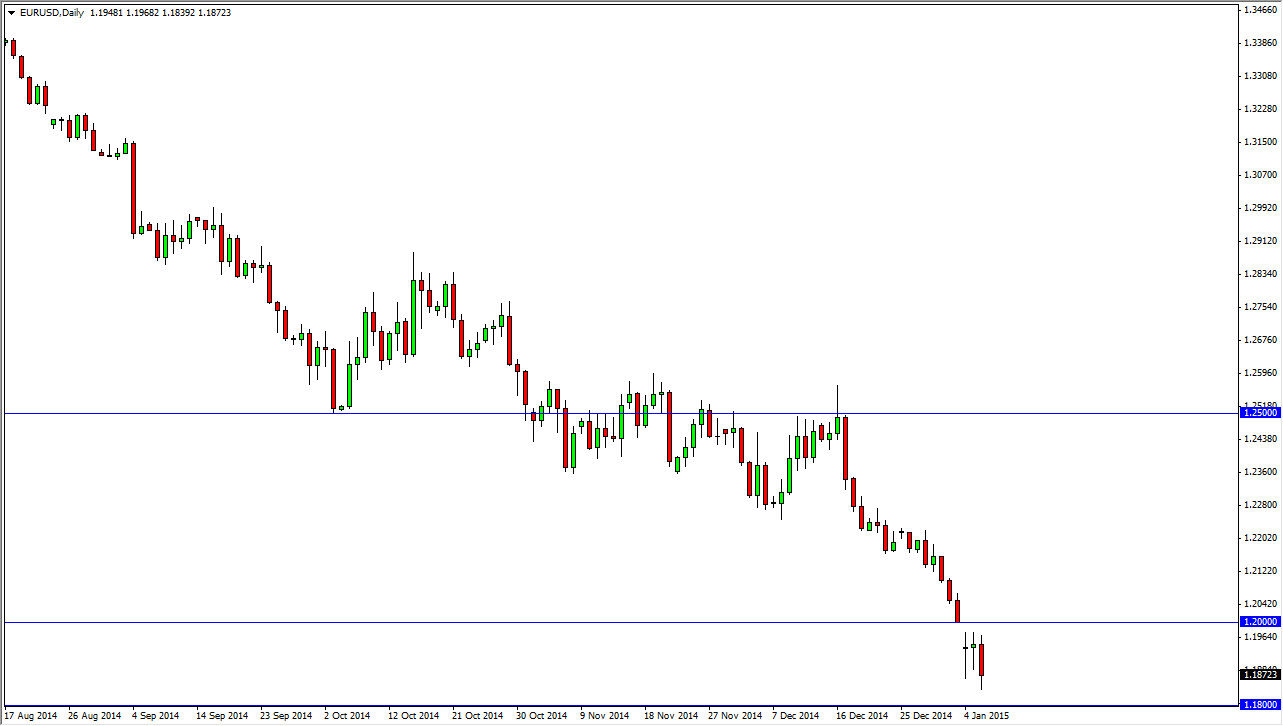

The EUR/USD pair fell during the session on Tuesday, as we have broken below the 1.19 level. However, there is a significant amount of support all the way down to the 1.18 handle in my opinion, and I believe that we are essentially in a 200 pips wide support zone. In other words, it’s not until we get below the 1.18 level that I’m comfortable selling this pair, and that’s mainly because of the way the monthly chart looks. There is obviously a major band of support in this general vicinity, and support on monthly charts need to be paid attention to in order to avoid losing mass amounts of money in the Forex markets. In fact, we are getting close to an area that I believe could be the end of the downtrend is things line up quite right.

Oversold

The market has been selling off the Euro like it’s going to absolutely implode. That being said, I believe that the very least we need to see some type of bounce from this level. After all, there can’t be that many people left to sell this pair right now and although I do believe that the US dollar continues to be one of the favored currencies in the Forex markets. I just believe that the Euro has been sold way too viciously.

To put it simply, unless the European Union is about to collapse, I think the currency has been beaten up far too stringently. However, if we do break below the 1.18 level, Lookout below! At that point time I think we go as low as 1.10, a level that I didn’t think I would ever see again. However, I think it can to take something special break down below there, and that would more than likely be a combination of a very hawkish FOMC meeting minutes release, which of course comes out today, and a stronger than anticipated jobs number on Friday. Unless we get both of those, my suspicion is that we are about to see a bounce.