EUR/USD Signal Update

No signal was given yesterday.

Today’s EUR/USD Signals

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.1893.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

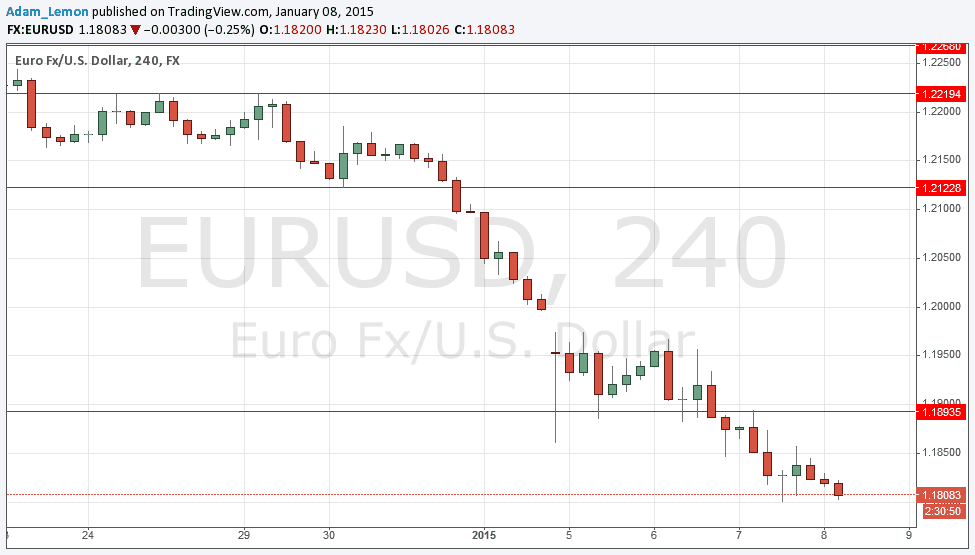

EUR/USD Analysis

The price fell yesterday again, fairly weakly, with the news that the Eurozone now has negative inflation. The fact of deflation ensures that weakness continues in the EUR. Later, following the FOMC release, the pair rose back near to opening prices, but has fallen again overnight. We open this morning very close to yesterday's lows.

The technical picture is a little strange as we still have an unfilled gap above us and some illiquid price action behaviour. Support is very hard to gauge as we are at nine year lows. The only key resistance level anywhere nearby is at 1.1893 which is more or less the overlap of a recent daily low that became a recent daily high. A return to that level could see a good shorting opportunity.

There are high-impact data releases scheduled today concerning the USD only. At 1:30pm London time there will be a release of the U.S. Unemployment Claims data. It is likely to be a fairly quiet day for this pair before the New York session opens.