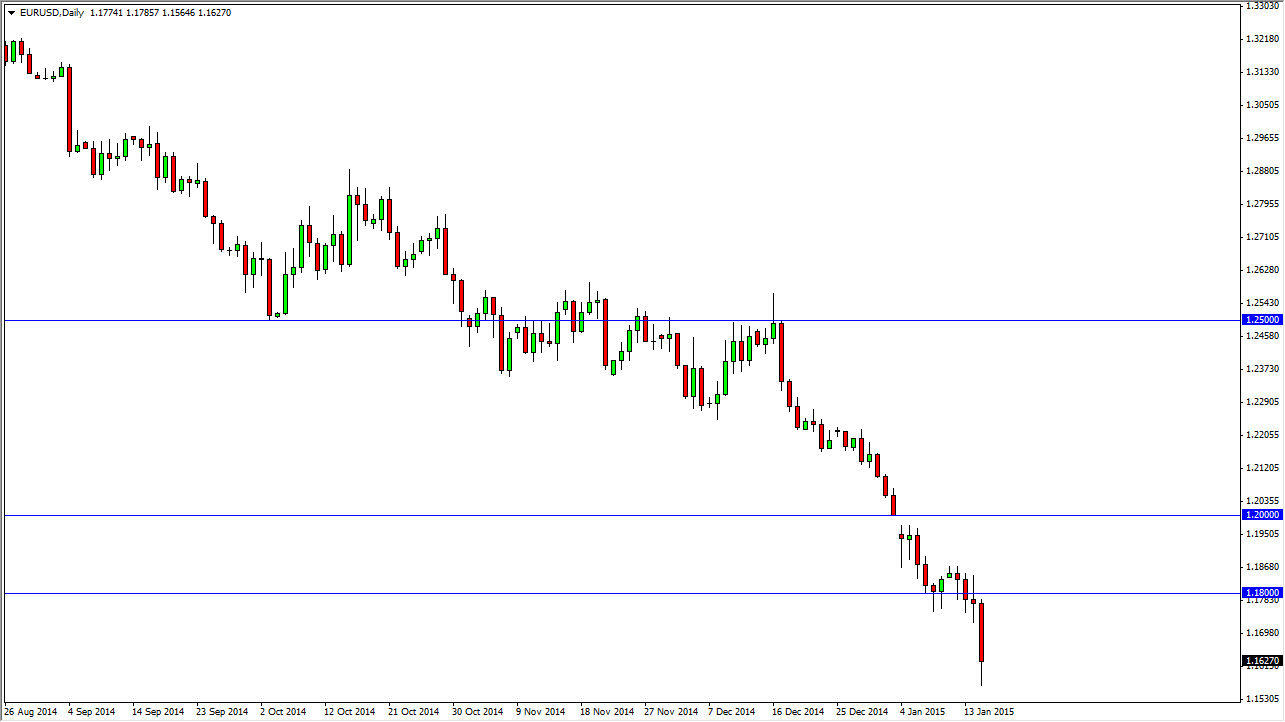

The EUR/USD pair fell during the bulk of the session on Thursday, and sliced through the 1.16 level at one point. While this move of course is a negative move, you have to keep in mind that this coincides with the Swiss National Bank and its removal of the currency peg that it had been defending for three years in the EUR/CHF pair. Because of that, the Euro sold off drastically around the world, and that of course carried over into this pair which already looked a bit soft.

The economic numbers out of Europe haven’t exactly been thrilling either, so that of course puts a damper on the idea of the EUR rising with any significance. That being the case, I feel that the market will sell off every time it rallies. I’m looking to short-term charts with resistive looking candles in order to sell again.

Quite frankly, I’m a bit surprised.

I thought that this area, or I should say the 1.18 region, was going to offer more support than it really did. With that being said, it’s difficult to imagine buying this pair now. I would consider doing it if we broke above the highs from earlier this week. That of course would show quite a bit of buying pressure, but that would take quite a bit of effort my opinion. I quite frankly feel that the one hour charts will probably offer plenty of selling opportunities to go lower, and that could be a trend that we could continue falling for some time. That being said, expect a lot of volatility going forward.

Ultimately, this pair could fall as low as 1.10, a level that I couldn’t even have imagined two or three weeks ago. Ultimately though, you can only follow the trend and that’s exactly what this trend is telling us. Keep in mind that this pair does tend to have a mind of its own at times, but you have to pay attention to the longer time frames because over the last several years we simply gone from point a to point B, and back again.