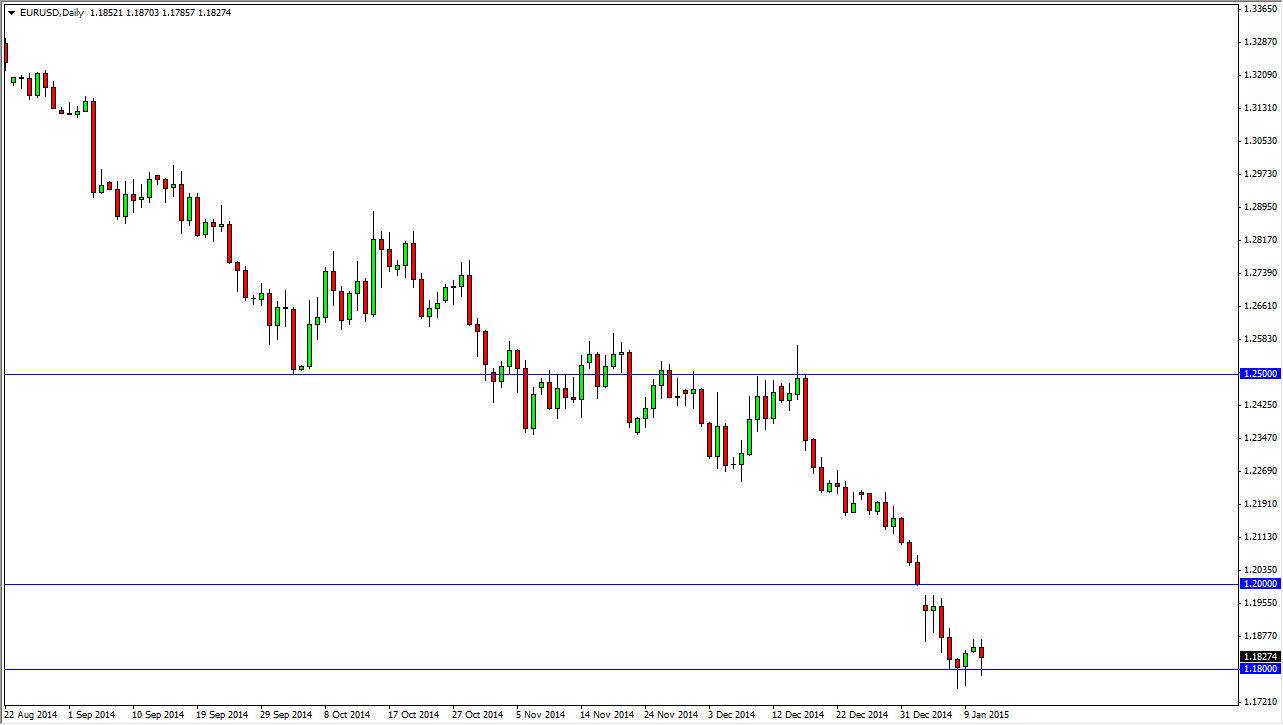

The EUR/USD pair fell during the bulk of the session on Monday, testing the 1.18 level for support. That area is a massive amount of support just waiting happen, based upon the monthly chart. I have been suggesting that the 1.18 level could very well be where the market turned back around, and quite frankly I am seeing more and more indications that we may very well be trying to do that right now. For starters, we have formed three hammers in a row now and then of course is a massive supportive sign as far as I can see.

With that being said, I cannot help but pay attention to pullbacks as potential buying opportunities, and I will be paying attention to the longer-term charts as well. It doesn’t mean that this is going to be an easy move higher, but I think based upon the fact that we have seen the last three hammers form in a row, we will more than likely head to the 1.20 level next as there is a gap at that area.

Above 1.2

If we can get above the 1.2 level, I believe would then head to the 1.2350 level, which is the next resistance barrier. Above there, we then head to the 1.25 handle, which is even more resistant. If we can get above that level on the other hand, that would in fact be essentially a trend change as far as I can see. Nonetheless, we do need a bit of a bounce regardless of what this market wants to do because it is so far sold off at this point in time.

In the short-term though, I do expect positivity based upon the fact that the US dollar is overbought, and the fact that we are at such a massive support level as far as long-term charts are concerned. In other words, there should almost always be a bounce at one of these levels, and that’s essentially what I’m banking on at this point in time. The candlesticks of course are bit difficult to ignore as well.