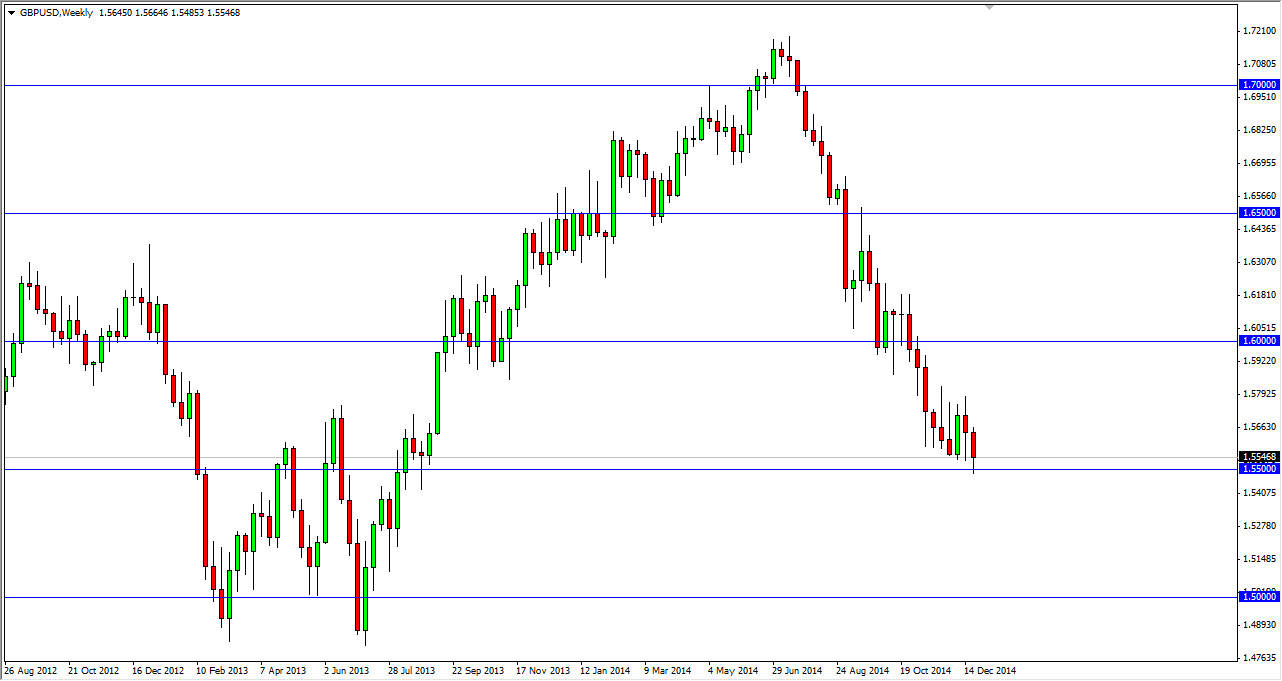

GBP/USD

The GBP/USD pair fell during the course of the week, testing the 1.55 level. We did bounce a bit from there though, so I think that we could have a little bit of a fight on our hands. However, I believe that selling on a break below are is the way to go, and as a result we break the lows from last week, I am in fact selling but I recognize it will be a choppy move down to the 1.50 region. Rallies could offer selling opportunities as well if we form resistive type candles.

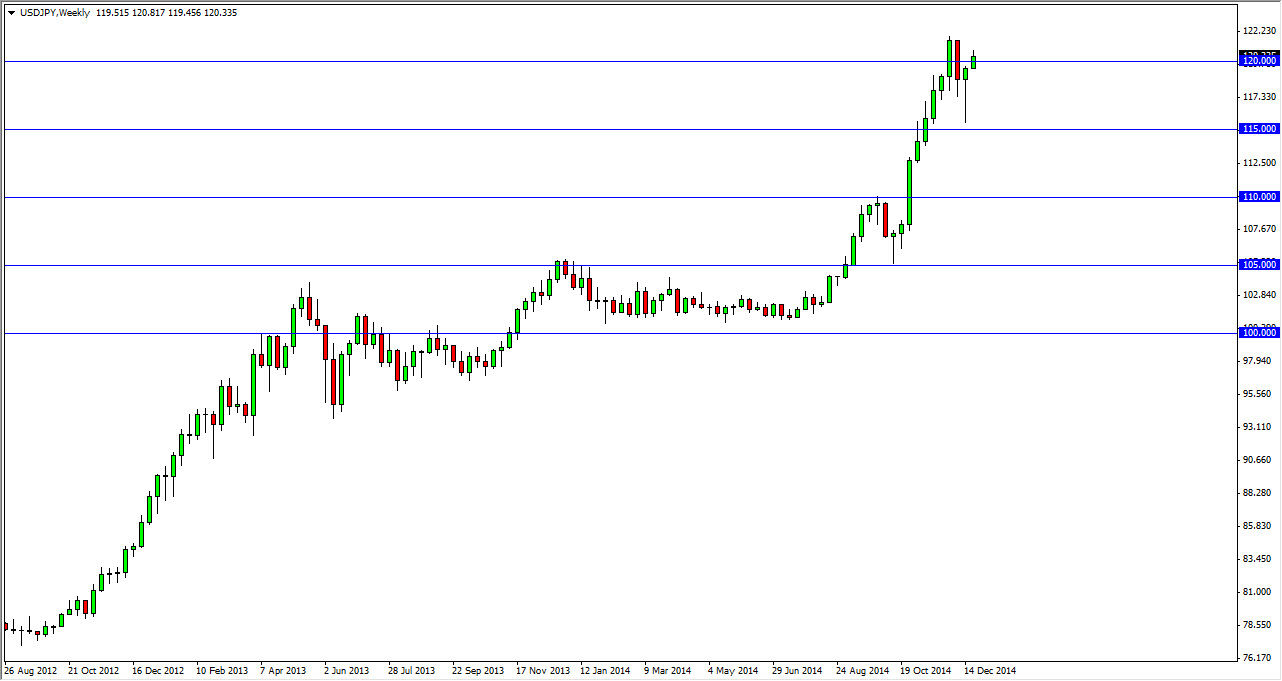

USD/JPY

The USD/JPY pair broke higher during the course of the week, and closed above the 120 handle. Because of that, I feel that the market is ready to continue going higher, and therefore short-term pullbacks will be buying opportunities as we should make fresh new highs. With that being the case though, I think that the 150 level is the floor of the market right now, and most certainly 110 is. Until we get below 110, I would have absolutely no thoughts selling this pair, as I do think that we are entering a longer-term “buy-and-hold” type of situation.