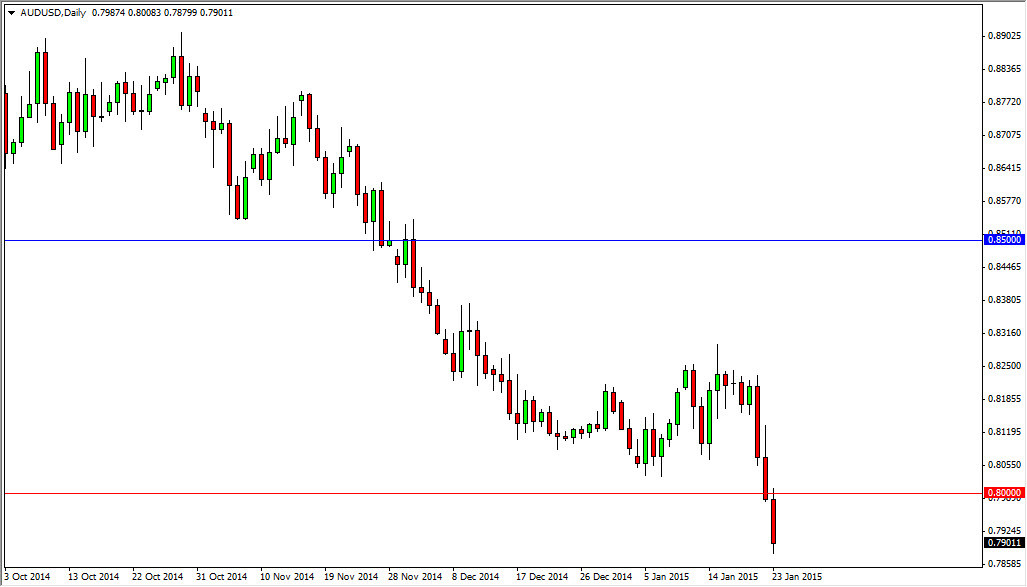

The AUD/USD pair broke down during the course of the session on Friday, finally clearing the 0.80 level and giving it the opportunity to fall with significant momentum. The 0.80 level was massively resistive before the financial crisis, and as a result when we broke above it, the market noticed and it should now be an important part of the AUD/USD pair overall. The fact that we have broken down below this and closed so far below it tells me that this market is in fact facing a significant amount of bearish pressure.

The Australian dollar is highly correlated with the gold market, and even a rising gold price has not been able to help the Aussie dollar. That tells me just how soft the Aussie is at the moment, and as a result I will continue to sell this pair in general. On top of that, the US dollar is extraordinarily strong so I do not want to sell it.

Selling rallies down to the 0.75

I believe that selling rallies all the way down to the next significant level, the 0.75 level, is the way to go going forward. I believe that the Australian dollar will continue to soften, and now that we have broken below this area we could drop too much lower areas. It doesn’t really matter though at this point time though, because I believe it using short-term charts will probably be the way to go as there will be a lot of volatility in this market going forward. Even though I see a path down to the 0.75 handle, I also recognize that there will be a pretty significant fight all the way down there.

If we bounced from here, it would not be until we get above the 0.83 handle that I would consider buying. This is something that I do not anticipate seen anytime soon, so therefore I’m not really even looking for buying opportunities. Again, I will look at bounces as value in the US dollar.