EUR/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be entered before 5pm London time.

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.1300.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.1458.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

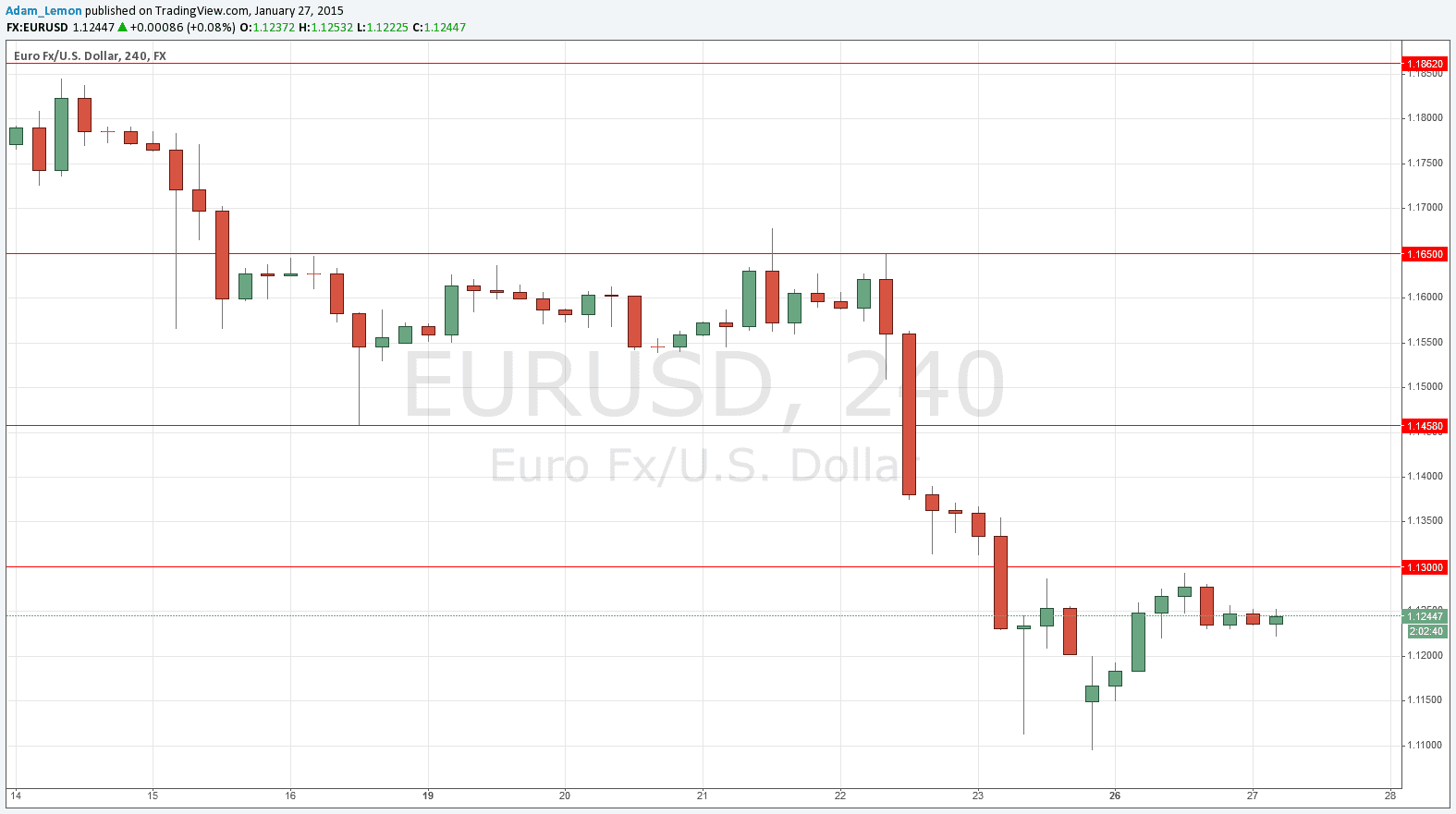

EUR/USD Analysis

I wrote yesterday that we could expect resistance close to 1.1300 and that is what happened, with the price missing that level by 6 pips before falling by 50 pips. However it wasn’t the real failed test we were waiting for, so it makes sense to wait for a failed test of the whole number at 1.1300 and a reversal before going short.

The EUR showed some real strength yesterday, and the strength of any move we get up to 1.1300 as London gets going will be interesting. A break above 1.1300 could clear the way to 1.1458.

There are no high-impact data releases scheduled today concerning the EUR, but there are regarding the USD. At 1:30pm London time there will be a release of U.S. Core Durable Goods Orders data followed by CB Consumer Confidence and New Home Sales at 3pm. Therefore the most volatile time is likely to occur during the New York / London overlap.