We are now more than halfway through the first trading week after the Swiss National Bank’s shock announcement sent the CHF up about 15% against most other global currencies. Now that the dust is settling after the chaos, it is worth taking a look at how the CHF is shaping up now against its major pairs.

Immediately after the crisis, I wrote that strong moves such as these tend to continue during the following weeks and months, therefore I was effectively forecasting that the CHF will strengthen further.

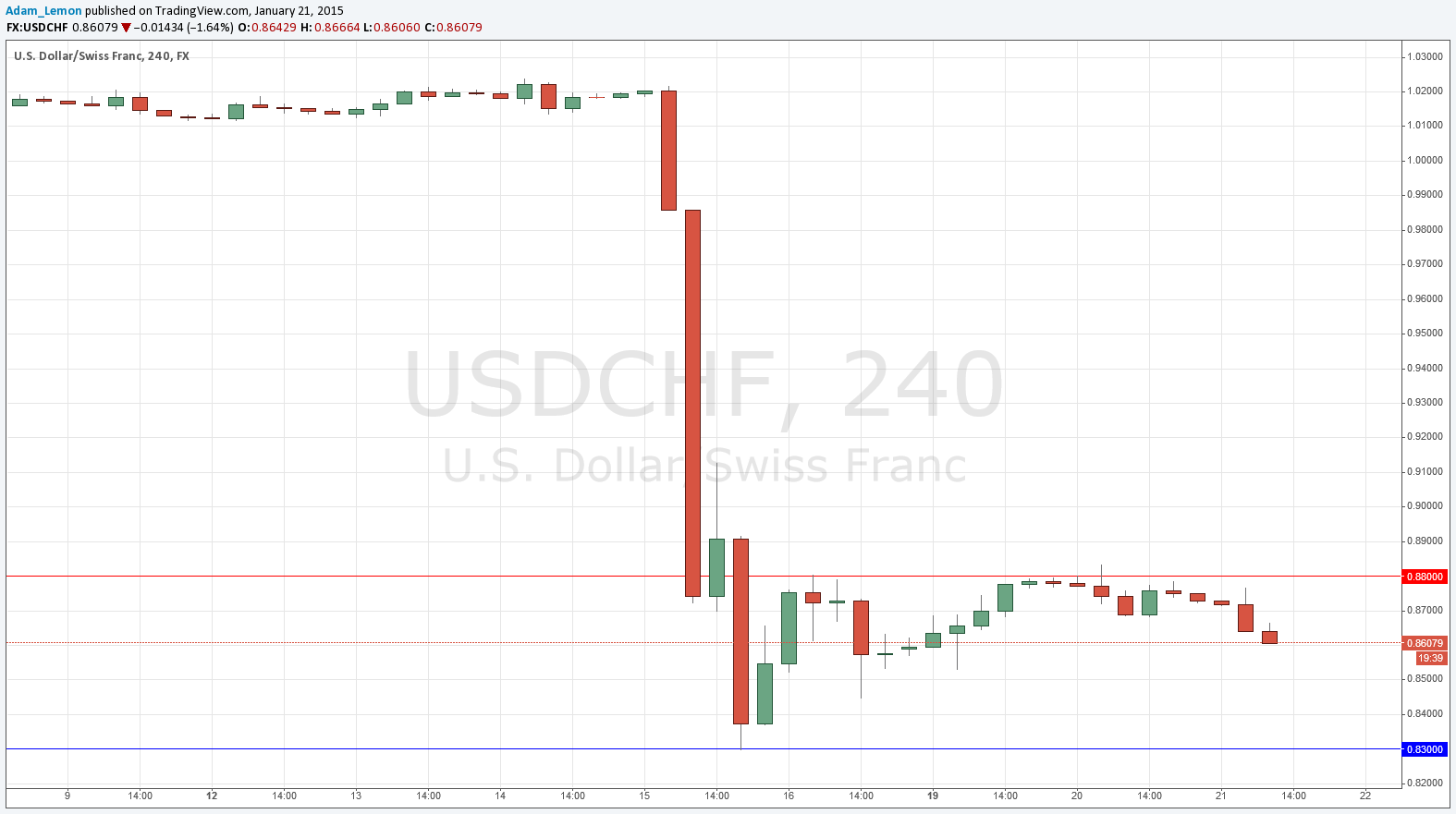

USD/CHF

My analysis yesterday identified resistance at 0.8800 and support at 0.8300, which is a very wide range. This suggested a long CHF play off 0.8800 would match the line of least resistance, and the price has in fact fallen well below the local support that seemed to be developing at around 0.8700, to a level just short of 0.8600 as at the time of writing. This morning, I was not predicting any detailed moves.

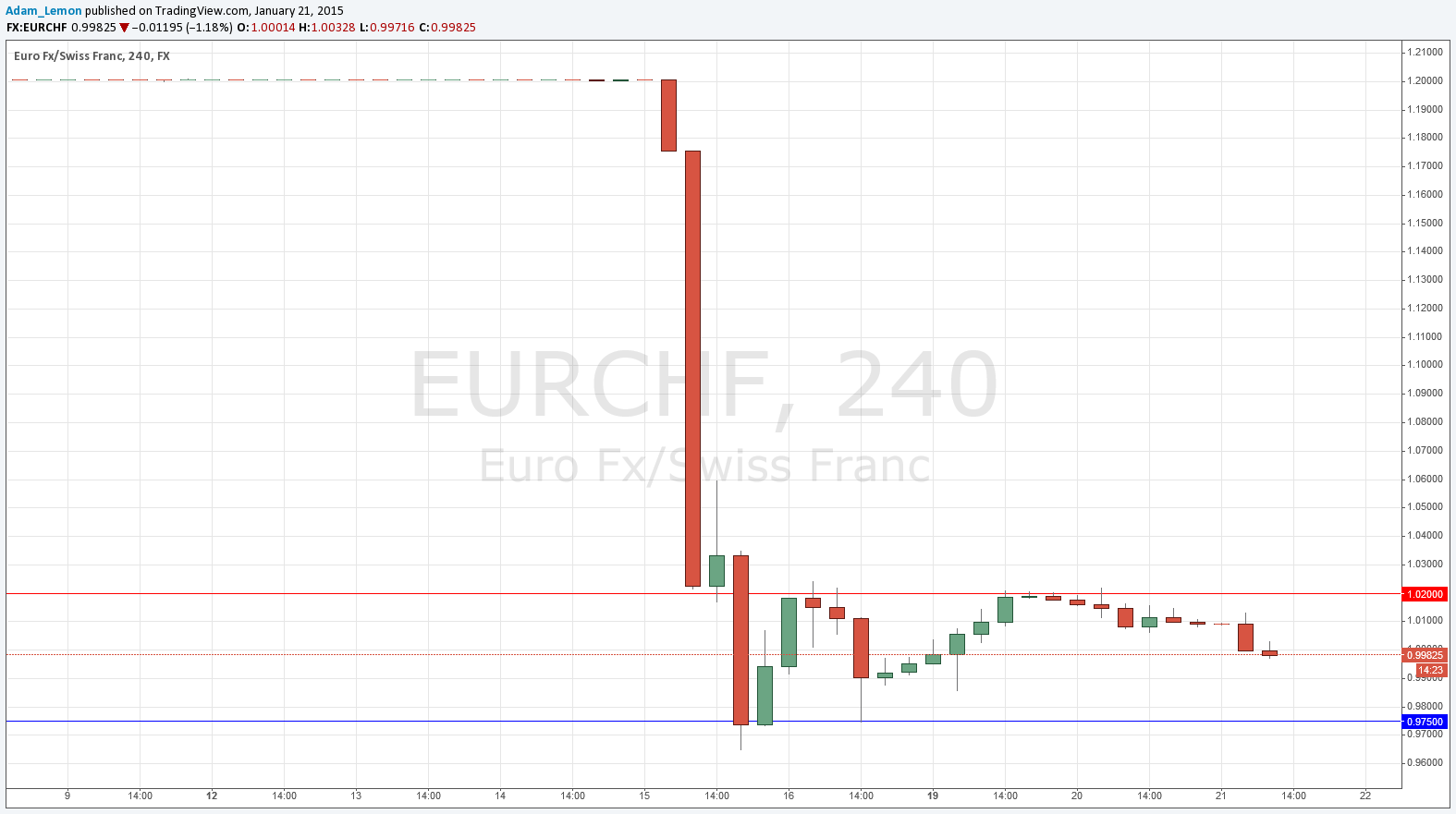

EUR/CHF

The hot topic right now in the Forex market is the anticipated announcement due tomorrow from the ECB signalling that a Eurozone Quantitative Easing program is to begin. Together with uncoupling of the Swiss Franc, that makes this cross one of the hottest. Unsurprisingly, the chart shows a very similar picture to USD/CHF, but with a key resistance level at 1.02 and a key support level at 0.9750:

Summary

After pulling back and weakening earlier this week, the CHF is dominating the Forex market with a renewed strengthening. This can be expected to manifest itself most strongly as a short move in EUR/CHF if there a program of strong QE is announced tomorrow by the ECB. As the USD remains generally strong with plenty of residual momentum behind it, USD/CHF is expected to not be the optimal trade, but may be less volatile, especially if the market is surprised by the ECB tomorrow.

The CHF is still below its weekly open against both the EUR and the USD.