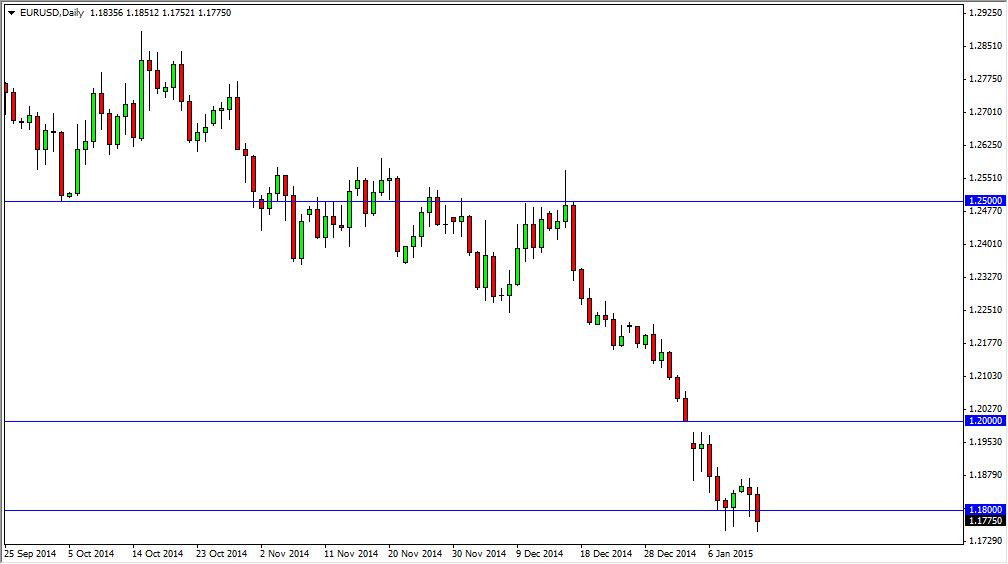

The EUR/USD pair broke down during the session on Tuesday, slicing through the 1.18 level. However, you can see that we bounce a little bit off of the bottom, so we are not ready to break down yet. On top of that, the European Court of Justice is ruling on some legalities as far as monetary policy is concerned out of the European Central Bank. This of course can have a massive effect on the Euro in general, so because of that I think the market is going to struggle to make up its mind on where to go next until we get that announcement.

That’s going to be difficult announcement to quantify, so having said that you may be wise to stay on the sidelines until the end of the session, as it allows you to see how the market reacts. Nonetheless, I recognize this area as massively supportive, and the fact that we have formed three hammers is important in my opinion. However, you have to keep in mind that we are closing at a fresh loan now, at least as far as the close price is concerned, and that of course means something. At this point in time, the sellers are still certainly in control, but that could disappear today.

Longer-term bounce: it’s possible

A longer-term bounce is most certainly possible in this general vicinity, as it is a massive support level from the last 10 years on the monthly chart. With that being the case, the market looks as if the buyers should continue to have an interest in going long of this market in this general vicinity, and with that I feel that a bounce is certainly going to happen sooner or later. However, waiting until the market reacts to the court decision is probably going to be the safest way to play this market.

If we do break above the hammer from the previous sessions, we more than likely will test the 1.20 level, as it is the scene of a decent gap. If we break above there, we should then head to the 1.2350 level.