EUR/USD Signal Update

Yesterday’s signals expired without being triggered as the price did not reach either level during the London session.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be made before 5pm London time.

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.1458.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

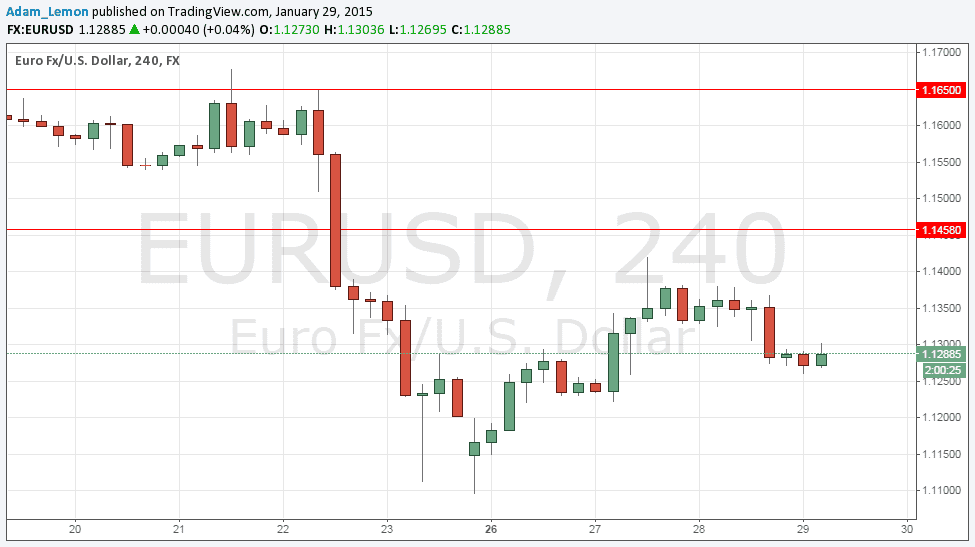

EUR/USD Analysis

I expected a fairly quiet London session yesterday, and that is exactly what we got. Yesterday's FOMC announcement gave the USD a little more strength against generally weaker currencies and it was interesting to see that it only pushed this pair down by a fairly small amount. In early tradeing this morning, the pair moved back up above 1.1300.

The support I was identifying at around 1.1290 is now too muddied to be useful and the only clear line visible anywhere near the current price on higher time frame charts is probable resistane at 1.1458.

There may be minor support at 1.1250.

There are high-impact data releases scheduled today concerning both the USD the EUR. At 1:30pm London time there will be a release of Unemployment Claims data, which is likely to affect the USD. At some unknown time, there will be a release of German Preliminary CPI data, which is likely to affect the EUR.