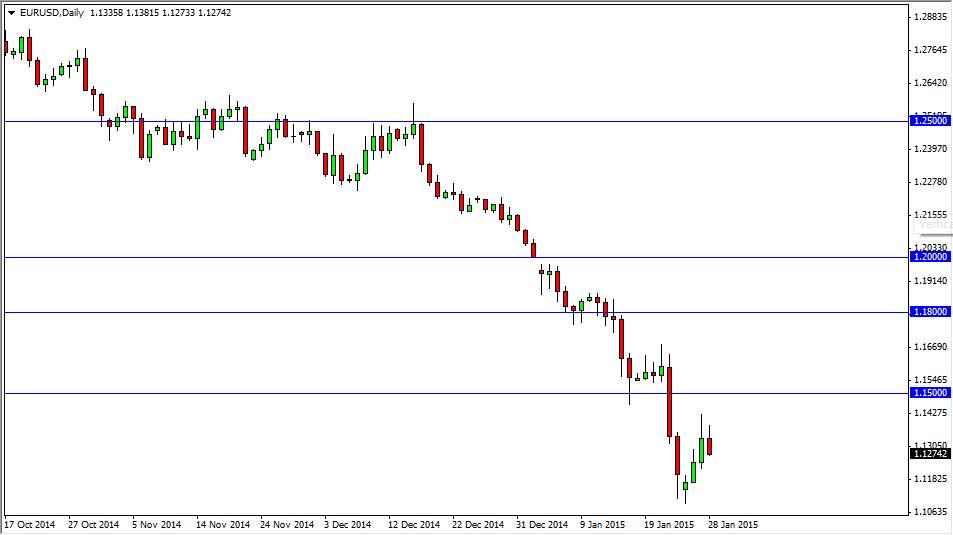

The EUR/USD pair initially tried to rally during the course of the session on Wednesday, but as you can see pullback from the 1.14 level. This is a pair that is most certainly negative, so the fact that we struggle and turned back around isn’t much of a surprise to me. I believe that we will continue down to the 1.10 level at the very least, and possibly even lower than that. However, be aware of the fact that the 1.10 level is massively important on longer-term charts, so we could very well have a situation where we bounce significantly from there.

Ultimately, I think that the 1.15 level will continue to be massively resistive, and therefore it’s almost impossible to buy this pair. Any rally at this point time has to be looked at with complete suspicion, as the European Union continues to struggle with a lot of moving parts. Think that this way: would you rather invest in a part of the world that has such issues as uncertainty in Greece and deflation, or another part of the world which is relatively stable and seems to be coming out of quantitative easing altogether? As far as currency traders are concerned, it’s a pretty straightforward answer.

Looking to sell rallies as they come.

Every time this pair rallies, I will be selling. I will be looking at shorter-term charts as well, as it gives us plenty of trading opportunities time and time again. This does not look like a market that’s ready to meltdown though, don’t get me wrong. I think that most of the easy money shorting this market has already been made. With that being the case, I feel that the market is one that we can come back to time and time again, and it should also be looked at as a measure of the Euro strength or weakness against other currencies. After all, I am seeing opportunities in other EUR related crosses. This has a good way to measure relative strength of the Euro in general.