By: Stephanie Brown

A 40% slump in oil prices sent oil stocks plummeting much to the disgust of investors who were used to the high returns from the monopolistic industry. However, all is not lost as new strategies could generate impressive and exciting returns for the likes of Exxon Mobil Corporation (NYSE:XOM).

Saudi Arabia, one of the largest oil producing nations has already affirmed that oil companies need to refocus their attention on some basic principles as pressure of further decline in oil prices continue to mount. Exxon for example must try to attain maximum value from its current oil reserves instead of shifting attention to developing new reserves. If they fail to do so, shareholders will continue receiving low returns. Some oil players are already pushing for the oil supply to be reduced in order to curtail a further slump in prices.

The vast sums of money that Exxon intended to use in exploring and developing new reserves can now be used to maintain the current low-cost reserves that can sustain even a 50% slump in oil prices. There is no way that Exon and other western producers can ever match the amount or the cost of oil pumped by the likes of Saudi Armco and Russia’s Rosneft, which have access to some of the world’s finest reserves. The only way Exxon and BP plc (ADR) (NYSE:BP) can be successful in guaranteeing shareholder value is by not spending billions of dollars when drilling through Arctic ice caps in a push to compete with the Saudis who pump oil from the desert at a low cost.

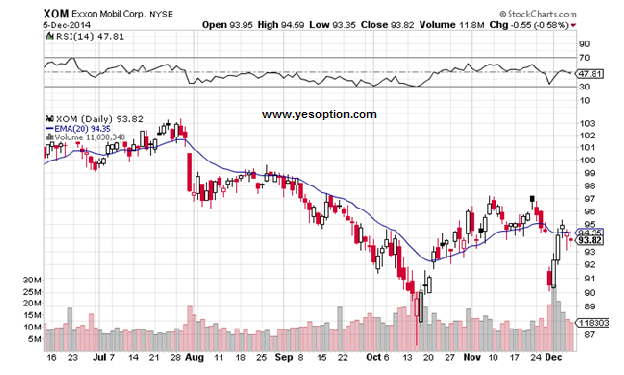

Technical Analysis

Exxon Mobil Corporation (NYSE:XOM)

Exxon recently started making lower-tops and higher-bottoms. The stock is in a short-term downtrend since last Wednesday, causing it to lose more than 5% of its market value. Exxon is currently trading below its 20-Day EMA of $94.35, with an RSI of 47.81.

Actionable Insight

Sell Exxon Mobil Corporation (NYSE:XOM) below $93.5 for target of $93, $92.6 with a $93.75 stop-loss.