By: Stephanie Brown

Internet service providers seem to be doing all they can to provide their consumers some of the fastest internet download speeds, according to Netflix, Inc. (NASDAQ:NFLX). Customers reportedly experienced fewer interruptions when downloading content from the likes of Netflix due to increased speeds, which commenced in November 2013.

The company stated that most of its users experienced an increase of 3.07 Mbps in internet speeds from ten of the largest service providers. The increase in internet speeds comes at a time when there is a bitter standoff as to how to adhere to Net Neutrality policies.

Netflix saw a 51% increase in streaming, with the Midwest region being the biggest beneficiary, which is enjoying a 74% increase in streaming speeds. These measurements are based on Netflix’s ISP speed index that measures streaming performance on various internet service providers. Netflix takes a keen interest on internet speeds due to its large market share in the video streaming business. The streaming giant accounts for almost 35% of the total bandwidth usage across North America. It is no secret that faster internet speeds enable better streaming. Additionally it allows high-quality viewing with fewer interruptions and faster start times for movies. Netflix has already congratulated companies such as Cablevision, Charter and Cox for improving their internet speeds, with customers incurring no extra costs.

Technical Analysis

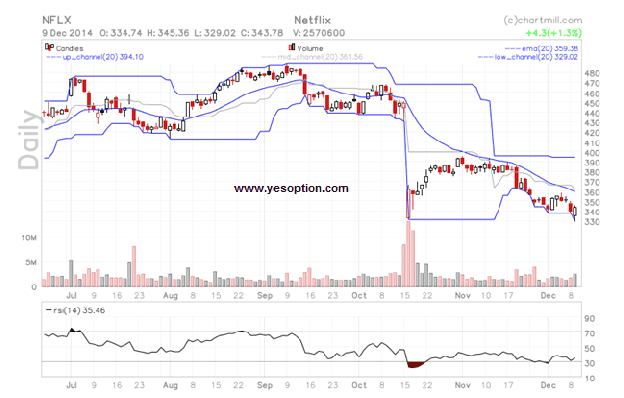

Netflix, Inc. (NASDAQ:NFLX) hit a new low in yesterday’s trading session before rebounding and closing in the green. The stock has been falling continuously ever since it closed below $380. Additionally, it is currently trading below its 20-Day EMA of $359.38 with an RSI of 35.46. Lastly, Netflix is facing resistance at $350, $358, and support is coming at $336, $328 on the downside.

Actionable Insight

Sell Netflix, Inc. (NASDAQ:NFLX) below $341.5 for target of $337, $332 with a stop-loss of $343.