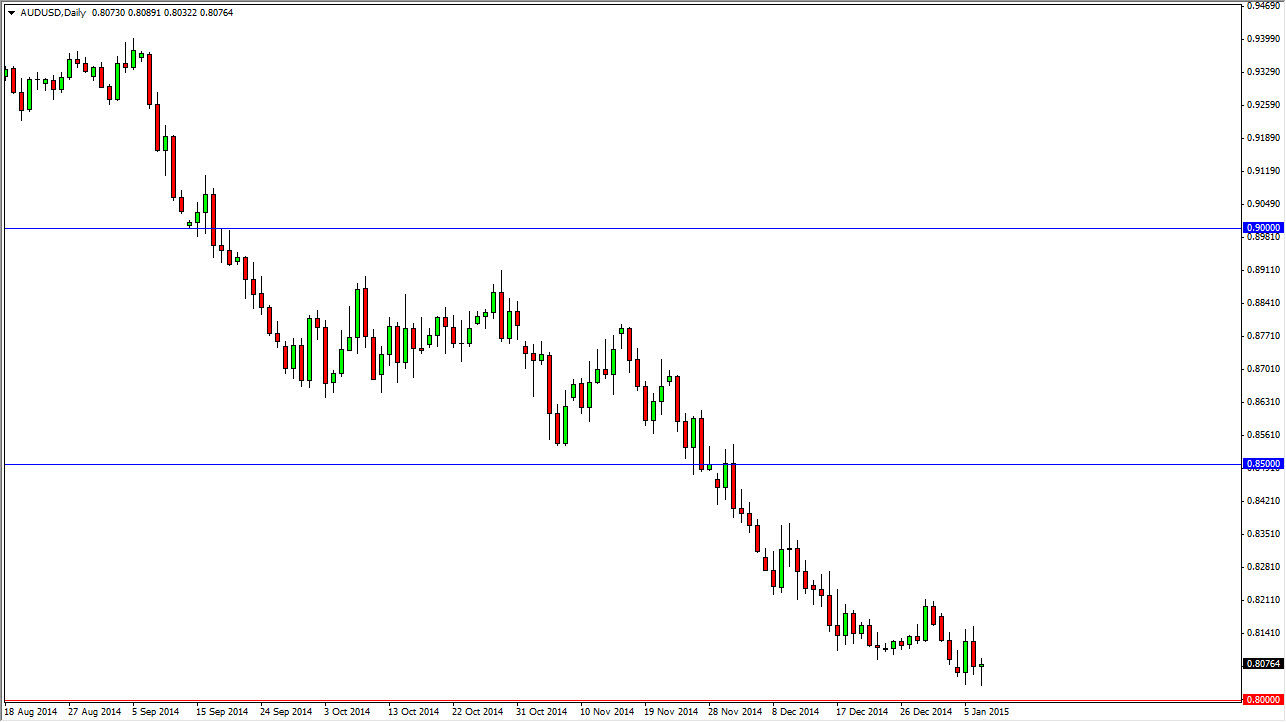

Looking at the AUD/USD pair it appears that we are starting to find fairly serious support just above the 0.80 handle. That’s not a big surprise to me though, as it is an area that has been important in the Australian dollar for the last 20 years. With that being said, I believe that we will find support in this general vicinity given enough time. Quite frankly, I’m surprised we haven’t found buyers yet, but the gold markets of course have been working against the value of the Aussie.

We have nonfarm payroll numbers coming out on Friday, and that of course could keep this market fairly quiet of the next day or two. However, once that announcement comes out we will get some volatility. Remember that when a trend changes, it’s very rare that happens quickly. It tends to be something that happens over a longer period of time, so it is messy. Until we break down below the 0.80 level however, I am not willing to sell this pair again, unless of course we get a significant bounce first.

A daily close below 0.80 is disastrous for the Aussie

If we do get a daily close below the aforementioned 0.80 handle, the Australian dollar could fly south to the 0.75 handle without any issues whatsoever. In fact, we could be talking a complete meltdown sooner or later. I don’t know that’s going to happen, and certainly it’s hard to imagine anybody out there that hasn’t already sold this pair. I have to think that the upside is much more likely to be in the minds of traders than the downside at this point.

This is why I’m waiting for daily candles to show where the market wants to go. I think even if we have a little bit of a buying opportunity here and that the market is going to bounce around to try to change the trend, it’s probably one of these deals that will have to happen over the course of three or four different attempts.