By: Stephanie Brown

Many analysts believe that the frenzy surrounding Bitcoin is fading over the past few months as the volumes in the markets have dried up. However, volumes did increase a few days ago, thanks to the second Bitcoin auction conducted by the U.S. Marshal Service. This occurred due to the infamous closure of Silk Road, an online marketplace that was used to conduct various illicit operations. A company called SecondMarket, started in 2004, by CEO Barry Silbert swept the auction by winning 48,000 out of the 50,000 Bitcoins that were for sale and venture capitalist, Timothy Draper won the rest. Even though, there were many other bidders involved, many analysts believe that the turnout was not what it could have been, due to fading interest as volatile price movements that Bitcoin has witnessed over the past few months is keeping a number of potential investors away.

Recently, an online exchange called Bitmarkets came to the fore, claiming that it is a decentralized marketplace that runs on the Thor Network and uses BitMessage for communications between buyers and sellers. The founders of Bitmarkets believe that even though Silk Road, which was another decentralized online market-place that ceased all operations, it became even more imperative to form another decentralized exchange that will not be brought down by the authorities.

Additionally, they believe that Bitcoins offer a unique opportunity for users to maintain their privacy online and reduce transactions costs, which are significantly higher on other platforms because of mediators and third party applications. Furthermore, Bitmarkets should be able to provide users with a seamless experience and more importantly security, something that has been a concerning buyers and sellers for quite some time.

Technical Analysis

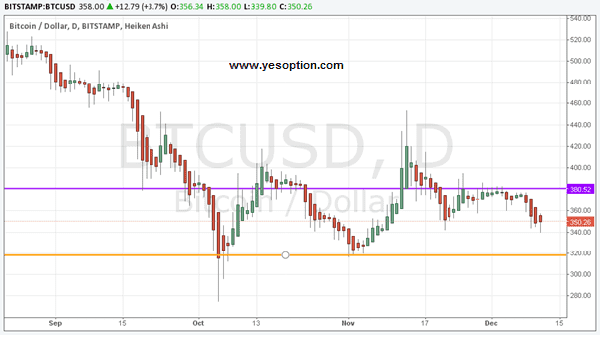

The BTC/USD continues to remain under pressure although it is trading in green at the moment. After every rally the crypto-currency faces extreme selling pressure, which is indicative of weak a trader sentiment along with a lack of direction on the upside. Lastly, the BTC/USD has strong support at $348 and $340 on the downside, with $362, $368 resistance on the upside.

Actionable Insight

Sell the BTCUSD below $356 for target of $350, $344 with a stop-loss of $359.5.