By: Stephanie Brown

DigitalTangible currently manages the world’s first Bitcoin/precious metal exchange. It allows consumers to use Bitcoins to buy these metals online, with the users identified through block chains. The metals are stored in digital vaults currently being managed by the International Depository Services of Delaware. Although, transportation costs for precious metals are rather steep but DigitalTangible believes that it can take care of these costs and would ultimately cater to the demands of users spread across the globe. The company additionally announced that it will be partnering with Agora Commodities in order to meet the present demand from current and future users.

MasterCard is now the latest company to have fallen out with the Bitcoin community following HSBC, which recently closed Bitcoin Hedge Fund accounts, fearing that they may be used for money laundering activities. The credit card processing giant asked the Australian Senate to not adopt the digital currency. The reason being, revolves around the user anonymity, which the company believes will likely increase money laundering. Many industry experts believe that payment processing companies like MasterCard are rallying against the Bitcoin community, because the crypto-currency provides a cheaper and a better alternative to users. This could in fact direct the masses away from credit card companies, thus eroding their current monopolistic hold on the market place.

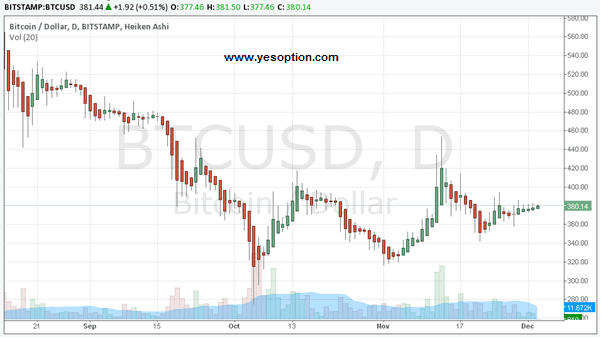

Technical Analysis

The BTC/USD finally ascended above $378 and is currently trading at $381.44. It is finding strong support at $376 on the downside, while facing resistance at $385 on the upside. A positive close above $384 in today’s trading session should indicate a short-term upside.

Actionable Insight

Buy the BTC/USD above $382.5 for target of $385, $388 with a stop-loss of $381.7