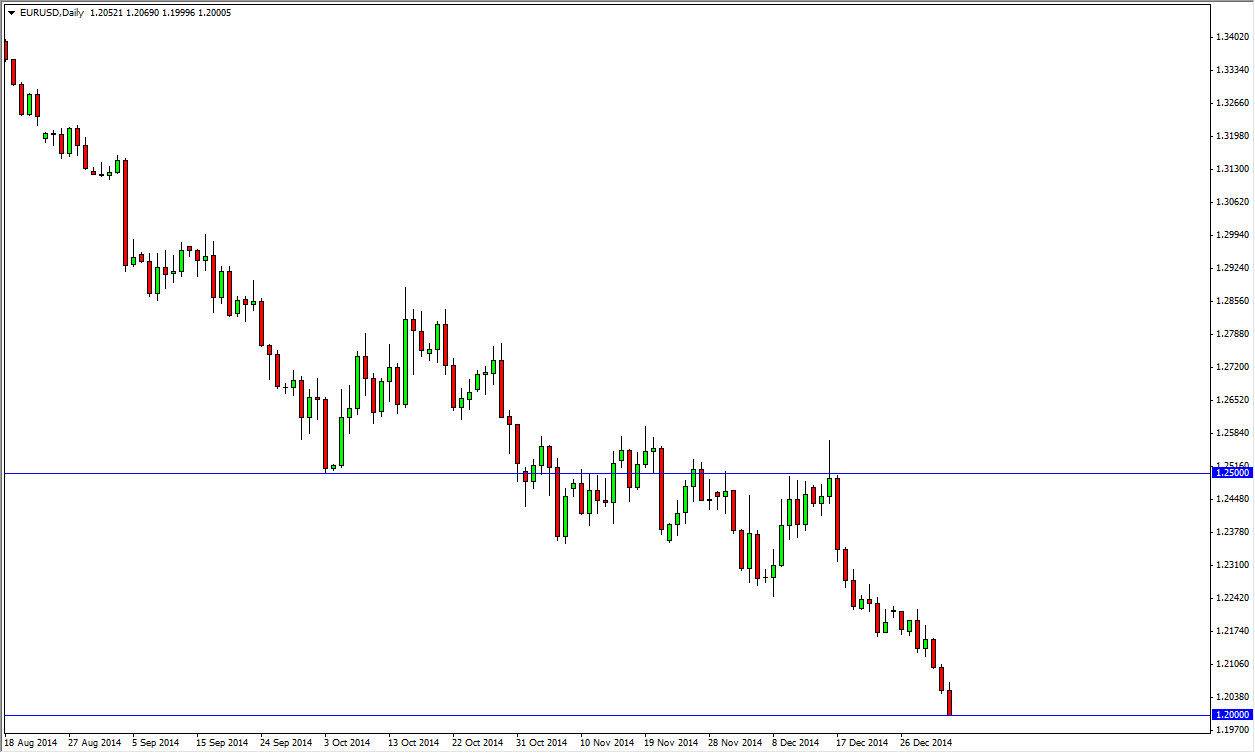

The EUR/USD pair fell after initially trying to rally on Friday, and parked right at the 1.20 handle. This is an area that I think will be massively supportive, or at least the beginning of massive support. However, when you look at the candle is the fact that we closed right at the bottom of the range that does in fact suggest that we are going to try to break down from here. The question then becomes whether or not we can sustain any of those losses?

When you look at the longer-term charts, there is a massive amount of support in this area based upon the monthly timeframe. Because of this, I am a bit hesitant to start shorting here and would prefer to see some type of rally that I could sell. However, I will be very diligent about looking for sell signals as well, although at this point time I really feel that if you are not already shorting this market, are probably best sitting on the sidelines and waiting for higher levels to sell from.

Do not forget to look at longer-term charts

One thing you cannot do is forget to look at longer-term charts. This is mainly because if we see a buying opportunity in this marketplace, it will more than likely show itself on the higher time frames. Be cognizant of the fact that the market go sideways here, it could eventually end up forming a hammer or something like that which would be a longer-term buy-and-hold signal.

I am not a big fan of buying the Euro quite yet, but do recognize that the currency is completely oversold. The US dollar of course will continue to strengthen over the longer term, but the question that remains whether or not it will have its way with the Euro as it has had recently. After all, there are other currencies of the US dollar can beat up on, such as the Japanese yen. Best traded my opinion: selling bounces as they appear. Of course, everything changes if we break above the 1.26 handle.