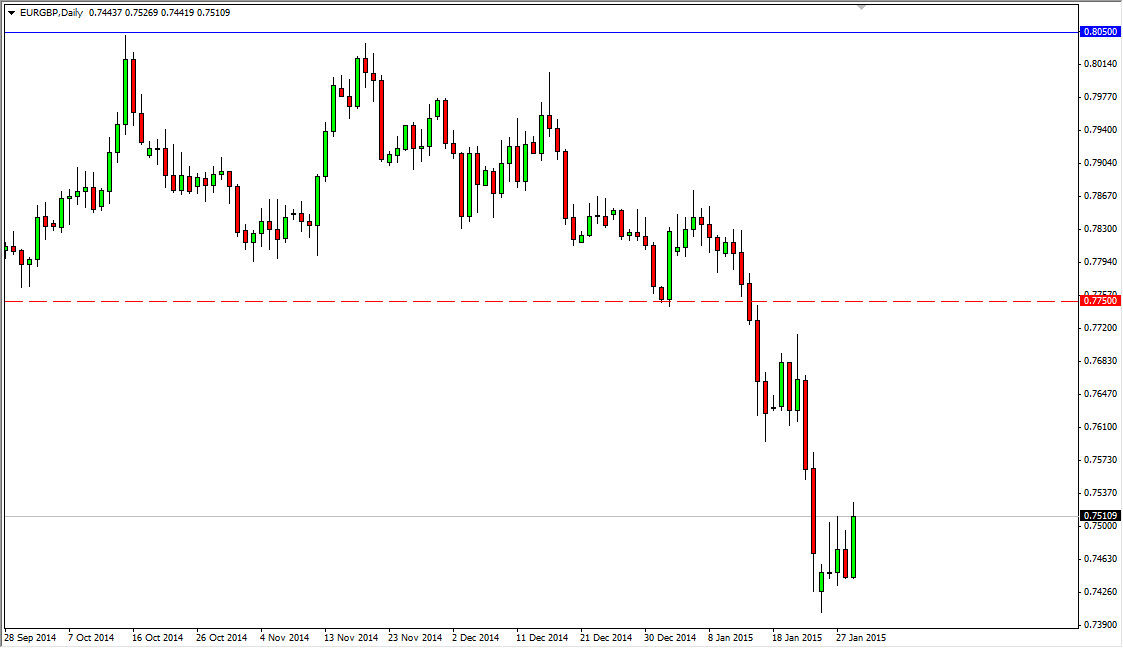

The EUR/GBP pair broke out to the upside during the session on Thursday, clearing the top of a couple of shooting stars. This of course is a very bullish sign but at the end of the day this is a market that is still very much in a downtrend. This of course hasn’t been lost on me, and therefore I am looking for selling opportunities. I recognize that we could go a bit higher, but at the end of the day, I have no interest in owning the Euro right now. I believe that we will now start to look to resistance at higher levels in order to start selling.

It should be noted that we are at the 0.75 handle, which of course is a large, round, psychologically significant number. Therefore, I may not get much of a bounce to sell from in this general vicinity. However, if we do break out to the upside I would anticipate the 0.76 region to start offering trouble, just as the 0.7750 level most certainly will based upon the fact that it was previous support.

Looking to sell rallies

I am essentially looking to sell rallies in this pair, and even though I don’t necessarily think that the British pound is the strongest currency out there, the truth is that it’s not the Euro, and in this particular case that’s all that matters. In other words, I think that it will do better than the Euro, only marginally so though. I like selling resistive daily candles, because this pair tends to be a little bit difficult to trade on short-term charts. After all, it is naturally choppy but you also have to keep in mind that the PIP value is roughly twice as much as many of the other pairs.

I think that the market breaking below the 0.75 level signals that it wants to go down to the 0.70 handle, and at this point in time I don’t see anything to suggest that we won’t be able to do that ultimately.