EUR/USD Signal Update

Last Thursday’s signal expired without being triggered.

Today’s EUR/USD Signals

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.1650.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.1860.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

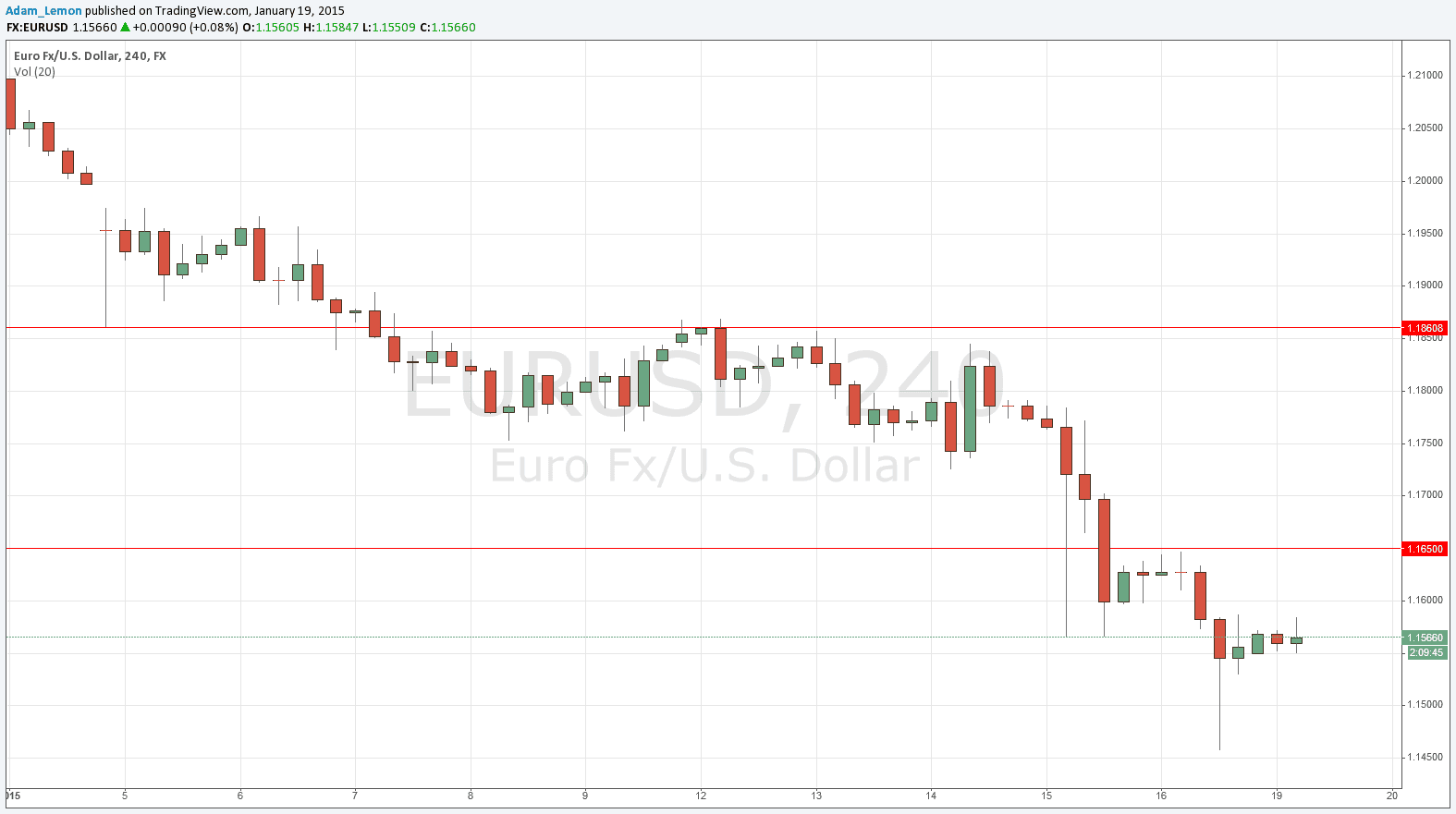

EUR/USD Analysis

The pair fell very strongly on Thursday and Friday after a sharp pull back on Wednesday that drove the price up above 1.1800. At one point late last week the price even got well below 1.1500, before rising with a fairly strong bounce. It would seem logical that 1.1500 would be fairly supportive, but due to the high volatility and turbulence unleashed by the uncapping of the CHF by the Swiss National Bank last Thursday, it is hard to see supportive levels holding with any precision. There is no real obvious probably support before the area at around 1.10, and it is widely expected that this pair has further to fall.

Due to the strong downwards trend and bias, and the absence of obvious support, it makes sense to look for short opportunities at previously flipped level. The first such level that we have above us is a nice round number at 1.1650. Above that, there is 1.1860.

There are no high-impact data releases scheduled today concerning either the EUR or the USD. It is a public holiday in the USA. Therefore it is likely that today will be a relatively quiet day for this pair, especially after 1pm London time.