USD/JPY

The USD/JPY pair broke higher during the course of the week, going higher than the 120 barrier level. Because of this, I am a bit perplexed because we are without a doubt overbought at this point. I am looking for pullbacks to take a penny to value in the US dollar, and I think the closer that we get to the end of the year, a significant pullback in becoming due to the lack of volatility and money managers taking profits. Nonetheless though, I look at that as a potential buying opportunity.

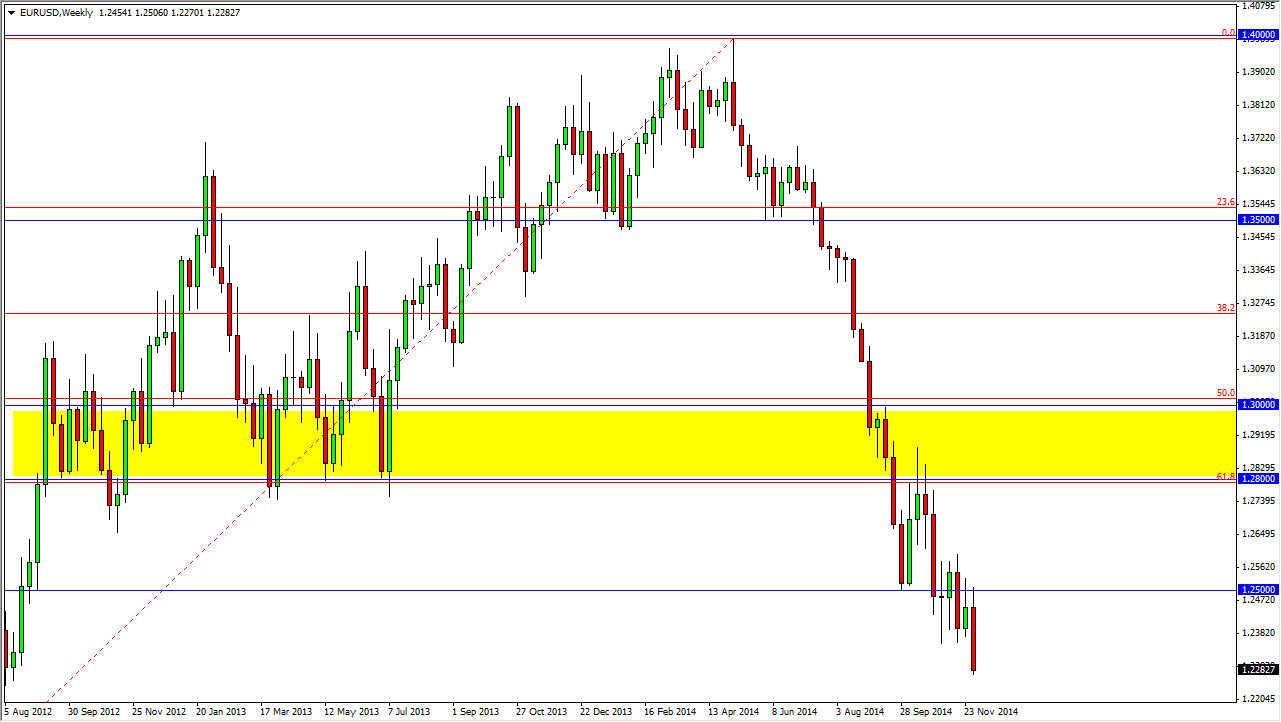

EUR/USD

The EUR/USD pair tried to rally during the course of the week, but as you can see struggled at the 1.25 handle. We ended up falling significantly, and that was only exacerbated by a stronger than anticipated employment number coming out of the United States. With that, I believe that this market still continues lower, probably heading to the 1.2050 handle, and then possible bounces that offer selling opportunities.

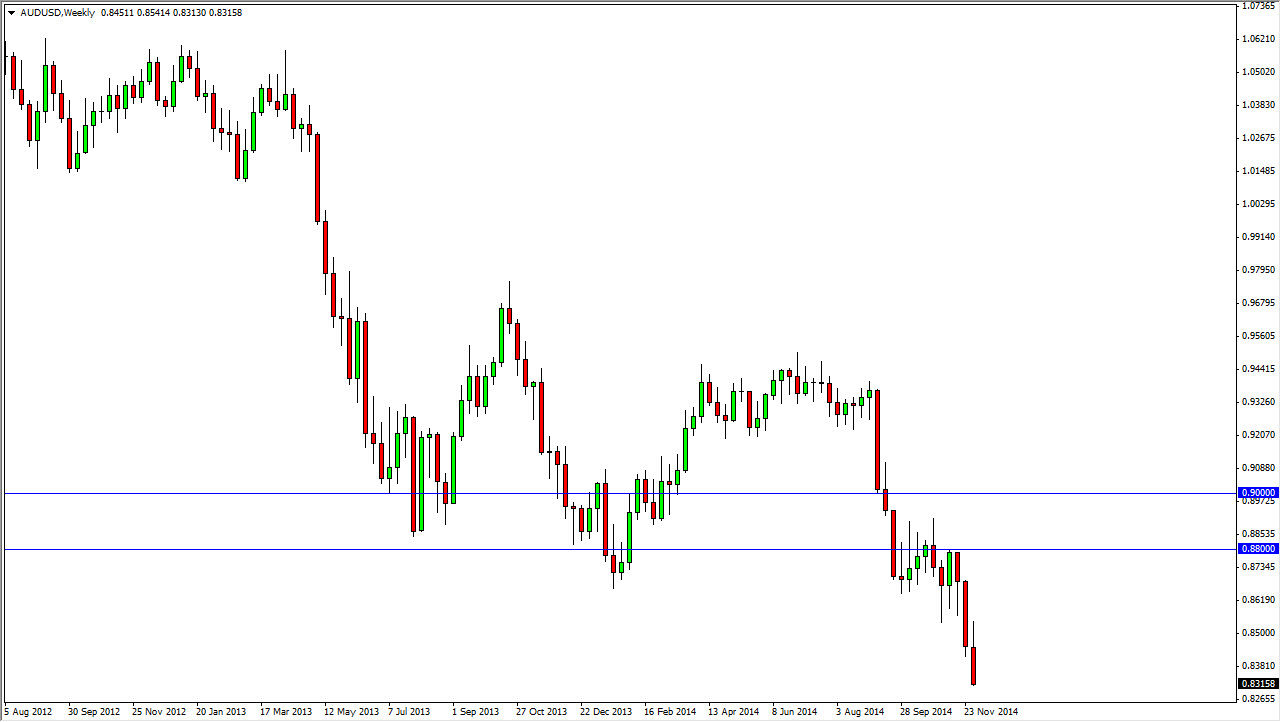

AUD/USD

The AUD/USD pair tried to rally during the course of the week, but as you can see the 0.85 level offered enough resistance to turn the market back around. With that being the case, we formed a very negative candle and it now appears that there is nothing standing between here and the 0.80 handle. Ultimately, I think that we could see a massive rally from that area, so I am selling in the short-term, meaning the rest the year, but very cognizant that we may get a turnaround starting in 2015.

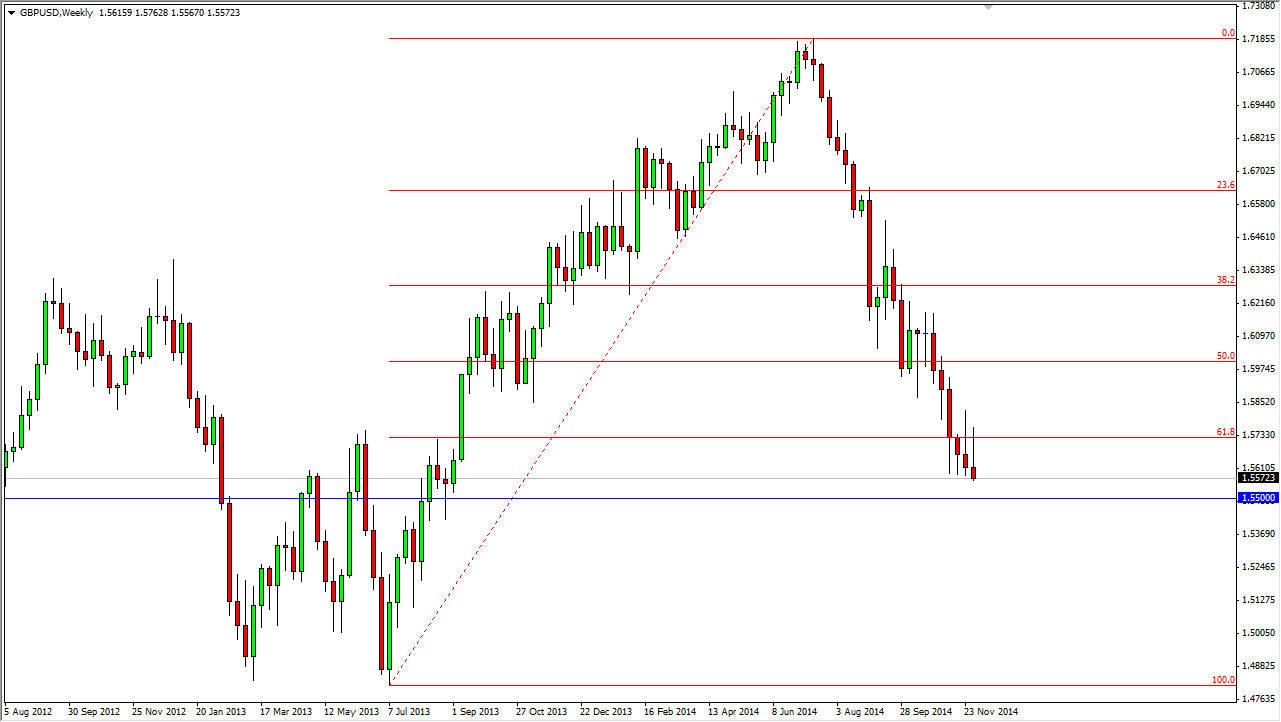

GBP/USD

The GBP/USD pair broke higher during the course of the week, but as you can see struggled above the 1.57 handle. With that, it’s very likely that we would see sellers above there, probably pushing this pair much lower. I think that the 1.55 level will come in as somewhat supportive, but ultimately I don’t see anything stopping this market from falling all the way down to the 1.50 level given enough time. With that, I continue to sell rallies, and believe that ultimately the US dollar continues to strengthen in general.