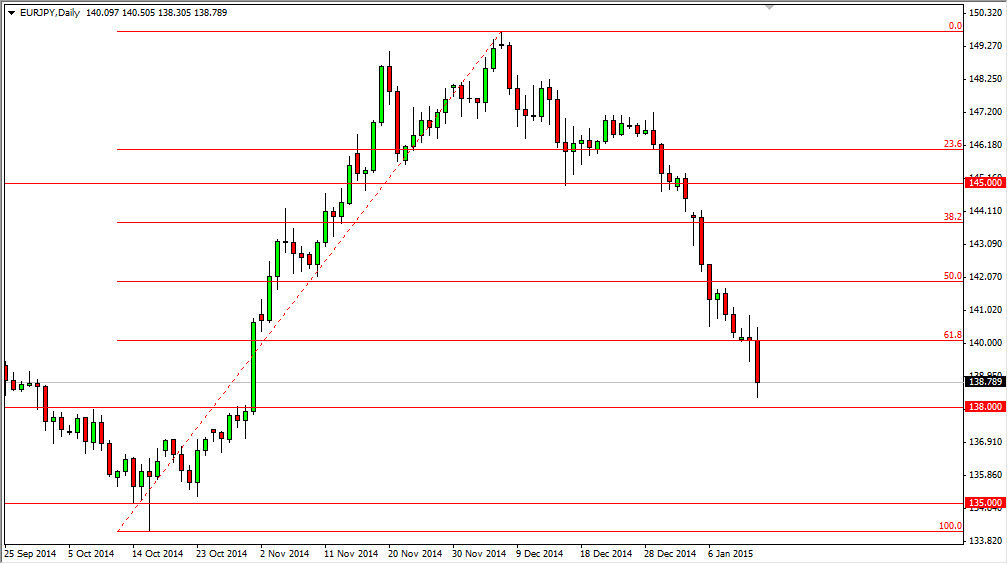

The EUR/JPY pair fell during the course of the day on Tuesday, testing the 138 handle for support. We did bounce a little bit from there, and as a result it looks like the buyers could step in this general vicinity. However, based upon Fibonacci retracement studies, we could go as low as 134 before this move is all said and done. Having said that, if we get a supportive candle in this general vicinity, I believe that this market will bounce as well. I’m not necessarily a huge Fibonacci retracement trader, but recognize that there are a lot of people out there who are.

Going forward, I don’t know the real break down below the lows from the beginning of the uptrend. I essentially in waiting for some type of supportive candle to place a larger position on, because I know how unloved the Japanese yen is at the moment, even though the Euro is in exactly doing much better.

European Court of Justice

The European Court of Justice in Luxembourg today will decide on the legality of some of the monetary policies that the European Central Bank is trying to implement. If they find anything illegal or wrong about the policies, that could keep the ECB from loosening monetary policy and send the value of the Euro higher in general. However, I don’t anticipate this being the case, simply because we all know that the central banks typically get what they want. On top of that, they would simply find another way to loosen monetary policy in the end anyway.

So having said that I am placing a smaller trade to the downside, and a larger one once we get a supportive candle. In the meantime, I would anticipate quite a bit of volatility, hence the smaller position. If we turn things back around and break above the candle from Monday, I would be a buyer at that point in time as well. With that being said, I am being very cautious.